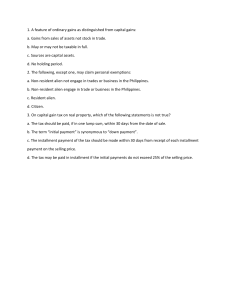

INCOME TAX SCHEMES, ACCOUNTING PERIODS, ACCOUNTING METHODS, AND REPORTING Compiled by: MAY ANNE C. CALUBAYAN, CPA, MBA INCOME TAXATION SCHEMES There are three income taxation schemes under NIRC: a. Final income taxation b. Capital gains taxation c. Regular income taxation Classification on Items of Gross Income Items of gross income can be classified as follows: 1. Gross income subject to final tax 2. Gross income subject to capital gain tax 3. Gross income subject to regular tax FINAL INCOME TAXATION Final income taxation is characterized by final taxes where taxes are withheld or deducted at source. Final taxation is applicable only to certain passive income. Not all passive income is subject to final tax. Passive income vs Active Income Passive incomes are earned with very minimal or even without active involvement of the taxpayer in the earning process. Examples: 1. Interest income from banks 2. Dividends from domestic corporations 3. Royalties Active or regular income arises from transactions requiring a considerable degree of effort or understanding from the taxpayer, Examples: 1. Compensation income 2. Business income 3. Professional income Capital Gains Taxation A Capital gain tax is imposed on the capital gain on the sale, exchange and other disposition of certain capital assets. Not all capital gains are subject to capital gains tax. Most of them are subject to regular income tax. Capital Assets vs Ordinary Assets Capital assets include all other assets other than ordinary assets. Ordinary Assets are assets directly used in the business, trade or profession of the taxpayer such as inventory, supplies and items of property, plant and equipment. Capital Gains vs Ordinary Gains Capital gains arise from the sale, exchange and other disposition of capital assets. Ordinary gains arise from the sale, exchange and other disposition of ordinary assets. REGULAR INCOME TAXATION The regular income taxation is the general rule in income taxation and covers all other income such as: 1. Active income 2. Gains from dealings in properties a. b. Dealings in ordinary assets Dealings in other capital asset not subject to capital gains tax 3. Other income, active or passive, not subject to final tax. ACCOUNTING PERIOD Accounting period is the length of time over which income is measured and reported. Types of Accounting Periods 1. Regular accounting period-12 months length a) b) Calendar (starts from January 1 and ends December 31.) Fiscal (any 12 month period that ends on any day other than December 31.) 2. Short accounting period-less than 12 months Deadline of Filing the Income Tax Returns Under the NIRC, the return is due for filing on the fifteenth day of the fourth month following the close of the taxable year of the taxpayer. The regular tax due is payable upon filing of the Income tax return. Instances of Short Accounting Period 1. Newly commenced business. The accounting period covers the date of the start of the business until the designated year-end of the business. Illustration: Palawan Inc. started business operation on June 30, 2014 and opted to use the calendar year accounting period. Palawan should files its first income tax return covering June 30 to December 31, 2014 for the year 2014. The return must be filed on or before April 15, 2015. Instances of Short Accounting Period 2. Dissolution of business – The accounting period covers the start of the current year to the date of dissolution of the business. Instances of Short Accounting Period 3. Change of accounting period by corporate taxpayers. The accounting period covers the start of the previous accounting period up to the designated year-end of the new accounting period. Instances of Short Accounting Period 4. Death of the taxpayer. The accounting period covers the start of the calendar year until the death of the taxpayer. Instances of Short Accounting Period 5. Termination of the accounting period of the taxpayer by the Commissioner of Internal Revenue. The accounting period covers the start of the current year until the date of the termination of the accounting period. ACCOUNTING METHODS Accounting methods are accounting techniques used to measure income. Types of Accounting Methods: 1. The general methods a) b) 2. 3. 4. 5. Accrual basis Cash basis Installment and deferred payment method Percentage of completion method Outright and spread-out method Crop-year basis Distinction between Accrual Basis and Cash Basis Distinction between Accrual Basis and Cash Basis Tax Accrual Basis Tax Cash Basis Expense Hybrid Basis Hybrid basis is any combination of accrual basis, cash basis and or other methods of accounting. Sale of Goods with Extended Payment Terms The sale of goods with extended terms may be reported using the accrual basis, installment method, or deferred payment method. Installment Method Under the installment method, gross income is recognized and reported in proportion to the collection from the installment sales. Installment method is available to the following taxpayers: 1. Dealers of personal property on the sale of properties they regularly sell. 2. Dealers of real properties, only if their initial payment does not exceed 25% of the selling price. 3. Casual sale of non-dealers in property, real or personal, when their selling price exceeds P1,000 and their initial payment does not exceed 25% of the selling price. Terms related to installment method: Initial Payment – means total payment by the buyer or property, in the taxable year the sale was made. The term “initial payment” is broader than downpayment. Selling Price – means the entire amount for which the buyer is obligated to the seller. Contract Price – is the amount receivable in cash or other property from the buyer. With indebtedness assumed by the buyer Indebtedness assumed exceeds tax basis of property sold Deferred Payment Method The deferred payment method is a variant of the accrual basis and is used in reporting income when a non-interest bearing note is received as consideration in a sale. Under the deferred payment method, the gross income is computed based on the present value (discounted value) of a note receivable from the contract. The discount interest on the note is amortized (i.e. spread) as interest over the installment term. The Percentage of Completion Method for Construction Contracts Under the percentage of completion method, the estimated gross income from construction is reported based on the percentage of completion of the construction project. There are several methods of estimating project completion in practice, but the output method based on engineering survey is prescribed by the NIRC. Income from Leasehold Improvement Leasehold improvements are tangible improvements made by the lessee to the property of the lessor. Improvements will benefit the lessor when their useful life extends beyond the lease term. This benefit is referred to as income from leasehold improvement. Income from Leasehold Improvement Under Revenue Regulation No. 2, it can be reported using either of the following method at the option of the taxpayer: 1. Outright method 2. Spread-out method Farming Income Farming income is commonly recognized using the cash basis or accrual basis. However, long term crops or those that take more than one year to harvest may be accounted for under the crop year basis. Crop Year Basis Under the crop year basis, farming income is recognized as the difference between the proceeds of harvest and expenses of the particular crop harvested. The expenses of each crop are accumulated and deducted upon the harvest of the crop. Crop Year Basis This method is employed by farmers whose crops shall be harvested for more than a year from the time of planting. Crop Year Basis INCOME TAX REPORTING The Self-Assessment Method In preparing their tax return, taxpayers declare their income and expenses, and personally determine the tax due thereon. Types of Income-tax related returns filed to the government: 1. Income tax returns 2. Withholding tax returns 3. Information returns Types of income tax return 1. Capital gains tax return 2. Regular income tax return The Withholding System Where to File Income Tax Return Taxpayers Mandated to use the eFPS Penalties for Late Filing or Payment of Tax 12% per annum Delay Period Factor For every day of delay Number of days/365 days For every month of delay* Number of months/12 For every year of delay 1 Compromise Penalty Compromise penalty is an amount paid in lieu of criminal prosecution over a tax violation. Penalties for Non-filing or late filing of information return