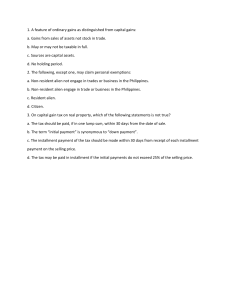

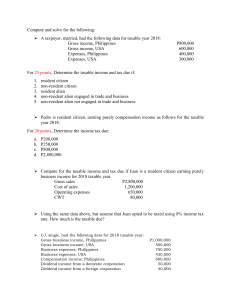

MODULE 5 REVIEW QUESTIONS I. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. TRUE OR FALSE A sale of residential condo unit held as capital asset in the Philippines by a non-resident alien not engaged in trade or business is subject to 6% capital gains tax. Capital gain on sale of personal car is subject to capital gains tax. Royalties from books earned within the Philippines by a resident alien are subject to 10% final tax. Winnings of a resident citizen from abroad are subject to 20% final tax. To be exempted from capital gains tax, the acquisition of the new principal residence must be made within 12 months from date of sale. Employed individuals are required to use the graduated rates regardless of the amount of their compensation income. PCSO and lotto winnings more than P10,000 received by resident alien are subject to 25% final tax. All items of passive income are subject to final taxes. Sale of shares of stock in a domestic corporation by an individual dealer in securities is subject to capital gains tax. The NON-VAT individual taxpayer is exempted from the business tax if he uses 8% as his income tax rate. The sale of residential condominium unit classified as capital asset in the Philippines by a dealer in securities is subject to capital gains tax. A partner in a general professional partnership may avail of the 8% income tax rate if his income does not exceed P3 million. Benefits given to rank-and-file employees are not subject to any tax. Interest earned by a non-resident citizen from US dollar savings account in the Philippines is subject to 15% final tax. Clothing allowance of P5,000 given to a supervisory employee is subject to fringe benefit II. MULTIPLE CHOICE 1. The share of the partners in the net income of a general business partnership is a. Tax exempt b. Subject to 10% final tax. c. Subject to normal income tax. d. Subject to 20% final tax. 2. Which of the following is subject to 10% final tax? a. Interest earned on Philippine bank deposit b. Interest earned on Foreign currency bank deposit c. Royalty from patents d. Cash reward to BIR informers 3. If the proceeds are from the disposition of principal residence and fully utilized in acquiring or constructing a new principal residence, there is no capital gains tax, except: a. The Commission shall have been duly notified by the taxpayer within 60 days from date of sale of his intention to avail of the tax exemption. b. The seller is an individual. c. The historical cost or adjusted basis of the real property sold shall be carried over to the new principal residence. d. Acquisition or construction of the new principal residence is within 18 calendar months from date of disposition. 4. Which one of the following is not allowed to be taxed at 8% income tax rate? a. A businessman and professional with aggregate gross sales and receipt do not exceed P3,000,000. b. A partner in a general professional partnership with a separate business of not exceeding P3,000,000 in gross sales. c. An employee with a separate business of not exceeding P3,000,000 in gross sales. d. A partner in an ordinary partnership with a separate business of not exceeding P3,000,000 in gross sales. 5. Which is not a type of income tax? a. Capital gains tax b. Final tax on passive income c. Stock transaction tax d. Fringe benefit tax VBS 1 6. Royalties from books earned by a resident citizen in the United States are subject to: a. Personal income tax using graduated rates of 0% to 35% b. Final tax on passive income c. Corporate income tax d. Capital gains tax 7. Capital gain on the sale of real property located in Malaysia by an Australian national residing in the Philippines is a. Subject to personal income tax using graduated rates of 0% to 35% b. Subject to final tax on passive income c. Subject to capital gains tax d. Not subject to any income tax 8. Rentals earned by a resident citizen in New Zealand are subject to: a. Personal income tax using graduated rates of 0% to 35% b. Final tax on passive income c. Corporate income tax d. Capital gains tax 9. Those who in the interest of the employer effectively recommend such managerial actions if the exercise of such authority is not merely routinary or clerical in nature but requires the use of independent judgment. a. Officers b. Rank-and-file employees c. Supervisory employees d. Managerial employees 10. Which of the following statements is not correct? Relatively small meal allowances paid to rank-and-file employees intended to promote health and goodwill are: a. subject to income tax as compensation b. not subject to fringe benefit tax c. not subject to income tax as compensation d. considered as de minimis benefits III. PERSONAL INCOME TAX & 8% OPTIONAL INCOME TAX Mr. X works for XYZ Corp. He is not engaged in business nor has any other source of income other than his employment. Mr. X earns a total taxable compensation income of P1,200,000. 1. His income tax due is: a. P96,000 b. P202,500 c. d. P76,000 P349,000 Mr. Y operates a grocery store while he offers accounting services to his clients. For 20XX, his gross sales amounted to P1,250,000, in addition to his receipts from accounting services of P800,000. He incurred cost of sales and services, and operating expenses amounting to P750,000 and P400,000. 2. Using the current graduated rates, his income tax due is: a. P237,000 b. P164,000 c. d. P144,000 P127,500 3. If he signifies his intention to be taxed at 8% income tax rate in his 1st quarter return, his income tax liability is: a. P144,000 c. P164,000 b. P160,000 d. P237,000 4. For current taxable year, Mr. D, a CPA-lawyer, has generated gross receipts amounting P3,500,000. His cost of services and operating expenses are P1,000,000 and P600,000, respectively. He signifies his intention to be taxed at 8% income tax rate. His income tax due is: a. P260,000 c. P280,000 b. P377,500 d. P557,000 5. In 20XX, Mr. X owns a nightclub and videoke bar with gross sales and receipts amounting to P2,000,000. His cost of sales and operating expenses are P700,000 and P300,000, and with non-operating income of P200,000. His signifies his intention to be taxed at 8% income tax rate. His income tax due is: a. P202,500 c. P175,000 b. P250,000 d. P140,000 VBS 2 In 20XX, Mr. Y, a mixed income earner, has total taxable compensation income of P2,000,000 and gross receipts from accounting services of P2,000,000. His cost of services and operating expenses are P500,000 and P200,000, and with non-operating income of P300,000. 6. 7. If he has opted to be taxed using graduated rates, his income tax due is: a. P922,000 c. b. P1,002,000 d. P882,500 P674,000 If he has opted to be taxed at 8% income tax rate, his income tax due is: a. P922,000 c. P654,000 b. P1,002,000 d. P586,500 IV. FINAL TAX ON PASSIVE INCOME 1. The taxpayer had the following data at the end of the current year: Philippines Gross profit from sales P4,000,000 Rental income 500,000 Dividend income from domestic corporation 100,000 Dividend income from foreign corporation Royalties from musical compositions 500,000 Interest on Peso Bank Deposit 200,000 Interest on Foreign Currency Bank Deposit 100,000 Prizes 200,000 Abroad P2,000,000 200,000 50,000 300,000 500,000 200,000 100,000 The total amount of final taxes is: a. b. c. d. Resident Citizen Non-resident citizen Resident alien Non-resident alien engaged in trade _________________ _________________ _________________ _________________ The following are the royalties received as passive income by a taxpayer for the period: Source USA Philippines Books P1,200,000 P1,500,000 Patents 2,000,000 1,000,000 Franchise 1,500,000 2,000,000 Musical Composition 5,000,000 1,800,000 2. The final tax on royalties if the taxpayer is a resident citizen is: a. P930,000 c. b. P1,260,000 d. P2,250,000 P3,200,000 3. The final tax on royalties if the taxpayer is a non-resident alien engaged in trade or business is: a. P930,000 c. P2,250,000 b. P1,260,000 d. P3,200,000 4. The following are the items of income of a non-resident citizen for 2023: Interest income from a 5-year peso time deposit in Philippine bank Interest income from savings bank deposit in Philippine currency Interest income from foreign bank deposit Interest income from personal loan granted to a friend P10,000 P50,000 P60,000 P5,000 The final tax on interest income is a. P21,000 b. P19,000 c. P12,000 d. P10,000 5. A taxpayer received during the taxable year the following passive income within the Philippines, net of applicable tax, if any: Interest on foreign currency bank deposit P92,500 Royalty from musical composition 270,000 Dividend income from a domestic corporation 180,000 VBS 3 If the taxpayer is a non-resident alien engaged in business, the total amount of final taxes on the above passive incomes would amount to: a. P50,000 c. P57,500 b. P75,000 d. P82,500 V. CAPITAL GAINS TAX ON SALE OF SHARES OF STOCK IN A DOMESTIC CORPORATION A resident alien taxpayer during the current year sold his shares of stock in a domestic corporation held as capital assets: a. 350 Shares of SMB Corporation with par value, cost and gross selling price of P35,000, P80,000, and P125,000, respectively. b. 400 shares of BDO shares with book value, cost and selling price of P40,000, P120,000, and P100,000, respectively. c. 500 shares of Ayala Land with book value, cost and gross selling price of P65,000, P50,000 and P180,000, respectively. 1. If sold thru the local stock market, the total amount of taxes paid was P_____________________, 2. If sold outside the local stock exchange, The adjusted tax for the year would be P_____________________. 3. The amount payable or (refundable) at end of the year would be P__________________. VI. CAPITAL GAINS TAX ON SALE OF REAL PROPERTY A resident citizen taxpayer during the current year sold her real properties located in the Philippines held as capital assets: a. Sale of house and lot in Makati City Cost – P650,000, Gross Selling Price P950,000, Fair market value – P1,300,000 b. Sale of land in Manila Cost – P850,000, Gross Selling Price 600,000, Fair market value – P500,000 1. The total amount of capital gains taxes paid would be P________________________. Complete the missing information if a resident citizen sold his P2-million principal residence with fair market value of P7,500,000 for P5,000,0000 to acquire a new one within 18 calendar months: 2. 3. 4. 5. 6. 7. Acquisition Cost of New Principal Residence Capital Gains Tax Payable New Basis or Cost of New Principal Residence P4,000,000 P5,000,000 P6,000,000 ___________________ ___________________ ___________________ _____________________ _____________________ _____________________ Juan is a resident of Manila. He sold his family home for P8,000,000 which was previously acquired for P4,000,000. At the time of sale, the fair market value of the family home was P10,000,000. Juan complied all BIR requirements to avail of tax exemption and spent P5,000,000 to acquire new family home. How much is the capital gains tax to be paid by Juan? a. P180,000 c. P480,000 b. P225,000 d. P600,000 How much is the new basis of the family home? a. P1,500,000 b. P2,000,000 c. d. P2,500,000 P5,000,000 Mr. Juan, a real estate dealer, sold a residential lot for P6,000,000, payable in 24 equal monthly installments starting June 30, 2018. At the time of sale, the zonal value was P7,000,000 while the assessor’s fair market value was P5,000,000. How much is the capital gains tax payable on the first monthly installment? a. P0 c. P17,500 b. P420,000 d. P15,000 VBS 4 VII. FRINGE BENEFIT TAX 1. An employer gave fringe benefits to employees, as follows: To rank-and-file employees To supervisory employees To managerial employees The fringe benefit tax would be _________________________. P200,000 P300,000 P924,000 2. In 2022, Aerith Gainsborough, a non-resident alien not engaged in trade in the Philippines and employed as chief executive officer in a domestic corporation, is provided by her employer with a maid and personal driver who stay with her in her household. Annual salaries of the maid and driver were P50,000 and P100,000, respectively. The fringe benefit tax to be paid by the employer is ________________________. 3. Kukoo is a resident alien employed as finance manager of a foreign service contractor engaged in petroleum operations in the Philippines. Her daughter’s educational expenses is being shouldered by her employer. For the year 2018, expenses related thereto amount to P250,000. The fringe benefit tax due from the employer is ____________________. VIII. DE MINIMIS BENEFITS Ben, a rank-and-file employee, had the following data in a calendar year Basic salary, net of mandatory contributions P500,000 13th month pay 70,000 Clothing allowance 12,000 Rice subsidy 10,000 Actual medical benefits 20,000 Dividend from domestic corporation 5,000 1. The taxable compensation income of Ben is ________________________. 2. The personal income tax due of Ben is _________________________. VBS 5