toyota motor(adr) nyse-tm

advertisement

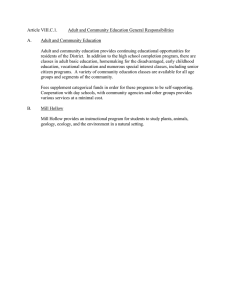

TOYOTA MOTOR (ADR) TIMELINESS SAFETY TECHNICAL 5 2 5 Lowered 7/22/16 Raised 5/20/16 Lowered 8/19/16 BETA 1.00 (1.00 = Market) High: Low: RECENT PRICE NYSE-TM 104.9 70.9 135.1 94.5 138.0 104.5 9.5 RELATIVE DIV’D Median: 18.0) P/E RATIO 0.65 YLD 3.4% 117.42 P/ERATIO 12.2(Trailing: 117.6 55.4 87.7 56.8 92.0 67.6 93.9 60.4 93.4 67.3 134.9 93.2 129.3 103.4 145.8 105.0 122.3 97.8 VALUE LINE Target Price Range 2019 2020 2021 LEGENDS 7.0 x ″Cash Flow″p ADR . . . . Relative Price Strength Options: Yes Shaded area indicates recession 400 320 2019-21 PROJECTIONS 200 160 120 100 80 60 Ann’l Total Price Gain Return High 200 (+70%) 16% Low 150 (+30%) 10% Insider Decisions NOT REPORTED 40 % TOT. RETURN 7/16 U.S. Institutional Decisions 3Q2015 163 to Buy to Sell 140 Hld’s(000) 20378 4Q2015 148 167 19367 1Q2016 129 193 17691 Percent shares traded 3 2 1 1 yr. 3 yr. 5 yr. 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 124.00 133.00 120.00 106.00 107.00 117.00 117.00 99.86 57.55 58.87 71.45 90.68 95.71 99.22 106.69 145.77 6.39 5.62 7.47 11.18 11.19 12.36 14.24 21.20 2.92 2.28 3.52 6.47 6.62 7.38 8.68 12.93 .40 .42 .60 .83 .97 1.31 1.80 2.33 1.92 3.87 4.64 7.81 9.92 18.61 13.35 15.30 31.00 29.87 32.82 42.88 46.66 49.81 55.70 65.82 1842.5 1825.0 1805.0 1804.5 1805.0 1805.0 1800.0 1800.0 27.7 25.9 14.6 9.1 11.6 12.0 13.5 8.9 1.80 1.33 .80 .52 .61 .64 .73 .47 .5% .7% 1.2% 1.4% 1.3% 1.5% 1.5% 2.0% CAPITAL STRUCTURE as of 3/31/16 192038 262394 14.2% 18.4% Total Debt $116043 mill. Due in 5 Yrs $83500 11712 14883 mill. 13927 23284 LT Debt $83426 mill. LT Interest $4600 mill. 24.9% 38.8% (36% of Cap’l) 7.3% 8.9% Pension Assets 3/16 $19.6 bill. Oblig. $27.4 bill. Pfd Stock None 143.0 1452.0 53059 59706 Common Stock 3146.8 mill. shares (equivalent 100263 118470 to 1573.4 mill. American Depositary Receipts) E 9.1% 13.1% 13.9% 19.7% MARKET CAP: $185 billion (Large Cap) CURRENT POSITION 2013 2014 3/31/16 11.0% 16.0% 21% 18% ($MILL.) Cash Assets Receivables Inventory (FIFO) Other Current Assets Accts Payable Debt Due Other Current Liab. ANNUAL RATES of change (per ADR) Sales ‘‘Cash Flow’’ Earnings Dividends Book Value Fiscal Year Begins 2013 2014 2015 2016 2017 Fiscal Year Begins 2013 2014 2015 2016 2017 Calendar 2012 2013 2014 2015 2016 41445 43477 19032 19772 17577 17566 18398 17817 17808 73004 70636 95015 152619 149507 149421 21490 20093 20082 75549 74707 32617 45511 42163 84185 142550 136963 136884 Past 10 Yrs. 5.0% 8.0% 7.0% 6.0% 6.0% Past Est’d ’11-’14 5 Yrs. to ’19-’21 4.5% 4.5% 13.0% 11.5% 13.0% 22.5% 3.0% 18.5% 4.5% 4.5% ANNUAL SALES ($ mill.) B Jun.30 Sep.30 Dec.31 Mar.31 65684 61745 60424 61615 58395 56259 56362 55864 57201 59310 61011 60466 65094 60000 61000 60906 61000 62000 62000 63000 EARNINGS PER ADR B C Jun.30 Sep.30 Dec.31 Mar.31 3.94 2.82 3.15 1.86 3.66 3.11 3.17 2.37 3.36 3.21 3.32 2.39 3.54 2.00 2.00 2.06 2.45 2.50 2.50 2.65 GROSS QUARTERLY DIV’DS PAID D Mar.31 Jun.30 Sep.30 Dec.31 -.757 - .730 -1.263 - 1.273 -1.956 - 1.273 -2.012 - 1.628 -2.015 Full Fiscal Year 249468 226880 237988 247000 248000 Full Fiscal Year 11.77 12.31 12.28 9.60 10.10 Full Year 1.49 2.54 3.23 3.64 99.13 133.46 6.88 d2.84 2.74 15.11 65.41 1566.0 --3.4% 208995 9.8% 15221 d4448 -NMF 7224.0 64150 102425 NMF NMF NMF NMF 93.04 129.90 11.13 1.44 1.18 9.85 71.01 1568.0 NMF NMF 1.5% 203687 12.0% 15204 2251.0 31.8% 1.1% 25660 75402 111347 1.2% 2.0% .7% 67% 82.78 145.68 10.91 1.89 1.22 12.97 83.76 1568.0 40.5 2.58 1.6% 228427 12.0% 14138 2965.0 NMF 1.3% 12492 77561 131329 1.4% 2.3% 1.0% 57% 82.19 142.80 10.38 2.20 1.27 11.77 85.04 1583.4 34.0 2.13 1.7% 226106 10.8% 12992 3450.0 60.6% 1.5% 6565.0 73516 134645 1.7% 2.6% 1.1% 55% 94.05 148.13 14.66 7.24 1.99 13.25 81.56 1583.7 11.7 .74 2.3% 234601 13.9% 11750 11465 30.7% 4.9% 9276.0 78020 129166 5.5% 8.9% 6.5% 27% 103.00 120.17 110.00 157.41 144.20 151.40 19.43 19.84 20.70 11.77 12.31 12.28 3.28 3.64 3.23 16.41 17.72 13.15 88.65 93.44 101.80 1584.9 1573.4 1572.0 9.8 10.1 10.3 .52 .51 .58 2.7% 2.9% 2.7% 249468 226880 237988 17.0% 15.3% 19.5% 12146 11738 13200 18653 19474 19304 27.4% 25.2% 39.0% 8.6% 8.1% 7.5% 10069 12537 11200 82990 83426 85000 140495 147013 160000 8.5% 11.0% 8.4% 13.3% 13.2% 12.0% 10.5% 10.1% 10.5% 24% 28% 21% 105.00 157.05 18.25 9.60 4.00 13.20 103.90 1573.0 105.00 157.55 19.15 10.10 4.35 13.30 106.75 1574.0 Bold figures are Value Line estimates 247000 248000 17.5% 18.0% 13600 14200 15100 15910 39.0% 39.0% 6.1% 6.4% 11400 11900 86000 87000 163400 168000 8.0% 8.5% 9.0% 9.5% 7.5% 8.0% 32% 33% THIS STOCK VL ARITH.* INDEX -16.4 -8.4 36.2 4.8 25.2 69.0 © VALUE LINE PUB. LLC 19-21 Translation Rate (Yen/$)A Sales per ADR B ‘‘Cash Flow’’ per ADR Earnings per ADR B C Gross Div’ds Decl’d/ADR Cap’l Spending per ADR Book Value per ADR Equiv ADRs Outst’g E Avg Ann’l P/E Ratio Relative P/E Ratio Avg Ann’l Div’d Yield Sales ($mill) B Operating Margin Depreciation ($mill) Net Profit ($mill) Income Tax Rate Net Profit Margin Working Cap’l ($mill) Long-Term Debt ($mill) Shr. Equity ($mill) Return on Total Capital Return on Shr. Equity Retained to Com Eq All Div’ds to Net Prof 110.00 173.40 23.55 13.40 D 5.15 13.85 117.70 1580.0 13.0 .80 3.0% 274000 19.5% 16000 21200 39.0% 7.7% 12800 92000 186000 10.5% 11.5% 10.0% 29% BUSINESS: Toyota Motor Corp. is Japan’s largest automobile maker. Sells various vehicles under the Toyota and Lexus (luxury) nameplates. It is also a major player in the hybrid car market with the Prius and Crown. The company commenced operations in 1933. It sells its vehicles in more than 170 countries and regions. Has production facil. in Japan, U.S., and 21 other nations. Unit sales in 12 months ended March ’16: 8.681 mill. cars, trucks, & buses. For. sales: 74%. R&D: 5% of sales. Has 354,974 employ. Chairman: Takeshi Uchiyamada. Pres.: Akio Toyoda. Incorporated: Japan. Address: 1, Toyota-cho, Toyota City, Aichi Prefecture 4718571, Japan. U.S. address: 9 West 57th Street, New York, NY 10019. Tel.: 212-223-0303. Internet: www.toyota.com. Toyota reported mixed results for the fiscal first quarter of 2016 (ended June 30th). Consolidated vehicle sales totaled 2.173 million units, a 3% rise from a year earlier. This was a fairly strong showing, particularly given the suspension of production of vehicles following the earthquake in Japan in April. In fact, Toyota reported that volumes in the country still grew 9%, to 511,000 units. However, international sales were nearly flat, rising only 1%. The company posted yearover-year unit declines in North America, the Middle East, and Africa, which were essentially countered by solid gains in the Philippines, Indonesia, and much of Europe. Operating earnings during the period decreased from the prior-year tally, largely due to unfavorable foreign exchange rates, particularly the appreciation of the Japanese yen. This more than offset ongoing cost-reduction efforts and more streamlined marketing. 2016 earnings are expected to fall well below the prior-year figure. While management maintained its forecast for consolidated vehicle sales for the year at 8.9 million units, lingering pressures from unfavorable foreign exchange rates ought to continue to hurt the bottom line, despite ongoing cost-reduction initiatives. Sales in North America should rebound a bit, thanks to solid demand for pick-up trucks and SUVs. Improving conditions in parts of Asia should allow that region to post decent results, as well. However, management looks for a further reduction in sales in the Middle East, as the marketing environment continues to deteriorate with weak oil prices. All told, we think share net for the year will decrease 25% compared to the prior-year tally. We have lowered the Timeliness rank of Toyota shares by a notch, to 5 (Lowest). Short-term earnings are expected to continue to be hurt by unfavorable exchange rates, despite management’s best efforts to cut costs and optimize marketing spending. Over the 3- to 5-year period, these shares, which have a good dividend yield of over 3%, offer aboveaverage price appreciation potential at the recent quotation. The stock may also appeal to risk-averse investors, thanks to its Above-Average Safety rank (2). Iason Dalavagas August 19, 2016 (A) At fiscal yearend. (D) Before 15% Japanese tax for U.S. resi- (E) In mill. of ADRs. Each ADR equals 2 com(B) Fiscal year ends 3/31 of following year. dents. Dividends historically paid in late June mon shares. (C) Diluted earnings. Based on U.S. GAAP. and December. Next egs. report due early November. © 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind. THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product. Company’s Financial Strength Stock’s Price Stability Price Growth Persistence Earnings Predictability A 80 35 15 To subscribe call 1-800-VALUELINE