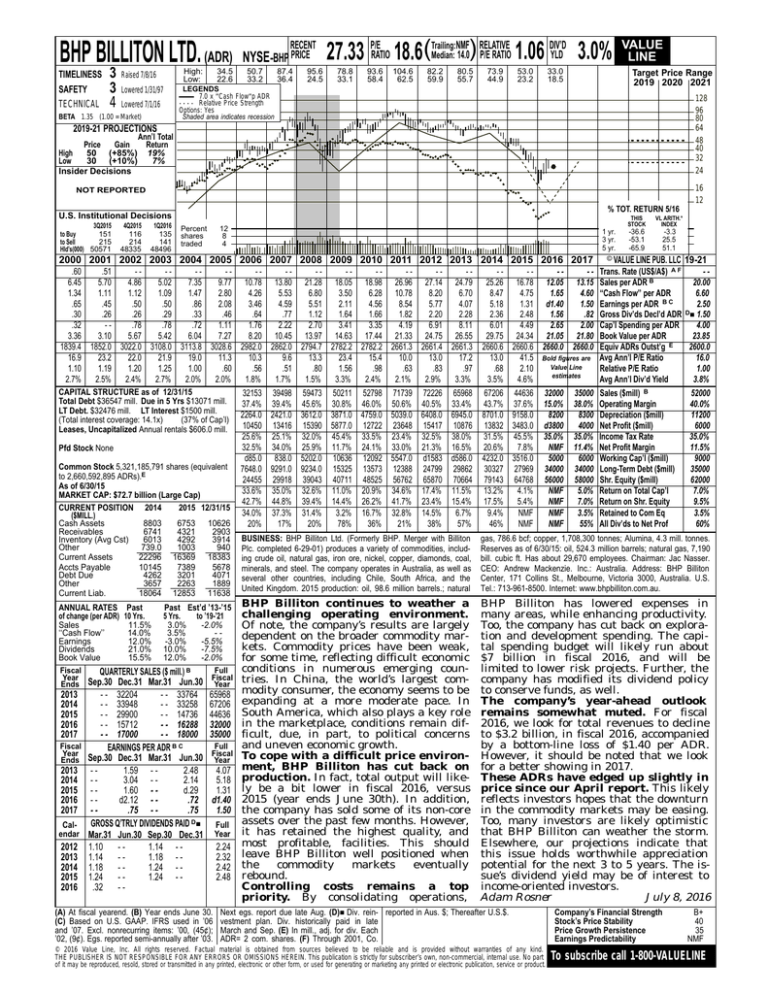

BHP BILLITON LTD. (ADR)

TIMELINESS

SAFETY

TECHNICAL

3

3

4

High:

Low:

Raised 7/8/16

34.5

22.6

RECENT

NYSE-BHP PRICE

50.7

33.2

87.4

36.4

95.6

24.5

NMF RELATIVE

DIV’D

Median: 14.0) P/E RATIO 1.06 YLD 3.0%

27.33 P/ERATIO 18.6(Trailing:

78.8

33.1

93.6

58.4

104.6

62.5

82.2

59.9

80.5

55.7

73.9

44.9

53.0

23.2

33.0

18.5

Target Price Range

2019 2020 2021

LEGENDS

7.0 x ″Cash Flow″p ADR

. . . . Relative Price Strength

Options: Yes

Shaded area indicates recession

Lowered 1/31/97

Lowered 7/1/16

BETA 1.35 (1.00 = Market)

VALUE

LINE

128

96

80

64

48

40

32

24

2019-21 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

50 (+85%) 19%

Low

30 (+10%)

7%

Insider Decisions

16

12

NOT REPORTED

% TOT. RETURN 5/16

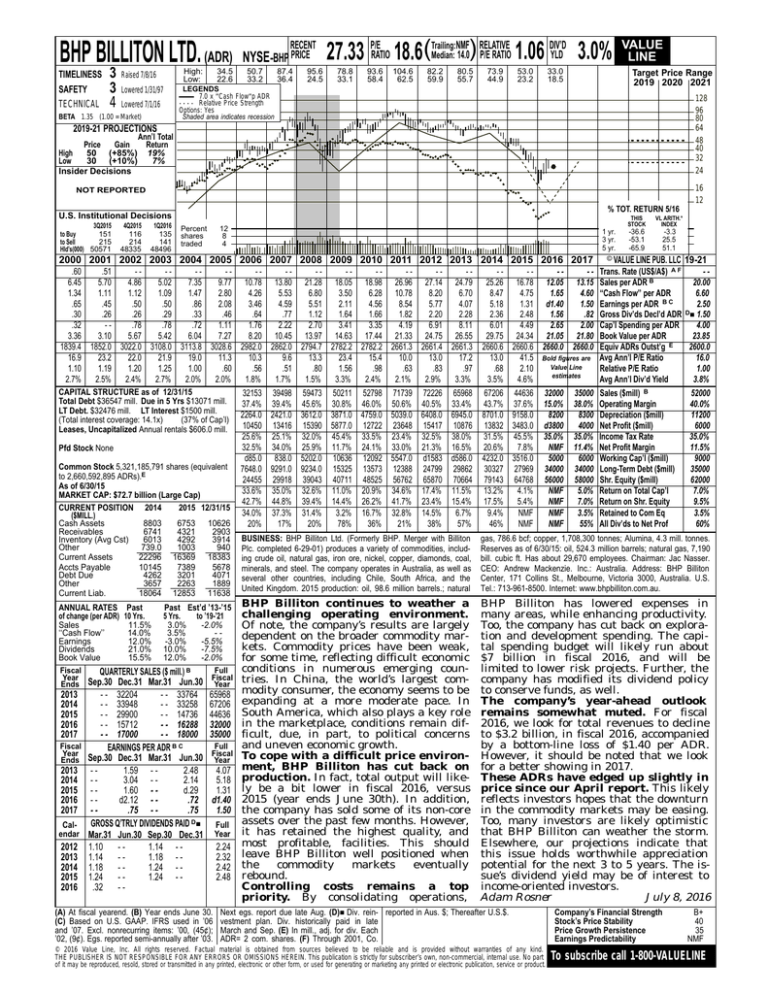

U.S. Institutional Decisions

3Q2015

151

to Buy

to Sell

215

Hld’s(000) 50571

4Q2015

116

214

48335

1Q2016

135

141

48496

Percent

shares

traded

12

8

4

1 yr.

3 yr.

5 yr.

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

.60

.51

------------6.45

5.70

4.86

5.02

7.35

9.77 10.78 13.80 21.28 18.05 18.98 26.96 27.14 24.79

1.34

1.11

1.12

1.09

1.47

2.80

4.26

5.53

6.80

3.50

6.28 10.78

8.20

6.70

.65

.45

.50

.50

.86

2.08

3.46

4.59

5.51

2.11

4.56

8.54

5.77

4.07

.30

.26

.26

.29

.33

.46

.64

.77

1.12

1.64

1.66

1.82

2.20

2.28

.32

-.78

.78

.72

1.11

1.76

2.22

2.70

3.41

3.35

4.19

6.91

8.11

3.36

3.10

5.67

5.42

6.04

7.27

8.20 10.45 13.97 14.63 17.44 21.33 24.75 26.55

1839.4 1852.0 3022.0 3108.0 3113.8 3028.6 2982.0 2862.0 2794.7 2782.2 2782.2 2661.3 2661.4 2661.3

16.9

23.2

22.0

21.9

19.0

11.3

10.3

9.6

13.3

23.4

15.4

10.0

13.0

17.2

1.10

1.19

1.20

1.25

1.00

.60

.56

.51

.80

1.56

.98

.63

.83

.97

2.7%

2.5%

2.4%

2.7%

2.0%

2.0%

1.8%

1.7%

1.5%

3.3%

2.4%

2.1%

2.9%

3.3%

CAPITAL STRUCTURE as of 12/31/15

32153 39498 59473 50211 52798 71739 72226 65968

Total Debt $36547 mill. Due in 5 Yrs $13071 mill.

37.4% 39.4% 45.6% 30.8% 46.0% 50.6% 40.5% 33.4%

LT Debt. $32476 mill. LT Interest $1500 mill.

2264.0 2421.0 3612.0 3871.0 4759.0 5039.0 6408.0 6945.0

(Total interest coverage: 14.1x)

(37% of Cap’l)

10450 13416 15390 5877.0 12722 23648 15417 10876

Leases, Uncapitalized Annual rentals $606.0 mill.

25.6% 25.1% 32.0% 45.4% 33.5% 23.4% 32.5% 38.0%

32.5% 34.0% 25.9% 11.7% 24.1% 33.0% 21.3% 16.5%

Pfd Stock None

d85.0 838.0 5202.0 10636 12092 5547.0 d1583 d586.0

Common Stock 5,321,185,791 shares (equivalent

7648.0

9291.0 9234.0 15325 13573 12388 24799 29862

to 2,660,592,895 ADRs).E

24455 29918 39043 40711 48525 56762 65870 70664

As of 6/30/15

33.6% 35.0% 32.6% 11.0% 20.9% 34.6% 17.4% 11.5%

MARKET CAP: $72.7 billion (Large Cap)

42.7% 44.8% 39.4% 14.4% 26.2% 41.7% 23.4% 15.4%

CURRENT POSITION 2014

2015 12/31/15

34.0% 37.3% 31.4%

3.2% 16.7% 32.8% 14.5%

6.7%

($MILL.)

Cash Assets

8803

6753 10626

20%

17%

20%

78%

36%

21%

38%

57%

Receivables

Inventory (Avg Cst)

Other

Current Assets

Accts Payable

Debt Due

Other

Current Liab.

6741

6013

739.0

22296

10145

4262

3657

18064

ANNUAL RATES Past

of change (per ADR) 10 Yrs.

Sales

11.5%

‘‘Cash Flow’’

14.0%

Earnings

12.0%

Dividends

21.0%

Book Value

15.5%

Fiscal

Year

Ends

2013

2014

2015

2016

2017

Fiscal

Year

Ends

2013

2014

2015

2016

2017

Calendar

2012

2013

2014

2015

2016

4321

4292

1003

16369

7389

3201

2263

12853

2903

3914

940

18383

5678

4071

1889

11638

Past Est’d ’13-’15

5 Yrs.

to ’19-’21

3.0%

-2.0%

3.5%

--3.0%

-5.5%

10.0%

-7.5%

12.0%

-2.0%

QUARTERLY SALES ($ mill.) B

Sep.30 Dec.31 Mar.31 Jun.30

- - 32204

- - 33764

- - 33948

- - 33258

- - 29900

- - 14736

- - 15712

- - 16288

- - 17000

- - 18000

EARNINGS PER ADR B C

Sep.30 Dec.31 Mar.31 Jun.30

-1.59 - 2.48

-3.04 - 2.14

-1.60 - d.29

-d2.12 - .72

-.75 - .75

GROSS Q’TRLY DIVIDENDS PAID D■

Mar.31 Jun.30 Sep.30 Dec.31

1.10 - 1.14 - 1.14 - 1.18 - 1.18 - 1.24 - 1.24 - 1.24 - .32 - -

Full

Fiscal

Year

65968

67206

44636

32000

35000

Full

Fiscal

Year

4.07

5.18

1.31

d1.40

1.50

(A) At fiscal yearend. (B) Year ends June 30.

(C) Based on U.S. GAAP. IFRS used in ’06

and ’07. Excl. nonrecurring items: ’00, (45¢);

’02, (9¢). Egs. reported semi-annually after ’03.

Full

Year

2.24

2.32

2.42

2.48

-25.26

8.47

5.18

2.36

6.01

29.75

2660.6

13.0

.68

3.5%

67206

43.7%

8701.0

13832

31.5%

20.6%

4232.0

30327

79143

13.2%

17.5%

9.4%

46%

---16.78 12.05 13.15

4.75

1.65

4.60

1.31 d1.40

1.50

2.48

1.56

.82

4.49

2.65

2.00

24.34 21.05 21.80

2660.6 2660.0 2660.0

41.5 Bold figures are

Value Line

2.10

estimates

4.6%

44636 32000 35000

37.6% 15.0% 38.0%

9158.0

8200

8300

3483.0 d3800

4000

45.5% 35.0% 35.0%

7.8%

NMF 11.4%

3516.0

5000

6000

27969 34000 34000

64768 56000 58000

4.1%

NMF

5.0%

5.4%

NMF

7.0%

NMF

NMF

3.5%

NMF

NMF

55%

THIS

STOCK

VL ARITH.*

INDEX

-36.6

-53.1

-65.9

-3.3

25.5

51.1

© VALUE LINE PUB. LLC

Trans. Rate (US$/A$) A F

Sales per ADR B

‘‘Cash Flow’’ per ADR

Earnings per ADR B C

Gross Div’ds Decl’d ADR

Cap’l Spending per ADR

Book Value per ADR

Equiv ADRs Outst’g E

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

Sales ($mill) B

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

19-21

-20.00

6.60

2.50

D■ 1.50

4.00

23.85

2600.0

16.0

1.00

3.8%

52000

40.0%

11200

6000

35.0%

11.5%

9000

35000

62000

7.0%

9.5%

3.5%

60%

BUSINESS: BHP Billiton Ltd. (Formerly BHP. Merger with Billiton

Plc. completed 6-29-01) produces a variety of commodities, including crude oil, natural gas, iron ore, nickel, copper, diamonds, coal,

minerals, and steel. The company operates in Australia, as well as

several other countries, including Chile, South Africa, and the

United Kingdom. 2015 production: oil, 98.6 million barrels.; natural

gas, 786.6 bcf; copper, 1,708,300 tonnes; Alumina, 4.3 mill. tonnes.

Reserves as of 6/30/15: oil, 524.3 million barrels; natural gas, 7,190

bill. cubic ft. Has about 29,670 employees. Chairman: Jac Nasser.

CEO: Andrew Mackenzie. Inc.: Australia. Address: BHP Billiton

Center, 171 Collins St., Melbourne, Victoria 3000, Australia. U.S.

Tel.: 713-961-8500. Internet: www.bhpbilliton.com.au.

BHP Billiton continues to weather a

challenging operating environment.

Of note, the company’s results are largely

dependent on the broader commodity markets. Commodity prices have been weak,

for some time, reflecting difficult economic

conditions in numerous emerging countries. In China, the world’s largest commodity consumer, the economy seems to be

expanding at a more moderate pace. In

South America, which also plays a key role

in the marketplace, conditions remain difficult, due, in part, to political concerns

and uneven economic growth.

To cope with a difficult price environment, BHP Billiton has cut back on

production. In fact, total output will likely be a bit lower in fiscal 2016, versus

2015 (year ends June 30th). In addition,

the company has sold some of its non-core

assets over the past few months. However,

it has retained the highest quality, and

most profitable, facilities. This should

leave BHP Billiton well positioned when

the

commodity

markets

eventually

rebound.

Controlling costs remains a top

priority. By consolidating operations,

BHP Billiton has lowered expenses in

many areas, while enhancing productivity.

Too, the company has cut back on exploration and development spending. The capital spending budget will likely run about

$7 billion in fiscal 2016, and will be

limited to lower risk projects. Further, the

company has modified its dividend policy

to conserve funds, as well.

The company’s year-ahead outlook

remains somewhat muted. For fiscal

2016, we look for total revenues to decline

to $3.2 billion, in fiscal 2016, accompanied

by a bottom-line loss of $1.40 per ADR.

However, it should be noted that we look

for a better showing in 2017.

These ADRs have edged up slightly in

price since our April report. This likely

reflects investors hopes that the downturn

in the commodity markets may be easing.

Too, many investors are likely optimistic

that BHP Billiton can weather the storm.

Elsewhere, our projections indicate that

this issue holds worthwhile appreciation

potential for the next 3 to 5 years. The issue’s dividend yield may be of interest to

income-oriented investors.

Adam Rosner

July 8, 2016

Next egs. report due late Aug. (D)■ Div. rein- reported in Aus. $; Thereafter U.S.$.

vestment plan. Div. historically paid in late

March and Sep. (E) In mill., adj. for div. Each

ADR= 2 com. shares. (F) Through 2001, Co.

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

B+

40

35

NMF

To subscribe call 1-800-VALUELINE