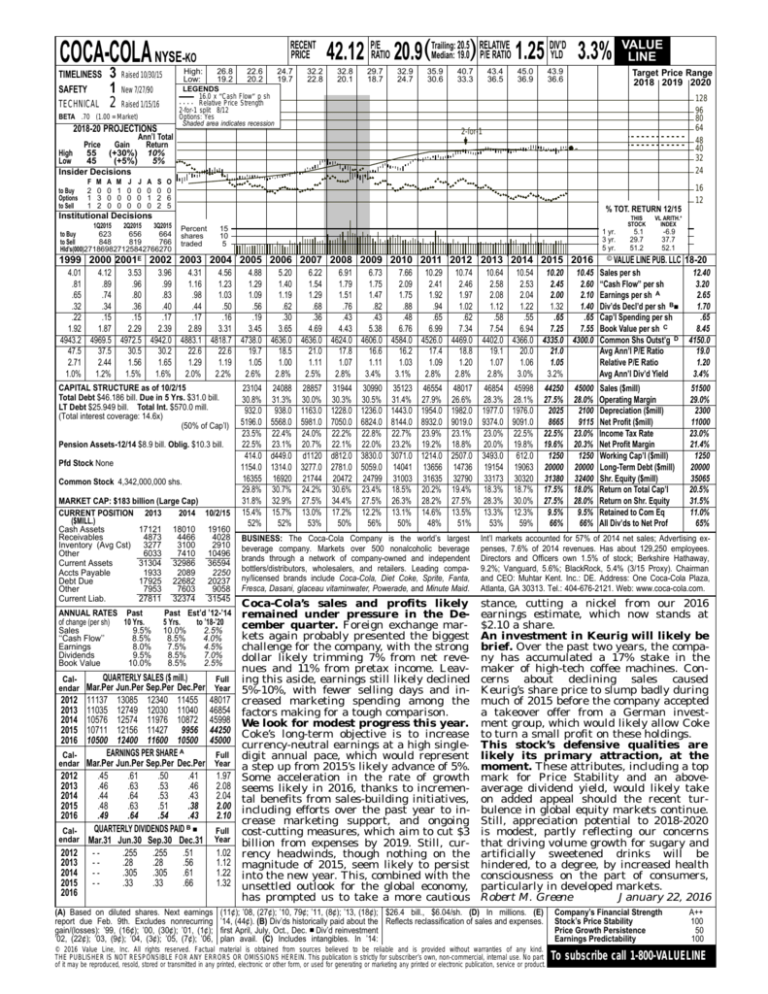

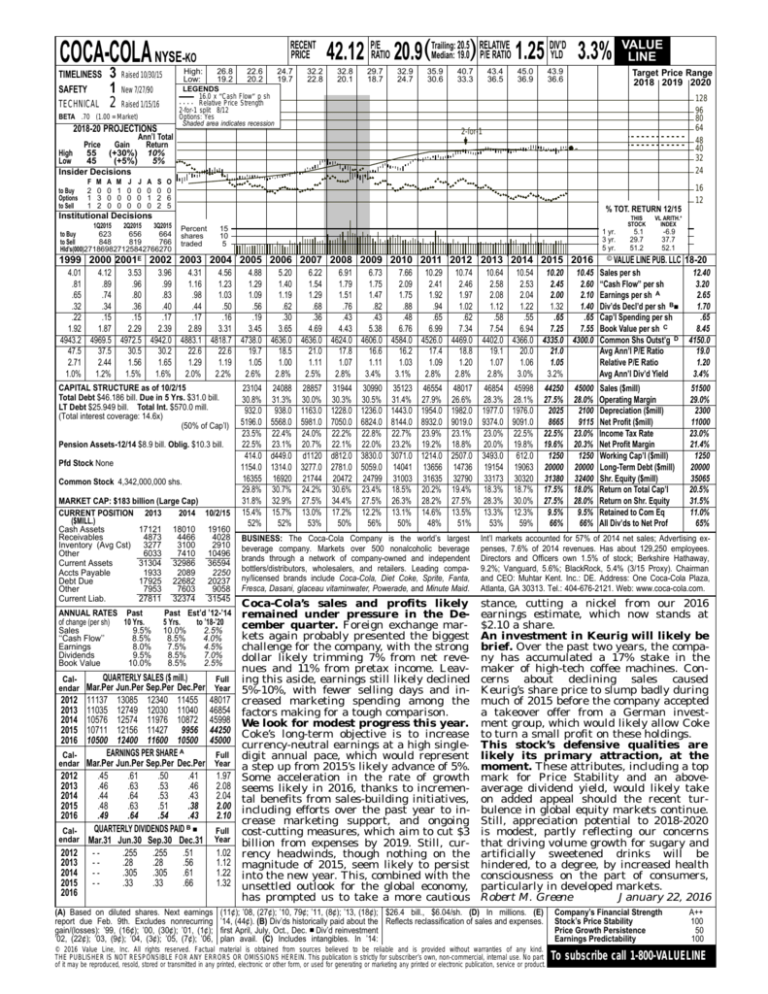

COCA-COLA NYSE-KO

TIMELINESS

SAFETY

TECHNICAL

3

1

2

RECENT

PRICE

High:

Low:

Raised 10/30/15

26.8

19.2

22.6

20.2

24.7

19.7

32.2

22.8

20.5 RELATIVE

DIV’D

Median: 19.0) P/E RATIO 1.25 YLD 3.3%

42.12 P/ERATIO 20.9(Trailing:

32.8

20.1

Raised 1/15/16

2018-20 PROJECTIONS

M

0

3

2

A

0

0

0

M

1

0

0

J

0

0

0

J

0

0

0

A

0

1

0

S

0

2

2

35.9

30.6

40.7

33.3

43.4

36.5

45.0

36.9

43.9

36.6

Target Price Range

2018 2019 2020

128

96

80

64

48

40

32

24

2-for-1

Ann’l Total

Price

Gain

Return

High

55 (+30%) 10%

Low

45

(+5%)

5%

Insider Decisions

F

2

1

1

32.9

24.7

LEGENDS

16.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

2-for-1 split 8/12

Options: Yes

Shaded area indicates recession

New 7/27/90

BETA .70 (1.00 = Market)

to Buy

Options

to Sell

29.7

18.7

O

0

6

5

16

12

% TOT. RETURN 12/15

Institutional Decisions

1Q2015

2Q2015

3Q2015

623

656

664

to Buy

to Sell

848

819

766

Hld’s(000)271869827125842766270

Percent

shares

traded

15

10

5

1 yr.

3 yr.

5 yr.

1999 2000 2001E 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

4.01

4.12

3.53

3.96

4.31

4.56

4.88

5.20

6.22

6.91

6.73

7.66 10.29 10.74

.81

.89

.96

.99

1.16

1.23

1.29

1.40

1.54

1.79

1.75

2.09

2.41

2.46

.65

.74

.80

.83

.98

1.03

1.09

1.19

1.29

1.51

1.47

1.75

1.92

1.97

.32

.34

.36

.40

.44

.50

.56

.62

.68

.76

.82

.88

.94

1.02

.22

.15

.15

.17

.17

.16

.19

.30

.36

.43

.43

.48

.65

.62

1.92

1.87

2.29

2.39

2.89

3.31

3.45

3.65

4.69

4.43

5.38

6.76

6.99

7.34

4943.2 4969.5 4972.5 4942.0 4883.1 4818.7 4738.0 4636.0 4636.0 4624.0 4606.0 4584.0 4526.0 4469.0

47.5

37.5

30.5

30.2

22.6

22.6

19.7

18.5

21.0

17.8

16.6

16.2

17.4

18.8

2.71

2.44

1.56

1.65

1.29

1.19

1.05

1.00

1.11

1.07

1.11

1.03

1.09

1.20

1.0%

1.2%

1.5%

1.6%

2.0%

2.2%

2.6%

2.8%

2.5%

2.8%

3.4%

3.1%

2.8%

2.8%

CAPITAL STRUCTURE as of 10/2/15

Total Debt $46.186 bill. Due in 5 Yrs. $31.0 bill.

LT Debt $25.949 bill. Total Int. $570.0 mill.

(Total interest coverage: 14.6x)

(50% of Cap’l)

Pension Assets-12/14 $8.9 bill. Oblig. $10.3 bill.

Pfd Stock None

Common Stock 4,342,000,000 shs.

MARKET CAP: $183 billion (Large Cap)

CURRENT POSITION 2013

2014 10/2/15

($MILL.)

Cash Assets

17121 18010 19160

Receivables

4873

4466

4028

Inventory (Avg Cst) 3277

3100

2910

Other

6033

7410 10496

Current Assets

31304 32986 36594

Accts Payable

1933

2089

2250

Debt Due

17925 22682 20237

Other

7953

7603

9058

Current Liab.

27811 32374 31545

ANNUAL RATES Past

of change (per sh)

10 Yrs.

Sales

9.5%

‘‘Cash Flow’’

8.5%

Earnings

8.0%

Dividends

9.5%

Book Value

10.0%

Past Est’d ’12-’14

5 Yrs.

to ’18-’20

10.0%

2.5%

8.5%

4.0%

7.5%

4.5%

8.5%

7.0%

8.5%

2.5%

QUARTERLY SALES ($ mill.)

Calendar Mar.Per Jun.Per Sep.Per Dec.Per

2012

2013

2014

2015

2016

Calendar

2012

2013

2014

2015

2016

Calendar

2012

2013

2014

2015

2016

VALUE

LINE

11137 13085 12340 11455

11035 12749 12030 11040

10576 12574 11976 10872

10711 12156 11427 9956

10500 12400 11600 10500

EARNINGS PER SHARE A

Mar.Per Jun.Per Sep.Per Dec.Per

.45

.61

.50

.41

.46

.63

.53

.46

.44

.64

.53

.43

.48

.63

.51

.38

.49

.64

.54

.43

QUARTERLY DIVIDENDS PAID B ■

Mar.31 Jun.30 Sep.30 Dec.31

-.255

.255

.51

-.28

.28

.56

-.305

.305

.61

-.33

.33

.66

Full

Year

48017

46854

45998

44250

45000

(A) Based on diluted shares. Next earnings

report due Feb. 9th. Excludes nonrecurring

gain/(losses): ’99, (16¢); ’00, (30¢); ’01, (1¢);

’02, (22¢); ’03, (9¢); ’04, (3¢); ’05, (7¢); ’06,

Full

Year

1.97

2.08

2.04

2.00

2.10

Full

Year

1.02

1.12

1.22

1.32

23104 24088 28857

30.8% 31.3% 30.0%

932.0 938.0 1163.0

5196.0 5568.0 5981.0

23.5% 22.4% 24.0%

22.5% 23.1% 20.7%

414.0 d449.0 d1120

1154.0 1314.0 3277.0

16355 16920 21744

29.8% 30.7% 24.2%

31.8% 32.9% 27.5%

15.4% 15.7% 13.0%

52%

52%

53%

31944

30.3%

1228.0

7050.0

22.2%

22.1%

d812.0

2781.0

20472

30.6%

34.4%

17.2%

50%

30990 35123 46554 48017

30.5% 31.4% 27.9% 26.6%

1236.0 1443.0 1954.0 1982.0

6824.0 8144.0 8932.0 9019.0

22.8% 22.7% 23.9% 23.1%

22.0% 23.2% 19.2% 18.8%

3830.0 3071.0 1214.0 2507.0

5059.0 14041 13656 14736

24799 31003 31635 32790

23.4% 18.5% 20.2% 19.4%

27.5% 26.3% 28.2% 27.5%

12.2% 13.1% 14.6% 13.5%

56%

50%

48%

51%

THIS

STOCK

VL ARITH.*

INDEX

5.1

29.7

51.2

-6.9

37.7

52.1

© VALUE LINE PUB. LLC

18-20

10.64 10.54 10.20 10.45 Sales per sh

2.58

2.53

2.45

2.60 ‘‘Cash Flow’’ per sh

2.08

2.04

2.00

2.10 Earnings per sh A

1.12

1.22

1.32

1.40 Div’ds Decl’d per sh B■

.58

.55

.65

.65 Cap’l Spending per sh

7.54

6.94

7.25

7.55 Book Value per sh C

4402.0 4366.0 4335.0 4300.0 Common Shs Outst’g D

19.1

20.0

21.0

Avg Ann’l P/E Ratio

1.07

1.06

1.05

Relative P/E Ratio

2.8%

3.0%

3.2%

Avg Ann’l Div’d Yield

12.40

3.20

2.65

1.70

.65

8.45

4150.0

19.0

1.20

3.4%

46854 45998

28.3% 28.1%

1977.0 1976.0

9374.0 9091.0

23.0% 22.5%

20.0% 19.8%

3493.0 612.0

19154 19063

33173 30320

18.3% 18.7%

28.3% 30.0%

13.3% 12.3%

53%

59%

51500

29.0%

2300

11000

23.0%

21.4%

1250

20000

35065

20.5%

31.5%

11.0%

65%

44250

27.5%

2025

8665

22.5%

19.6%

1250

20000

31380

17.5%

27.5%

9.5%

66%

45000

28.0%

2100

9115

23.0%

20.3%

1250

20000

32400

18.0%

28.0%

9.5%

66%

Sales ($mill)

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

BUSINESS: The Coca-Cola Company is the world’s largest

beverage company. Markets over 500 nonalcoholic beverage

brands through a network of company-owned and independent

bottlers/distributors, wholesalers, and retailers. Leading company/licensed brands include Coca-Cola, Diet Coke, Sprite, Fanta,

Fresca, Dasani, glaceau vitaminwater, Powerade, and Minute Maid.

Int’l markets accounted for 57% of 2014 net sales; Advertising expenses, 7.6% of 2014 revenues. Has about 129,250 employees.

Directors and Officers own 1.5% of stock; Berkshire Hathaway,

9.2%; Vanguard, 5.6%; BlackRock, 5.4% (3/15 Proxy). Chairman

and CEO: Muhtar Kent. Inc.: DE. Address: One Coca-Cola Plaza,

Atlanta, GA 30313. Tel.: 404-676-2121. Web: www.coca-cola.com.

Coca-Cola’s sales and profits likely

remained under pressure in the December quarter. Foreign exchange markets again probably presented the biggest

challenge for the company, with the strong

dollar likely trimming 7% from net revenues and 11% from pretax income. Leaving this aside, earnings still likely declined

5%-10%, with fewer selling days and increased marketing spending among the

factors making for a tough comparison.

We look for modest progress this year.

Coke’s long-term objective is to increase

currency-neutral earnings at a high singledigit annual pace, which would represent

a step up from 2015’s likely advance of 5%.

Some acceleration in the rate of growth

seems likely in 2016, thanks to incremental benefits from sales-building initiatives,

including efforts over the past year to increase marketing support, and ongoing

cost-cutting measures, which aim to cut $3

billion from expenses by 2019. Still, currency headwinds, though nothing on the

magnitude of 2015, seem likely to persist

into the new year. This, combined with the

unsettled outlook for the global economy,

has prompted us to take a more cautious

stance, cutting a nickel from our 2016

earnings estimate, which now stands at

$2.10 a share.

An investment in Keurig will likely be

brief. Over the past two years, the company has accumulated a 17% stake in the

maker of high-tech coffee machines. Concerns about declining sales caused

Keurig’s share price to slump badly during

much of 2015 before the company accepted

a takeover offer from a German investment group, which would likely allow Coke

to turn a small profit on these holdings.

This stock’s defensive qualities are

likely its primary attraction, at the

moment. These attributes, including a top

mark for Price Stability and an aboveaverage dividend yield, would likely take

on added appeal should the recent turbulence in global equity markets continue.

Still, appreciation potential to 2018-2020

is modest, partly reflecting our concerns

that driving volume growth for sugary and

artificially sweetened drinks will be

hindered, to a degree, by increased health

consciousness on the part of consumers,

particularly in developed markets.

Robert M. Greene

January 22, 2016

(11¢); ’08, (27¢); ’10, 79¢; ’11, (8¢); ’13, (18¢); $26.4 bill., $6.04/sh. (D) In millions. (E)

’14, (44¢). (B) Div’ds historically paid about the Reflects reclassification of sales and expenses.

first April, July, Oct., Dec. ■ Div’d reinvestment

plan avail. (C) Includes intangibles. In ’14:

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

A++

100

50

100

To subscribe call 1-800-VALUELINE