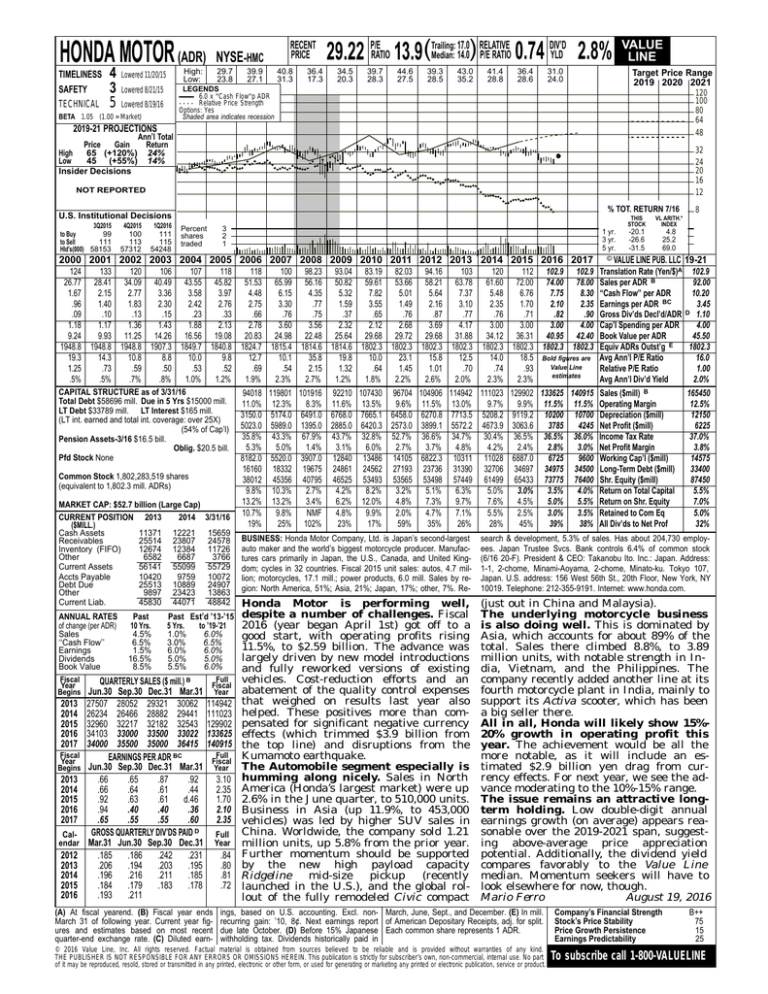

HONDA MOTOR (ADR)

TIMELINESS

SAFETY

TECHNICAL

4

3

5

High:

Low:

Lowered 11/20/15

RECENT

PRICE

NYSE-HMC

29.7

23.8

39.9

27.1

40.8

31.3

36.4

17.3

17.0 RELATIVE

DIV’D

Median: 14.0) P/E RATIO 0.74 YLD 2.8%

29.22 P/ERATIO 13.9(Trailing:

34.5

20.3

39.7

28.3

44.6

27.5

39.3

28.5

43.0

35.2

41.4

28.8

36.4

28.6

31.0

24.0

Target Price Range

2019 2020 2021

LEGENDS

6.0 x ″Cash Flow″p ADR

. . . . Relative Price Strength

Options: Yes

Shaded area indicates recession

Lowered 8/21/15

Lowered 8/19/16

BETA 1.05 (1.00 = Market)

VALUE

LINE

120

100

80

64

48

2019-21 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

65 (+120%) 24%

Low

45 (+55%) 14%

Insider Decisions

32

24

20

16

12

NOT REPORTED

% TOT. RETURN 7/16

U.S. Institutional Decisions

3Q2015

99

to Buy

to Sell

111

Hld’s(000) 58153

4Q2015

100

113

57312

1Q2016

111

115

54248

Percent

shares

traded

3

2

1

1 yr.

3 yr.

5 yr.

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

124

133

120

106

107

118

118

26.77 28.41 34.09 40.49 43.55 45.82 51.53

1.67

2.15

2.77

3.36

3.58

3.97

4.48

.96

1.40

1.83

2.30

2.42

2.76

2.75

.09

.10

.13

.15

.23

.33

.66

1.18

1.17

1.36

1.43

1.88

2.13

2.78

9.24

9.93 11.25 14.26 16.56 19.08 20.83

1948.8 1948.8 1948.8 1907.3 1849.7 1840.8 1824.7

19.3

14.3

10.8

8.8

10.0

9.8

12.7

1.25

.73

.59

.50

.53

.52

.69

.5%

.5%

.7%

.8%

1.0%

1.2%

1.9%

CAPITAL STRUCTURE as of 3/31/16

94018

Total Debt $58696 mill. Due in 5 Yrs $15000 mill.

11.0%

LT Debt $33789 mill. LT Interest $165 mill.

3150.0

(LT int. earned and total int. coverage: over 25X)

(54% of Cap’l) 5023.0

35.8%

Pension Assets-3/16 $16.5 bill.

5.3%

Oblig. $20.5 bill.

Pfd Stock None

8182.0

16160

Common Stock 1,802,283,519 shares

38012

(equivalent to 1,802.3 mill. ADRs)

9.8%

13.2%

MARKET CAP: $52.7 billion (Large Cap)

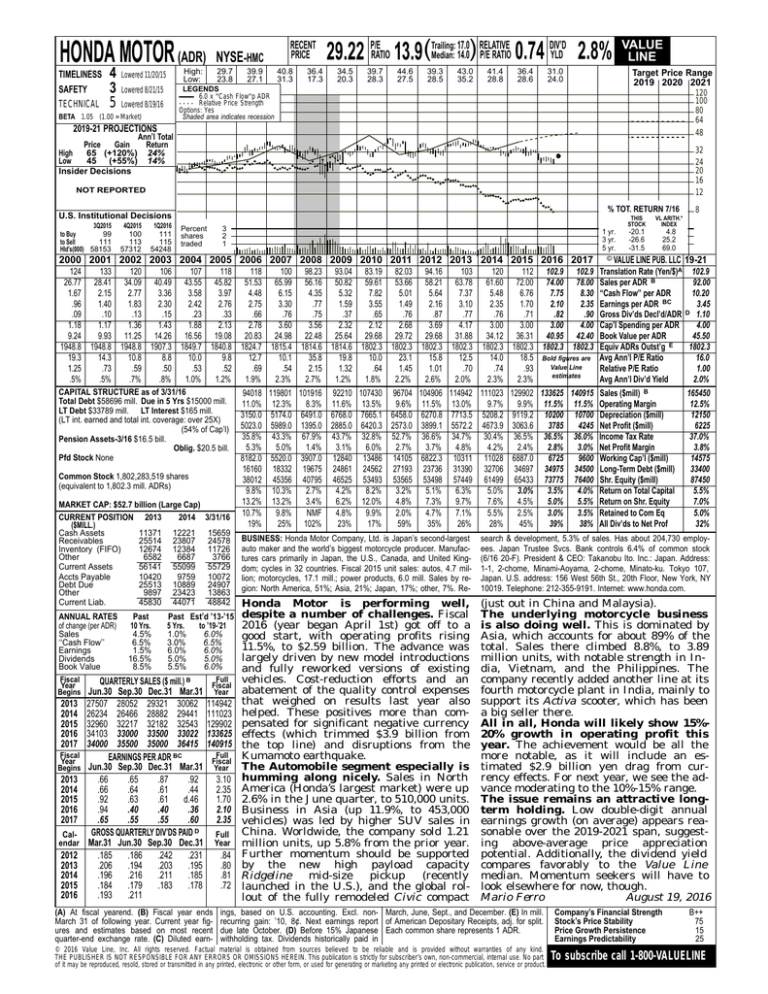

CURRENT POSITION 2013

2014 3/31/16 10.7%

19%

($MILL.)

Cash Assets

Receivables

Inventory (FIFO)

Other

Current Assets

Accts Payable

Debt Due

Other

Current Liab.

ANNUAL RATES

of change (per ADR)

Sales

‘‘Cash Flow’’

Earnings

Dividends

Book Value

Fiscal

Year

Begins

2013

2014

2015

2016

2017

Fiscal

Year

Begins

2013

2014

2015

2016

2017

Calendar

2012

2013

2014

2015

2016

11371

25514

12674

6582

56141

10420

25513

9897

45830

Past

10 Yrs.

4.5%

6.5%

1.5%

16.5%

8.5%

12221

23807

12384

6687

55099

9759

10889

23423

44071

15659

24578

11726

3766

55729

10072

24907

13863

48842

Past Est’d ’13-’15

5 Yrs.

to ’19-’21

1.0%

6.0%

3.0%

6.5%

6.0%

6.0%

5.0%

5.0%

5.5%

6.0%

QUARTERLY SALES ($ mill.) B

Jun.30 Sep.30 Dec.31 Mar.31

27507 28052 29321 30062

26234 26466 28882 29441

32960 32217 32182 32543

34103 33000 33500 33022

34000 35500 35000 36415

EARNINGS PER ADR BC

Jun.30 Sep.30 Dec.31 Mar.31

.66

.65

.87

.92

.66

.64

.61

.44

.92

.63

.61

d.46

.94

.40

.40

.36

.65

.55

.55

.60

GROSS QUARTERLY DIV’DS PAID D

Mar.31 Jun.30 Sep.30 Dec.31

.185

.186

.242

.231

.206

.194

.203

.195

.196

.216

.211

.185

.184

.179

.183

.178

.193

.211

Full

Fiscal

Year

114942

111023

129902

133625

140915

Full

Fiscal

Year

(A) At fiscal yearend. (B) Fiscal year ends

March 31 of following year. Current year figures and estimates based on most recent

quarter-end exchange rate. (C) Diluted earn-

3.10

2.35

1.70

2.10

2.35

Full

Year

.84

.80

.81

.72

100

65.99

6.15

3.30

.76

3.60

24.98

1815.4

10.1

.54

2.3%

119801

12.3%

5174.0

5989.0

43.3%

5.0%

5520.0

18332

45356

10.3%

13.2%

9.8%

25%

98.23 93.04 83.19 82.03 94.16

56.16 50.82 59.61 53.66 58.21

4.35

5.32

7.82

5.01

5.64

.77

1.59

3.55

1.49

2.16

.75

.37

.65

.76

.87

3.56

2.32

2.12

2.68

3.69

22.48 25.64 29.68 29.72 29.68

1814.6 1814.6 1802.3 1802.3 1802.3

35.8

19.8

10.0

23.1

15.8

2.15

1.32

.64

1.45

1.01

2.7%

1.2%

1.8%

2.2%

2.6%

101916 92210 107430 96704 104906

8.3% 11.6% 13.5%

9.6% 11.5%

6491.0 6768.0 7665.1 6458.0 6270.8

1395.0 2885.0 6420.3 2573.0 3899.1

67.9% 43.7% 32.8% 52.7% 36.6%

1.4%

3.1%

6.0%

2.7%

3.7%

3907.0 12840 13486 14105 6822.3

19675 24861 24562 27193 23736

40795 46525 53493 53565 53498

2.7%

4.2%

8.2%

3.2%

5.1%

3.4%

6.2% 12.0%

4.8%

7.3%

NMF

4.8%

9.9%

2.0%

4.7%

102%

23%

17%

59%

35%

THIS

STOCK

VL ARITH.*

INDEX

-20.1

-26.6

-31.5

4.8

25.2

69.0

© VALUE LINE PUB. LLC

103

120

112 102.9 102.9 Translation Rate (Yen/$)A

63.78 61.60 72.00 74.00 78.00 Sales per ADR B

5.48

6.76

7.75

8.30 ‘‘Cash Flow’’ per ADR

7.37

2.35

1.70

2.10

2.35 Earnings per ADR BC

3.10

.76

.71

.82

.90 Gross Div’ds Decl’d/ADR

.77

3.00

3.00

3.00

4.00 Cap’l Spending per ADR

4.17

31.88 34.12 36.31 40.95 42.40 Book Value per ADR

1802.3 1802.3 1802.3 1802.3 1802.3 Equiv ADRs Outst’g E

14.0

18.5 Bold figures are Avg Ann’l P/E Ratio

12.5

Value Line

.74

.93

Relative P/E Ratio

.70

estimates

2.3%

2.3%

Avg Ann’l Div’d Yield

2.0%

114942 111023 129902 133625 140915 Sales ($mill) B

9.7%

9.9% 11.5% 11.5% Operating Margin

13.0%

7713.5 5208.2 9119.2 10200 10700 Depreciation ($mill)

3785

4245 Net Profit ($mill)

5572.2 4673.9 3063.6

34.7% 30.4% 36.5% 36.5% 36.0% Income Tax Rate

4.2%

2.4%

2.8%

3.0% Net Profit Margin

4.8%

6725

9600 Working Cap’l ($mill)

10311 11028 6887.0

31390 32706 34697 34975 34500 Long-Term Debt ($mill)

57449 61499 65433 73775 76400 Shr. Equity ($mill)

5.0%

3.0%

3.5%

4.0% Return on Total Capital

6.3%

7.6%

4.5%

5.0%

5.5% Return on Shr. Equity

9.7%

5.5%

2.5%

3.0%

3.5% Retained to Com Eq

7.1%

28%

45%

39%

38% All Div’ds to Net Prof

26%

8

19-21

102.9

92.00

10.20

3.45

D 1.10

4.00

45.50

1802.3

16.0

1.00

2.0%

165450

12.5%

12150

6225

37.0%

3.8%

14575

33400

87450

5.5%

7.0%

5.0%

32%

BUSINESS: Honda Motor Company, Ltd. is Japan’s second-largest

auto maker and the world’s biggest motorcycle producer. Manufactures cars primarily in Japan, the U.S., Canada, and United Kingdom; cycles in 32 countries. Fiscal 2015 unit sales: autos, 4.7 million; motorcycles, 17.1 mill.; power products, 6.0 mill. Sales by region: North America, 51%; Asia, 21%; Japan, 17%; other, 7%. Re-

search & development, 5.3% of sales. Has about 204,730 employees. Japan Trustee Svcs. Bank controls 6.4% of common stock

(6/16 20-F). President & CEO: Takanobu Ito. Inc.: Japan. Address:

1-1, 2-chome, Minami-Aoyama, 2-chome, Minato-ku. Tokyo 107,

Japan. U.S. address: 156 West 56th St., 20th Floor, New York, NY

10019. Telephone: 212-355-9191. Internet: www.honda.com.

Honda Motor is performing well,

despite a number of challenges. Fiscal

2016 (year began April 1st) got off to a

good start, with operating profits rising

11.5%, to $2.59 billion. The advance was

largely driven by new model introductions

and fully reworked versions of existing

vehicles. Cost-reduction efforts and an

abatement of the quality control expenses

that weighed on results last year also

helped. These positives more than compensated for significant negative currency

effects (which trimmed $3.9 billion from

the top line) and disruptions from the

Kumamoto earthquake.

The Automobile segment especially is

humming along nicely. Sales in North

America (Honda’s largest market) were up

2.6% in the June quarter, to 510,000 units.

Business in Asia (up 11.9%, to 453,000

vehicles) was led by higher SUV sales in

China. Worldwide, the company sold 1.21

million units, up 5.8% from the prior year.

Further momentum should be supported

by the new high payload capacity

Ridgeline

mid-size

pickup

(recently

launched in the U.S.), and the global rollout of the fully remodeled Civic compact

(just out in China and Malaysia).

The underlying motorcycle business

is also doing well. This is dominated by

Asia, which accounts for about 89% of the

total. Sales there climbed 8.8%, to 3.89

million units, with notable strength in India, Vietnam, and the Philippines. The

company recently added another line at its

fourth motorcycle plant in India, mainly to

support its Activa scooter, which has been

a big seller there.

All in all, Honda will likely show 15%20% growth in operating profit this

year. The achievement would be all the

more notable, as it will include an estimated $2.9 billion yen drag from currency effects. For next year, we see the advance moderating to the 10%-15% range.

The issue remains an attractive longterm holding. Low double-digit annual

earnings growth (on average) appears reasonable over the 2019-2021 span, suggesting above-average price appreciation

potential. Additionally, the dividend yield

compares favorably to the Value Line

median. Momentum seekers will have to

look elsewhere for now, though.

Mario Ferro

August 19, 2016

ings, based on U.S. accounting. Excl. non- March, June, Sept., and December. (E) In mill.

recurring gain: ’10, 8¢. Next earnings report of American Depositary Receipts, adj. for split.

due late October. (D) Before 15% Japanese Each common share represents 1 ADR.

withholding tax. Dividends historically paid in

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

B++

75

15

25

To subscribe call 1-800-VALUELINE