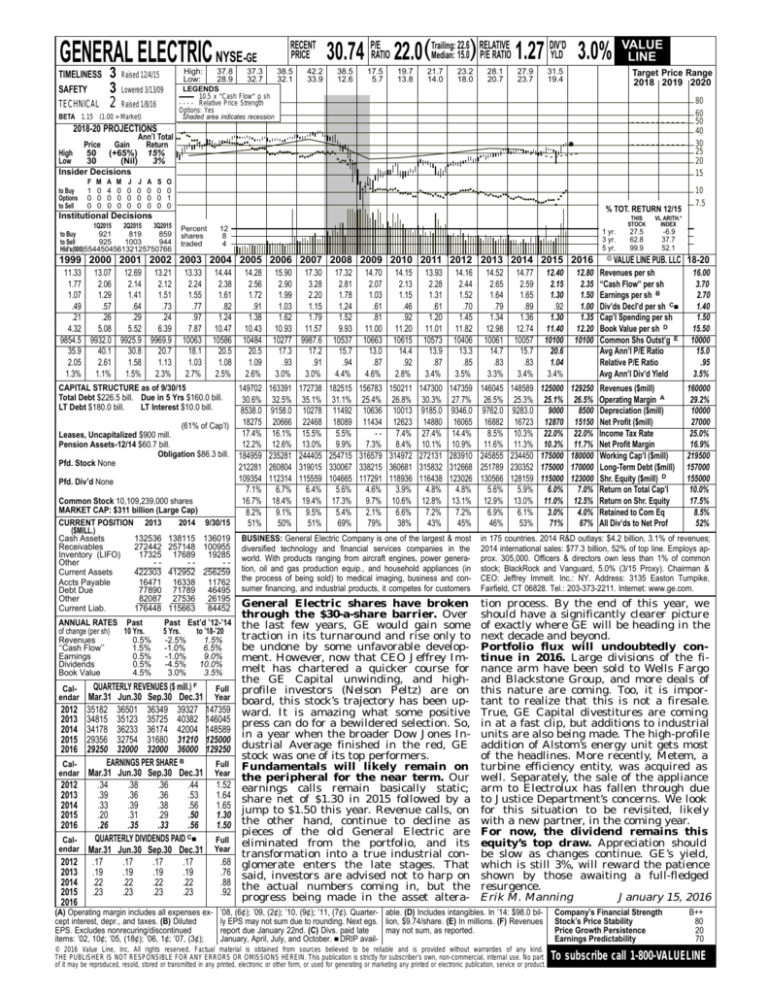

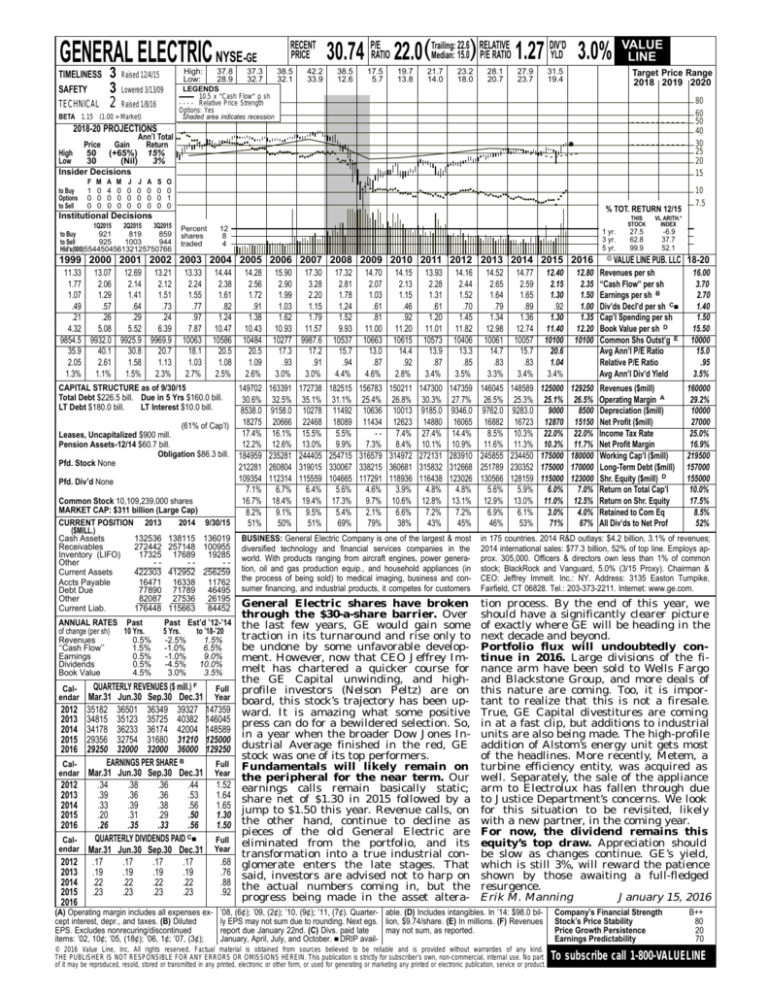

GENERAL ELECTRIC NYSE-GE

TIMELINESS

SAFETY

TECHNICAL

3

3

2

High:

Low:

Raised 12/4/15

37.8

28.9

RECENT

PRICE

37.3

32.7

38.5

32.1

42.2

33.9

22.6 RELATIVE

DIV’D

Median: 15.0) P/E RATIO 1.27 YLD 3.0%

30.74 P/ERATIO 22.0(Trailing:

38.5

12.6

17.5

5.7

19.7

13.8

21.7

14.0

23.2

18.0

28.1

20.7

27.9

23.7

31.5

19.4

Target Price Range

2018 2019 2020

LEGENDS

10.5 x ″Cash Flow″ p sh

. . . . Relative Price Strength

Options: Yes

Shaded area indicates recession

Lowered 3/13/09

Raised 1/8/16

BETA 1.15 (1.00 = Market)

VALUE

LINE

80

60

50

40

30

25

20

15

2018-20 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

50 (+65%) 15%

Low

30

(Nil)

3%

Insider Decisions

to Buy

Options

to Sell

F

1

0

0

M

0

0

0

A

4

0

0

M

0

0

0

J

0

0

0

J

0

0

0

A

0

0

0

S

0

0

0

O

0

1

0

% TOT. RETURN 12/15

Institutional Decisions

1Q2015

2Q2015

3Q2015

921

819

859

to Buy

to Sell

925

1003

944

Hld’s(000)554450456132125750766

Percent

shares

traded

12

8

4

1 yr.

3 yr.

5 yr.

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

11.33 13.07 12.69 13.21

1.77

2.06

2.14

2.12

1.07

1.29

1.41

1.51

.49

.57

.64

.73

.21

.26

.29

.24

4.32

5.08

5.52

6.39

9854.5 9932.0 9925.9 9969.9

35.9

40.1

30.8

20.7

2.05

2.61

1.58

1.13

1.3%

1.1%

1.5%

2.3%

13.33

2.24

1.55

.77

.97

7.87

10063

18.1

1.03

2.7%

14.44

2.38

1.61

.82

1.24

10.47

10586

20.5

1.08

2.5%

14.28

2.56

1.72

.91

1.38

10.43

10484

20.5

1.09

2.6%

149702

30.6%

8538.0

18275

(61% of Cap’l)

17.4%

Leases, Uncapitalized $900 mill.

Pension Assets-12/14 $60.7 bill.

12.2%

Obligation $86.3 bill. 184959

Pfd. Stock None

212281

109354

Pfd. Div’d None

7.1%

Common Stock 10,109,239,000 shares

16.7%

MARKET CAP: $311 billion (Large Cap)

8.2%

CURRENT POSITION 2013

2014 9/30/15

51%

CAPITAL STRUCTURE as of 9/30/15

Total Debt $226.5 bill. Due in 5 Yrs $160.0 bill.

LT Debt $180.0 bill.

LT Interest $10.0 bill.

($MILL.)

Cash Assets

Receivables

Inventory (LIFO)

Other

Current Assets

Accts Payable

Debt Due

Other

Current Liab.

15.90 17.30

2.90

3.28

1.99

2.20

1.03

1.15

1.62

1.79

10.93 11.57

10277 9987.6

17.3

17.2

.93

.91

3.0%

3.0%

163391

32.5%

9158.0

20666

16.1%

12.6%

235281

260804

112314

6.7%

18.4%

9.1%

50%

172738

35.1%

10278

22468

15.5%

13.0%

244405

319015

115559

6.4%

19.4%

9.5%

51%

THIS

STOCK

VL ARITH.*

INDEX

27.5

62.8

99.9

-6.9

37.7

52.1

© VALUE LINE PUB. LLC

10

7.5

18-20

17.32

2.81

1.78

1.24

1.52

9.93

10537

15.7

.94

4.4%

14.70

2.07

1.03

.61

.81

11.00

10663

13.0

.87

4.6%

14.15

2.13

1.15

.46

.92

11.20

10615

14.4

.92

2.8%

13.93

2.28

1.31

.61

1.20

11.01

10573

13.9

.87

3.4%

14.16

2.44

1.52

.70

1.45

11.82

10406

13.3

.85

3.5%

14.52

2.65

1.64

.79

1.34

12.98

10061

14.7

.83

3.3%

14.77

2.59

1.65

.89

1.36

12.74

10057

15.7

.83

3.4%

12.40

2.15

1.30

.92

1.30

11.40

10100

20.6

1.04

3.4%

12.80

2.35

1.50

1.00

1.35

12.20

10100

Revenues per sh

‘‘Cash Flow’’ per sh

Earnings per sh B

Div’ds Decl’d per sh C■

Cap’l Spending per sh

Book Value per sh D

Common Shs Outst’g E

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

16.00

3.70

2.70

1.40

1.50

15.50

10000

15.0

.95

3.5%

182515

31.1%

11492

18089

5.5%

9.9%

254715

330067

104665

5.6%

17.3%

5.4%

69%

156783

25.4%

10636

11434

-7.3%

316579

338215

117291

4.6%

9.7%

2.1%

79%

150211

26.8%

10013

12623

7.4%

8.4%

314972

360681

118936

3.9%

10.6%

6.6%

38%

147300

30.3%

9185.0

14880

27.4%

10.1%

272131

315832

116438

4.8%

12.8%

7.2%

43%

147359

27.7%

9346.0

16065

14.4%

10.9%

283910

312668

123026

4.8%

13.1%

7.2%

45%

146045

26.5%

9762.0

16882

8.5%

11.6%

245855

251789

130566

5.6%

12.9%

6.9%

46%

148589

25.3%

9283.0

16723

10.3%

11.3%

234450

230352

128159

5.9%

13.0%

6.1%

53%

125000

25.1%

9000

12870

22.0%

10.3%

175000

175000

115000

6.0%

11.0%

3.0%

71%

129250

26.5%

8500

15150

22.0%

11.7%

180000

170000

123000

7.0%

12.5%

4.0%

67%

Revenues ($mill)

Operating Margin A

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill) D

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

160000

29.2%

10000

27000

25.0%

16.9%

219500

157000

155000

10.0%

17.5%

8.5%

52%

BUSINESS: General Electric Company is one of the largest & most

diversified technology and financial services companies in the

world. With products ranging from aircraft engines, power generation, oil and gas production equip., and household appliances (in

the process of being sold) to medical imaging, business and consumer financing, and industrial products, it competes for customers

in 175 countries. 2014 R&D outlays: $4.2 billion, 3.1% of revenues;

2014 international sales: $77.3 billion, 52% of top line. Employs approx. 305,000. Officers & directors own less than 1% of common

stock; BlackRock and Vanguard, 5.0% (3/15 Proxy). Chairman &

CEO: Jeffrey Immelt. Inc.: NY. Address: 3135 Easton Turnpike,

Fairfield, CT 06828. Tel.: 203-373-2211. Internet: www.ge.com.

General Electric shares have broken

through the $30-a-share barrier. Over

ANNUAL RATES Past

Past Est’d ’12-’14 the last few years, GE would gain some

of change (per sh)

10 Yrs.

5 Yrs.

to ’18-’20

traction in its turnaround and rise only to

Revenues

0.5%

-2.5%

1.5%

be undone by some unfavorable develop‘‘Cash Flow’’

1.5%

-1.0%

6.5%

Earnings

0.5%

-1.0%

9.0%

ment. However, now that CEO Jeffrey ImDividends

0.5%

-4.5% 10.0%

melt has chartered a quicker course for

Book Value

4.5%

3.0%

3.5%

the GE Capital unwinding, and highQUARTERLY REVENUES ($ mill.) F

CalFull profile investors (Nelson Peltz) are on

endar Mar.31 Jun.30 Sep.30 Dec.31 Year board, this stock’s trajectory has been up2012 35182 36501 36349 39327 147359 ward. It is amazing what some positive

2013 34815 35123 35725 40382 146045 press can do for a bewildered selection. So,

2014 34178 36233 36174 42004 148589 in a year when the broader Dow Jones In2015 29356 32754 31680 31210 125000

2016 29250 32000 32000 36000 129250 dustrial Average finished in the red, GE

stock was one of its top performers.

EARNINGS PER SHARE B

CalFull Fundamentals will likely remain on

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

the peripheral for the near term. Our

2012

.34

.38

.36

.44

1.52 earnings calls remain basically static;

2013

.39

.36

.36

.53

1.64 share net of $1.30 in 2015 followed by a

2014

.33

.39

.38

.56

1.65

2015

.20

.31

.29

.50

1.30 jump to $1.50 this year. Revenue calls, on

2016

.26

.35

.33

.56

1.50 the other hand, continue to decline as

pieces of the old General Electric are

C■

QUARTERLY

DIVIDENDS

PAID

CalFull eliminated from the portfolio, and its

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

transformation into a true industrial con2012 .17

.17

.17

.17

.68 glomerate enters the late stages. That

2013 .19

.19

.19

.19

.76 said, investors are advised not to harp on

2014 .22

.22

.22

.22

.88 the actual numbers coming in, but the

2015 .23

.23

.23

.23

.92

progress being made in the asset altera2016

tion process. By the end of this year, we

should have a significantly clearer picture

of exactly where GE will be heading in the

next decade and beyond.

Portfolio flux will undoubtedly continue in 2016. Large divisions of the finance arm have been sold to Wells Fargo

and Blackstone Group, and more deals of

this nature are coming. Too, it is important to realize that this is not a firesale.

True, GE Capital divestitures are coming

in at a fast clip, but additions to industrial

units are also being made. The high-profile

addition of Alstom’s energy unit gets most

of the headlines. More recently, Metem, a

turbine efficiency entity, was acquired as

well. Separately, the sale of the appliance

arm to Electrolux has fallen through due

to Justice Department’s concerns. We look

for this situation to be revisited, likely

with a new partner, in the coming year.

For now, the dividend remains this

equity’s top draw. Appreciation should

be slow as changes continue. GE’s yield,

which is still 3%, will reward the patience

shown by those awaiting a full-fledged

resurgence.

Erik M. Manning

January 15, 2016

132536

272442

17325

-422303

16471

77890

82087

176448

138115 136019

257148 100955

17689 19285

--412952 256259

16338 11762

71789 46495

27536 26195

115663 84452

(A) Operating margin includes all expenses except interest, depr., and taxes. (B) Diluted

EPS. Excludes nonrecuring/discontinued

items: ’02, 10¢; ’05, (18¢); ’06, 1¢; ’07, (3¢);

’08, (6¢); ’09, (2¢); ’10, (9¢); ’11, (7¢). Quarter- able. (D) Includes intangibles. In ’14: $98.0 billy EPS may not sum due to rounding. Next egs. lion, $9.74/share. (E) In millions. (F) Revenues

may not sum, as reported.

report due January 22nd. (C) Divs. paid late

January, April, July, and October. ■ DRIP avail-

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

B++

80

20

70

To subscribe call 1-800-VALUELINE