general motorsnyse-gm

advertisement

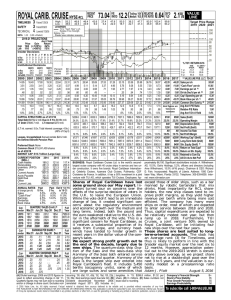

GENERAL MOTORS NYSE-GM TIMELINESS SAFETY TECHNICAL 5 3 5 RECENT PRICE 5.2 RELATIVE DIV’D Median: NMF) P/E RATIO 0.28 YLD 4.9% 31.07 P/ERATIO 5.2(Trailing: High: Low: Lowered 7/29/16 37.0 33.1 39.5 19.0 28.9 18.7 41.8 26.2 41.1 28.8 39.0 24.6 33.5 26.7 Target Price Range 2019 2020 2021 LEGENDS 4.0 x ″Cash Flow″ p sh . . . . Relative Price Strength Options: Yes Shaded area indicates recession New 2/25/11 Lowered 7/29/16 BETA 1.25 (1.00 = Market) VALUE LINE 128 96 80 64 48 40 32 24 2019-21 PROJECTIONS Ann’l Total Price Gain Return High 60 (+95%) 21% Low 40 (+30%) 11% Insider Decisions O N to Buy 0 0 Options 13 0 to Sell 0 2 D J F 0 0 0 0 12 14 1 0 1 M A 0 0 9 12 0 0 M 0 0 0 J 0 1 1 16 12 % TOT. RETURN 7/16 U.S. Institutional Decisions 3Q2015 4Q2015 1Q2016 477 447 474 to Buy to Sell 370 416 414 Hld’s(000)117129311509531169493 Percent shares traded 45 30 15 1 yr. 3 yr. 5 yr. Nearly a year and a half after emerging from 2006 2007 2008 2009 2010 2011 one of the largest bankruptcy restructurings --- - 86.88 96.04 ever, shares of General Motors were sold in ---7.38 9.20 the world’s largest IPO on November 18, ----2.89 3.88 2010. A total of 550 million shares, including -----an over-allotment option, were sold in the ---2.69 3.99 IPO. 413 million of which had been owned ---- - 16.52 17.72 by the U.S. Treasury, 102 million from the ---- - 1560.7 1564.7 UAW trust, and 35 million from the Canadi----12.0 7.3 an government’s stake. The stock was ----.76 .46 priced at $33 a share. Another $4.6 billion in ------preferred shares were also sold. --- - 135592 150276 CAPITAL STRUCTURE as of 6/30/16 Total Debt $75.3 bill. Due in 5 Yrs $53.0 bill. LT Debt $54.1 bill. LT Interest $550 mill. (55% of Total cap’l) Pension Assets 12/15 - $74.1 bill. Oblig. $101.3 bill. Leases, Uncapitalized Annual rentals $284 mill. Common Stock 1,561,921,814 shares (As of 7/14/16) MARKET CAP: $48.5 billion (Large Cap) CURRENT POSITION 2014 2015 ($MILL.) Cash Assets 18954 15238 Receivables 25605 26388 Inventory (FIFO) 13642 13764 Other 25469 22617 Current Assets 83670 78007 Accts Payable 22529 24062 Debt Due 14988 19562 Other 29170 27842 Current Liab. 65701 71466 ANNUAL RATES of change (per sh) Sales ‘‘Cash Flow’’ Earnings Dividends Book Value Calendar 2013 2014 2015 2016 2017 Calendar 2013 2014 2015 2016 2017 Calendar 2012 2013 2014 2015 2016 Past 10 Yrs. ------ 6/30/16 18923 30261 15026 10420 74630 26959 21230 27854 76043 Past Est’d ’13-’15 5 Yrs. to ’19-’21 -3.5% -5.0% -9.0% - - 12.5% -8.0% QUARTERLY REVENUES ($ mill.) Mar.31 Jun.30 Sep.30 Dec.31 36884 39075 38983 40485 37408 39649 39255 39617 35712 38180 38843 39621 37265 42372 39238 39900 37825 42075 39500 40100 EARNINGS PER SHARE A Mar.31 Jun.30 Sep.30 Dec.31 .67 .84 .96 .67 .30 .59 .97 1.19 .85 1.28 1.50 1.39 1.26 1.86 1.48 1.30 1.28 1.52 1.53 1.47 QUARTERLY DIVIDENDS PAID E Mar.31 Jun.30 Sep.30 Dec.31 --------.30 .30 .30 .30 .30 .36 .36 .36 .38 .38 Full Year 155427 155929 152356 158775 159500 (A) Diluted earnings. Excludes nonrecurring gain/(loss): ’11, 70¢; ’12, (9¢); ’13, (76¢); ’14, ($1.40); ’15, (89¢); ’16 Q2, (5¢). Next earnings report due mid-October. Quarterly total may not Full Year 3.14 3.05 5.02 5.90 5.80 Full Year --1.20 1.38 ------------- ------------- ------------- ------------ 2012 2013 2014 2015 2016 2017 111.43 103.62 12.34 8.31 2.92 3.18 --5.90 5.04 18.92 26.33 1366.4 1500.0 8.0 10.5 .51 .59 --- 97.46 101.57 105.85 106.35 7.62 10.75 11.75 11.75 3.05 5.02 5.90 5.80 1.20 1.38 1.52 1.58 4.43 5.25 6.00 5.80 22.16 26.88 29.40 31.75 1600.0 1500.0 1500.0 1500.0 11.3 6.8 Bold figures are Value Line .59 .35 estimates 3.5% 4.0% THIS STOCK VL ARITH.* INDEX 4.9 -2.8 26.0 4.8 25.2 69.0 © VALUE LINE PUB. LLC 19-21 Revenues per sh ‘‘Cash Flow’’ per sh Earnings per sh A Div’ds Decl’d per sh Cap’l Spending per sh Book Value per sh Common Shs Outst’g B Avg Ann’l P/E Ratio Relative P/E Ratio Avg Ann’l Div’d Yield 120.90 13.00 6.25 1.76 6.60 39.65 1400.0 8.0 .50 3.5% 152256 155427 155929 152356 158775 159500 Revenues ($mill) ---- - 18.8% 16.8% 17.0% 17.5% Market Share 8.3% 9.9% 10.5% 10.5% Operating Margin 8.9% 9.2% 6.6% 8.5% 8235 8500 8600 Net Profit ($mill) 6172.0 7974.0 6188.0 6646.0 6199.0 4.6% 27.0% 23.0% 24.0% Income Tax Rate 11.7% 6.5% - - 28.8% 4.0% 5.4% 5.8% 5.6% Net Profit Margin 4.6% 5.3% 4.1% 4.3% 5275 Working Cap’l ($mill) 4154.0 11315 16004 19089 17969 6541.0 800.0 8342.0 11543 10532 22452 31853 43549 54050 53550 Long-Term Debt ($mill) C 36180 38120 36244 42607 35457 40323 44100 47650 Shr. Equity ($mill) 9.5% 10.0% 9.5% 9.0% Return on Total Cap’l 14.7% 16.6% 13.8% 10.5% 17.1% 20.9% 17.1% 15.6% 17.5% 20.0% 21.0% 19.0% Return on Shr. Equity 8.6% 14.5% 15.5% 13.5% Retained to Com Eq 17.8% 25.5% 20.3% 12.6% 51% 27% 26% 27% All Div’ds to Net Prof D 25% 11% 15% 25% 169275 18.0% 10.5% 9250 25.0% 5.5% 4925 52050 55525 9.0% 16.5% 12.0% 28% BUSINESS: General Motors Company is the nation’s largest automobile manufacturer; sales represented 16.8% of North American U.S. car and truck market in 2015. Including strategic partnerships, GM manufacturers vehicles in over 30 countries, with sales in over 120 nations. About 39% of wholsale vehicle sales volume was generated outside N. America in 2015. Operations considered ‘‘Old GM’’ includes four major U.S. brands: Buick, Cadillac, Chevrolet, and GMC. Has about 215,000 employees. Operates OnStar subsidiary. UAW Retiree Medical Benefits Trust owned 9.1% of stock; officers & directors, less than 1% (4/16 Proxy). Chief Executive Officer: Mary T. Barra. Address: 300 Renaissance Center, Detroit, MI 48265. Tel.: 313-556-5000. Internet: www.gm.com. General Motors remained in high gear through the June quarter. The lion’s share of the standout performance was fueled by strength in U.S. retail sales. Notably, average transaction prices across all of the company’s models and brands were up about $1,500 per unit, with fullsize pickups nearly doubling that figure. Record business in China and a return to profitability in Europe also contributed. However, year-over-year comparisons for the remainder of 2016 may fall short of the mark. In addition to the usual seasonality of a softer second half for the entire industry, there is the as-yetunquantifiable fallout from the U.K.’s decision to leave the European Union. Management estimates this could have an impact of up to $400 million in the second half, mostly from a weaker pound sterling. Also, as U.K. citizens put off buying decisions, retail car sales are likely to soften. However, in light of the strong secondquarter showing, we have increased our 2016 share-net estimate by $0.20, to $5.90, indicating a gain of 15% to 20% over the prior-year tally. China may be holding the swing vote next year. Along with its joint-venture partners, GM sold a record 1.81 million vehicles there through June, up 5.3% from the prior year. However, business is being boosted by a tax break on smaller-engined vehicles, which is set to expire at the end of December. Absent any further stimulus actions, sales growth there would likely decelerate. Altogether, we are keeping our 2017 earnings estimate at $5.80. An aggressive vehicle launch schedule will play a key role in supporting earnings. New or refreshed automobiles represented about 26% of company sales in 2015, and GM aims to ramp that up to 40% by 2020. In addition to building up brands, the strategy boosts profitability, as pricing power is usually stronger on new products. An ongoing cost-efficiency program (targeting over $5.5 billion by 2018) should offset the increased investments in engineering and technology. Although untimely, GM stock remains a compelling long-term holding. The issue’s three- to five-year capital appreciation potential and dividend yield are both comfortably above the Value Line median. Mario Ferro August 19, 2016 sum due to rounding. (B) In millions. (C) Long- March, June, Sep., and Dec. term debt includes GM Financial securitized notes payable. (D) Based on preferred dividends before 2014. (E) Dividends paid late © 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind. THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product. Company’s Financial Strength Stock’s Price Stability Price Growth Persistence Earnings Predictability B++ 50 15 60 To subscribe call 1-800-VALUELINE