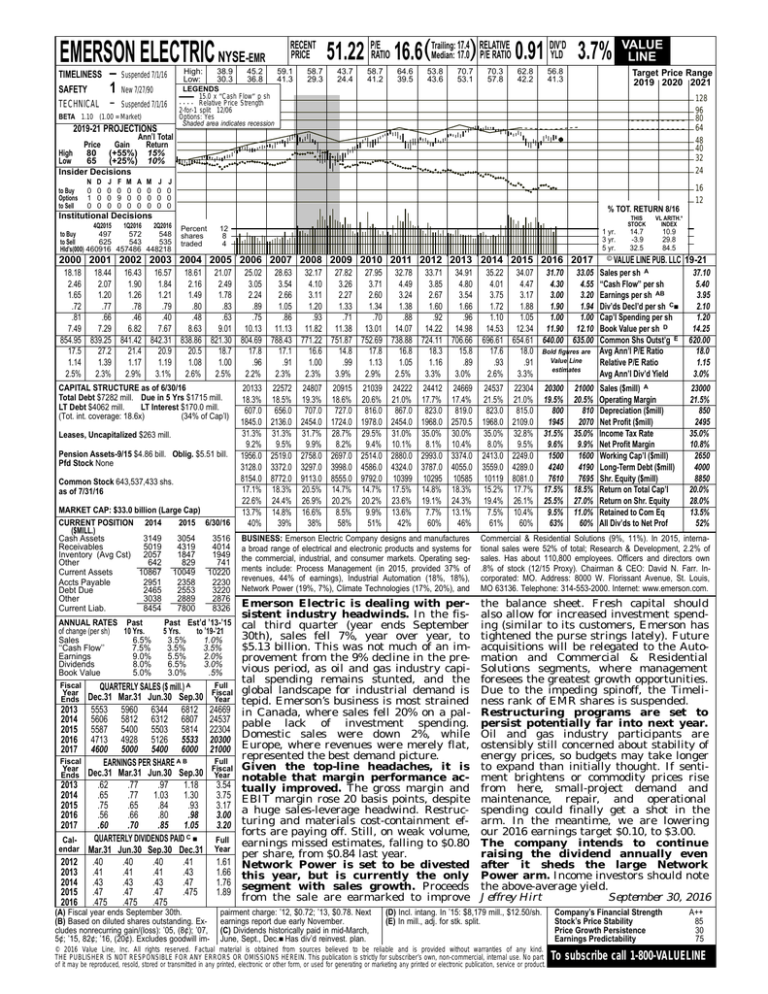

EMERSON ELECTRIC NYSE-EMR

TIMELINESS

SAFETY

TECHNICAL

–

1

–

Suspended 7/1/16

New 7/27/90

Suspended 7/1/16

BETA 1.10 (1.00 = Market)

2019-21 PROJECTIONS

High:

Low:

38.9

30.3

RECENT

PRICE

45.2

36.8

59.1

41.3

58.7

29.3

17.4 RELATIVE

DIV’D

Median: 17.0) P/E RATIO 0.91 YLD 3.7%

51.22 P/ERATIO 16.6(Trailing:

43.7

24.4

58.7

41.2

64.6

39.5

53.8

43.6

70.7

53.1

70.3

57.8

62.8

42.2

56.8

41.3

VALUE

LINE

Target Price Range

2019 2020 2021

LEGENDS

15.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

2-for-1 split 12/06

Options: Yes

Shaded area indicates recession

128

96

80

64

48

40

32

24

Ann’l Total

Price

Gain

Return

High

80 (+55%) 15%

Low

65 (+25%) 10%

Insider Decisions

to Buy

Options

to Sell

N

0

1

0

D

0

0

0

J

0

0

0

F

0

9

0

M

0

0

0

A

0

0

0

M

0

0

0

J

0

0

0

J

0

0

0

16

12

% TOT. RETURN 8/16

Institutional Decisions

4Q2015

1Q2016

2Q2016

497

572

548

to Buy

to Sell

625

543

535

Hld’s(000) 460916 457486 448218

Percent

shares

traded

12

8

4

1 yr.

3 yr.

5 yr.

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

18.18 18.44 16.43 16.57 18.61 21.07 25.02 28.63 32.17 27.82 27.95 32.78 33.71 34.91

2.46

2.07

1.90

1.84

2.16

2.49

3.05

3.54

4.10

3.26

3.71

4.49

3.85

4.80

1.65

1.20

1.26

1.21

1.49

1.78

2.24

2.66

3.11

2.27

2.60

3.24

2.67

3.54

.72

.77

.78

.79

.80

.83

.89

1.05

1.20

1.33

1.34

1.38

1.60

1.66

.81

.66

.46

.40

.48

.63

.75

.86

.93

.71

.70

.88

.92

.96

7.49

7.29

6.82

7.67

8.63

9.01 10.13 11.13 11.82 11.38 13.01 14.07 14.22 14.98

854.95 839.25 841.42 842.31 838.86 821.30 804.69 788.43 771.22 751.87 752.69 738.88 724.11 706.66

17.5

27.2

21.4

20.9

20.5

18.7

17.8

17.1

16.6

14.8

17.8

16.8

18.3

15.8

1.14

1.39

1.17

1.19

1.08

1.00

.96

.91

1.00

.99

1.13

1.05

1.16

.89

2.5%

2.3%

2.9%

3.1%

2.6%

2.5%

2.2%

2.3%

2.3%

3.9%

2.9%

2.5%

3.3%

3.0%

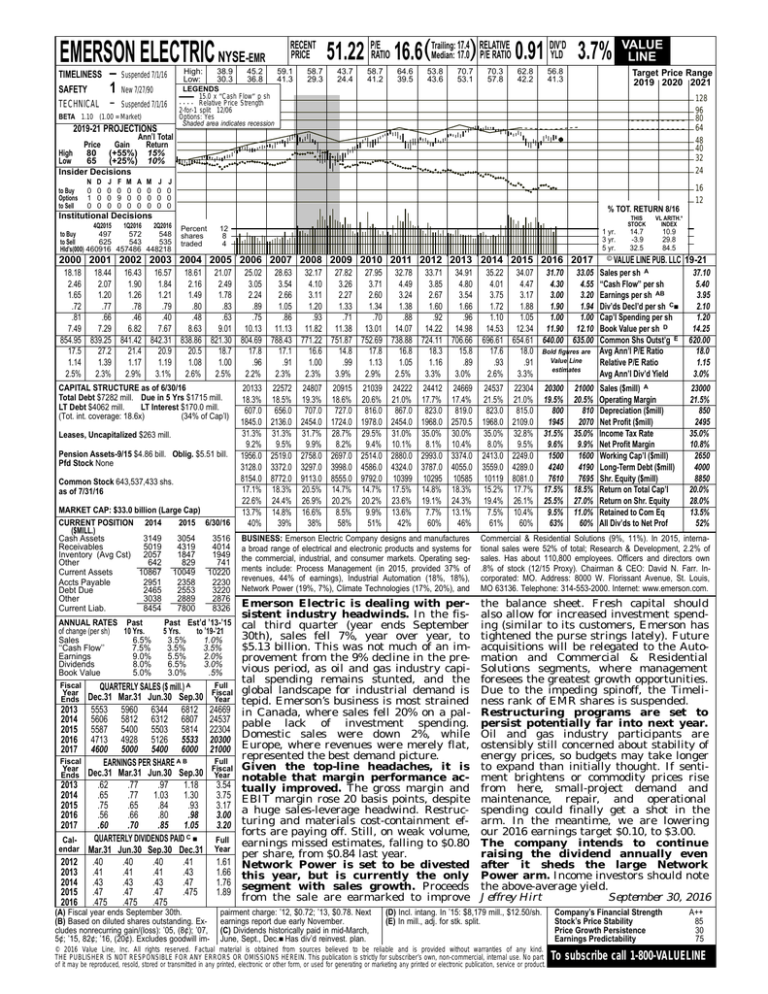

CAPITAL STRUCTURE as of 6/30/16

Total Debt $7282 mill. Due in 5 Yrs $1715 mill.

LT Debt $4062 mill.

LT Interest $170.0 mill.

(Tot. int. coverage: 18.6x)

(34% of Cap’l)

Leases, Uncapitalized $263 mill.

Pension Assets-9/15 $4.86 bill. Oblig. $5.51 bill.

Pfd Stock None

Common Stock 643,537,433 shs.

as of 7/31/16

MARKET CAP: $33.0 billion (Large Cap)

CURRENT POSITION 2014

2015 6/30/16

($MILL.)

Cash Assets

3149

3054

3516

Receivables

5019

4319

4014

Inventory (Avg Cst) 2057

1847

1949

Other

642

829

741

Current Assets

10867 10049 10220

Accts Payable

2951

2358

2230

Debt Due

2465

2553

3220

Other

3038

2889

2876

Current Liab.

8454

7800

8326

20133

18.3%

607.0

1845.0

31.3%

9.2%

1956.0

3128.0

8154.0

17.1%

22.6%

13.7%

40%

22572

18.5%

656.0

2136.0

31.3%

9.5%

2519.0

3372.0

8772.0

18.3%

24.4%

14.8%

39%

24807

19.3%

707.0

2454.0

31.7%

9.9%

2758.0

3297.0

9113.0

20.5%

26.9%

16.6%

38%

20915

18.6%

727.0

1724.0

28.7%

8.2%

2697.0

3998.0

8555.0

14.7%

20.2%

8.5%

58%

21039 24222 24412 24669

20.6% 21.0% 17.7% 17.4%

816.0 867.0 823.0 819.0

1978.0 2454.0 1968.0 2570.5

29.5% 31.0% 35.0% 30.0%

9.4% 10.1%

8.1% 10.4%

2514.0 2880.0 2993.0 3374.0

4586.0 4324.0 3787.0 4055.0

9792.0 10399 10295 10585

14.7% 17.5% 14.8% 18.3%

20.2% 23.6% 19.1% 24.3%

9.9% 13.6%

7.7% 13.1%

51%

42%

60%

46%

THIS

STOCK

VL ARITH.*

INDEX

14.7

-3.9

32.5

10.9

29.8

84.5

© VALUE LINE PUB. LLC

19-21

35.22 34.07 31.70 33.05

4.01

4.47

4.30

4.55

3.75

3.17

3.00

3.20

1.72

1.88

1.90

1.94

1.10

1.05

1.00

1.00

14.53 12.34 11.90 12.10

696.61 654.61 640.00 635.00

17.6

18.0 Bold figures are

Value Line

.93

.91

estimates

2.6%

3.3%

Sales per sh A

‘‘Cash Flow’’ per sh

Earnings per sh AB

Div’ds Decl’d per sh C■

Cap’l Spending per sh

Book Value per sh D

Common Shs Outst’g E

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

37.10

5.40

3.95

2.10

1.20

14.25

620.00

18.0

1.15

3.0%

24537

21.5%

823.0

1968.0

35.0%

8.0%

2413.0

3559.0

10119

15.2%

19.4%

7.5%

61%

Sales ($mill) A

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

23000

21.5%

850

2495

35.0%

10.8%

2650

4000

8850

20.0%

28.0%

13.5%

52%

22304

21.0%

815.0

2109.0

32.8%

9.5%

2249.0

4289.0

8081.0

17.7%

26.1%

10.4%

60%

20300

19.5%

800

1945

31.5%

9.6%

1500

4240

7610

17.5%

25.5%

9.5%

63%

21000

20.5%

810

2070

35.0%

9.9%

1600

4190

7695

18.5%

27.0%

11.0%

60%

BUSINESS: Emerson Electric Company designs and manufactures

a broad range of electrical and electronic products and systems for

the commercial, industrial, and consumer markets. Operating segments include: Process Management (in 2015, provided 37% of

revenues, 44% of earnings), Industrial Automation (18%, 18%),

Network Power (19%, 7%), Climate Technologies (17%, 20%), and

Commercial & Residential Solutions (9%, 11%). In 2015, international sales were 52% of total; Research & Development, 2.2% of

sales. Has about 110,800 employees. Officers and directors own

.8% of stock (12/15 Proxy). Chairman & CEO: David N. Farr. Incorporated: MO. Address: 8000 W. Florissant Avenue, St. Louis,

MO 63136. Telephone: 314-553-2000. Internet: www.emerson.com.

Emerson Electric is dealing with persistent industry headwinds. In the fisANNUAL RATES Past

Past Est’d ’13-’15 cal third quarter (year ends September

of change (per sh)

10 Yrs.

5 Yrs.

to ’19-’21

30th), sales fell 7%, year over year, to

Sales

6.5%

3.5%

1.0%

$5.13 billion. This was not much of an im‘‘Cash Flow’’

7.5%

3.5%

3.5%

Earnings

9.0%

5.5%

2.0%

provement from the 9% decline in the preDividends

8.0%

6.5%

3.0%

vious period, as oil and gas industry capiBook Value

5.0%

3.0%

.5%

tal spending remains stunted, and the

Fiscal

Full

QUARTERLY SALES ($ mill.) A

Year

Fiscal global landscape for industrial demand is

Dec.31

Mar.31

Jun.30

Sep.30

Ends

Year tepid. Emerson’s business is most strained

2013 5553 5960 6344 6812 24669 in Canada, where sales fell 20% on a pal2014 5606 5812 6312 6807 24537 pable lack of investment spending.

2015 5587 5400 5503 5814 22304 Domestic sales were down 2%, while

2016 4713 4928 5126 5533 20300

2017 4600 5000 5400 6000 21000 Europe, where revenues were merely flat,

represented the best demand picture.

Fiscal

Full

EARNINGS PER SHARE A B

Year

Fiscal Given the top-line headaches, it is

Dec.31

Mar.31

Jun.30

Sep.30

Ends

Year notable that margin performance ac2013

.62

.77

.97

1.18

3.54 tually improved. The gross margin and

2014

.65

.77

1.03

1.30

3.75 EBIT margin rose 20 basis points, despite

2015

.75

.65

.84

.93

3.17

2016

.56

.66

.80

.98

3.00 a huge sales-leverage headwind. Restruc2017

.60

.70

.85

1.05

3.20 turing and materials cost-containment efforts are paying off. Still, on weak volume,

C■

QUARTERLY

DIVIDENDS

PAID

CalFull earnings missed estimates, falling to $0.80

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

per share, from $0.84 last year.

2012 .40

.40

.40

.41

1.61 Network Power is set to be divested

2013 .41

.41

.41

.43

1.66 this year, but is currently the only

2014 .43

.43

.43

.47

1.76 segment with sales growth. Proceeds

2015 .47

.47

.47

.475

1.89

from the sale are earmarked to improve

2016 .475

.475

.475

the balance sheet. Fresh capital should

also allow for increased investment spending (similar to its customers, Emerson has

tightened the purse strings lately). Future

acquisitions will be relegated to the Automation and Commercial & Residential

Solutions segments, where management

foresees the greatest growth opportunities.

Due to the impeding spinoff, the Timeliness rank of EMR shares is suspended.

Restructuring programs are set to

persist potentially far into next year.

Oil and gas industry participants are

ostensibly still concerned about stability of

energy prices, so budgets may take longer

to expand than initially thought. If sentiment brightens or commodity prices rise

from here, small-project demand and

maintenance, repair, and operational

spending could finally get a shot in the

arm. In the meantime, we are lowering

our 2016 earnings target $0.10, to $3.00.

The company intends to continue

raising the dividend annually even

after it sheds the large Network

Power arm. Income investors should note

the above-average yield.

Jeffrey Hirt

September 30, 2016

(A) Fiscal year ends September 30th.

(B) Based on diluted shares outstanding. Excludes nonrecurring gain/(loss): ’05, (8¢); ’07,

5¢; ’15, 82¢; ’16, (20¢). Excludes goodwill im-

pairment charge: ’12, $0.72; ’13, $0.78. Next

earnings report due early November.

(C) Dividends historically paid in mid-March,

June, Sept., Dec.■ Has div’d reinvest. plan.

(D) Incl. intang. In ’15: $8,179 mill., $12.50/sh.

(E) In mill., adj. for stk. split.

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

A++

85

30

75

To subscribe call 1-800-VALUELINE