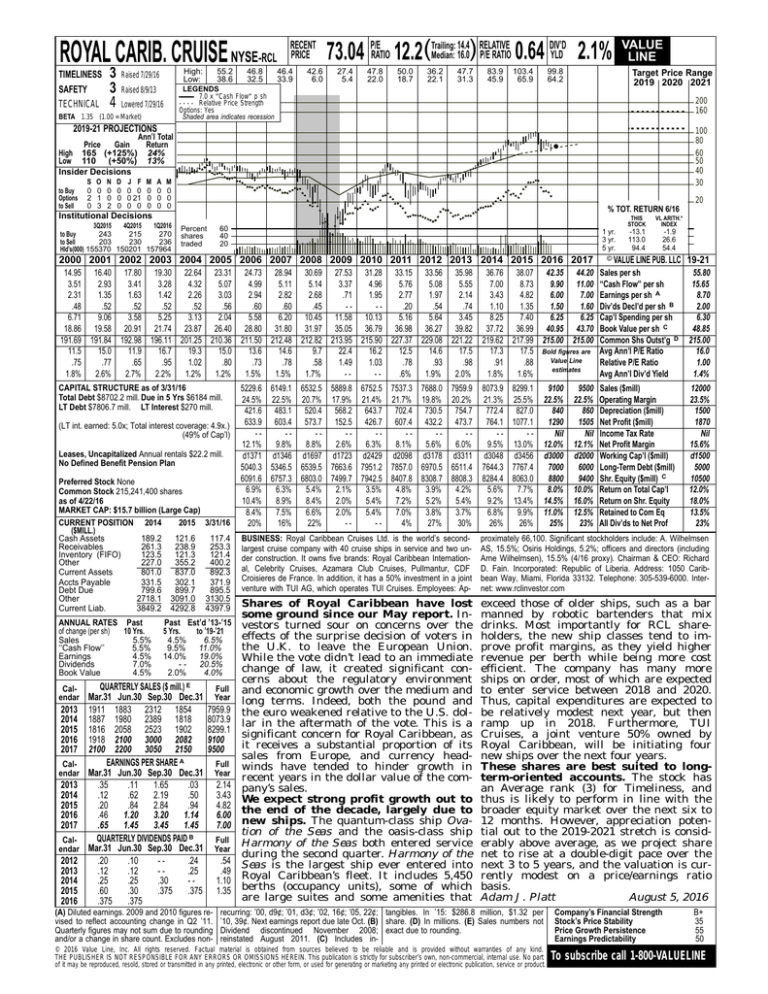

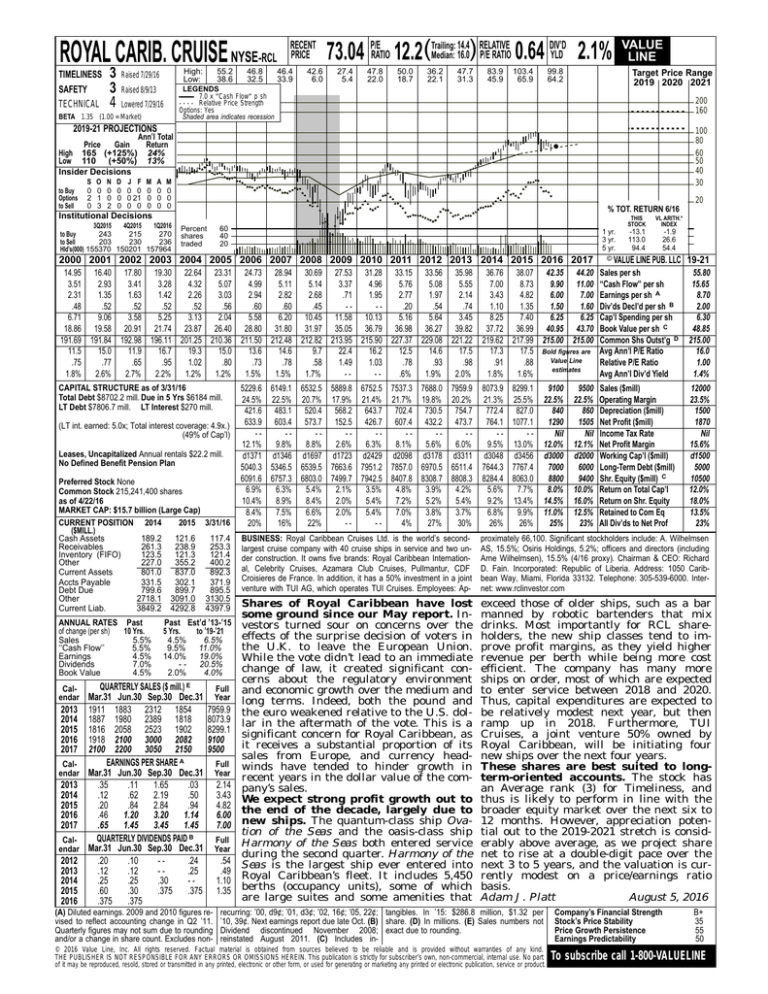

ROYAL CARIB. CRUISE NYSE-RCL

TIMELINESS

SAFETY

TECHNICAL

3

3

4

High:

Low:

Raised 7/29/16

55.2

38.6

46.8

32.5

RECENT

PRICE

46.4

33.9

42.6

6.0

14.4 RELATIVE

DIV’D

Median: 16.0) P/E RATIO 0.64 YLD 2.1%

73.04 P/ERATIO 12.2(Trailing:

27.4

5.4

47.8

22.0

50.0

18.7

36.2

22.1

47.7

31.3

83.9

45.9

103.4

65.9

99.8

64.2

Target Price Range

2019 2020 2021

LEGENDS

7.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

Options: Yes

Shaded area indicates recession

Raised 8/9/13

Lowered 7/29/16

BETA 1.35 (1.00 = Market)

VALUE

LINE

200

160

2019-21 PROJECTIONS

100

80

60

50

40

30

Ann’l Total

Price

Gain

Return

High 165 (+125%) 24%

Low 110 (+50%) 13%

Insider Decisions

to Buy

Options

to Sell

S

0

2

0

O

0

1

3

N

0

0

2

D

0

0

0

J F

0 0

0 21

0 0

M

0

0

0

A

0

0

0

M

0

0

0

20

% TOT. RETURN 6/16

Institutional Decisions

3Q2015

4Q2015

1Q2016

243

215

270

to Buy

to Sell

203

230

236

Hld’s(000) 155370 150201 157964

Percent

shares

traded

60

40

20

1 yr.

3 yr.

5 yr.

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

14.95 16.40 17.80 19.30 22.64 23.31 24.73 28.94 30.69 27.53 31.28 33.15 33.56 35.98

3.51

2.93

3.41

3.28

4.32

5.07

4.99

5.11

5.14

3.37

4.96

5.76

5.08

5.55

2.31

1.35

1.63

1.42

2.26

3.03

2.94

2.82

2.68

.71

1.95

2.77

1.97

2.14

.48

.52

.52

.52

.52

.56

.60

.60

.45

--.20

.54

.74

6.71

9.06

3.58

5.25

3.13

2.04

5.58

6.20 10.45 11.58 10.13

5.16

5.64

3.45

18.86 19.58 20.91 21.74 23.87 26.40 28.80 31.80 31.97 35.05 36.79 36.98 36.27 39.82

191.69 191.84 192.98 196.11 201.25 210.36 211.50 212.48 212.82 213.95 215.90 227.37 229.08 221.22

11.5

15.0

11.9

16.7

19.3

15.0

13.6

14.6

9.7

22.4

16.2

12.5

14.6

17.5

.75

.77

.65

.95

1.02

.80

.73

.78

.58

1.49

1.03

.78

.93

.98

1.8%

2.6%

2.7%

2.2%

1.2%

1.2%

1.5%

1.5%

1.7%

--.6%

1.9%

2.0%

THIS

STOCK

VL ARITH.*

INDEX

-13.1

113.0

94.4

-1.9

26.6

54.4

© VALUE LINE PUB. LLC

19-21

36.76 38.07 42.35 44.20

7.00

8.73

9.90 11.00

3.43

4.82

6.00

7.00

1.10

1.35

1.50

1.60

8.25

7.40

6.25

6.25

37.72 36.99 40.95 43.70

219.62 217.99 215.00 215.00

17.3

17.5 Bold figures are

Value Line

.91

.88

estimates

1.8%

1.6%

Sales per sh

‘‘Cash Flow’’ per sh

Earnings per sh A

Div’ds Decl’d per sh B

Cap’l Spending per sh

Book Value per sh C

Common Shs Outst’g D

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

55.80

15.65

8.70

2.00

6.30

48.85

215.00

16.0

1.00

1.4%

5229.6 6149.1 6532.5 5889.8 6752.5 7537.3 7688.0 7959.9

24.5% 22.5% 20.7% 17.9% 21.4% 21.7% 19.8% 20.2%

421.6 483.1 520.4 568.2 643.7 702.4 730.5 754.7

633.9 603.4 573.7 152.5 426.7 607.4 432.2 473.7

--------12.1%

9.8%

8.8%

2.6%

6.3%

8.1%

5.6%

6.0%

d1371 d1346 d1697 d1723 d2429 d2098 d3178 d3311

5040.3 5346.5 6539.5 7663.6 7951.2 7857.0 6970.5 6511.4

6091.6 6757.3 6803.0 7499.7 7942.5 8407.8 8308.7 8808.3

6.9%

6.3%

5.4%

2.1%

3.5%

4.8%

3.9%

4.2%

10.4%

8.9%

8.4%

2.0%

5.4%

7.2%

5.2%

5.4%

8.4%

7.5%

6.6%

2.0%

5.4%

7.0%

3.8%

3.7%

20%

16%

22%

--4%

27%

30%

8073.9

21.3%

772.4

764.1

-9.5%

d3048

7644.3

8284.4

5.6%

9.2%

6.8%

26%

Sales ($mill)

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill) C

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

12000

23.5%

1500

1870

Nil

15.6%

d1500

5000

10500

12.0%

18.0%

13.5%

23%

BUSINESS: Royal Caribbean Cruises Ltd. is the world’s secondlargest cruise company with 40 cruise ships in service and two under construction. It owns five brands: Royal Caribbean International, Celebrity Cruises, Azamara Club Cruises, Pullmantur, CDF

Croisieres de France. In addition, it has a 50% investment in a joint

venture with TUI AG, which operates TUI Cruises. Employees: Ap-

proximately 66,100. Significant stockholders include: A. Wilhelmsen

AS, 15.5%; Osiris Holdings, 5.2%; officers and directors (including

Arne Wilhelmsen), 15.5% (4/16 proxy). Chairman & CEO: Richard

D. Fain. Incorporated: Republic of Liberia. Address: 1050 Caribbean Way, Miami, Florida 33132. Telephone: 305-539-6000. Internet: www.rclinvestor.com

Shares of Royal Caribbean have lost

some ground since our May report. InANNUAL RATES Past

Past Est’d ’13-’15 vestors turned sour on concerns over the

of change (per sh)

10 Yrs.

5 Yrs.

to ’19-’21

effects of the surprise decision of voters in

Sales

5.5%

4.5%

6.5%

the U.K. to leave the European Union.

‘‘Cash Flow’’

5.5%

9.5% 11.0%

Earnings

4.5% 14.0% 19.0%

While the vote didn’t lead to an immediate

Dividends

7.0%

- - 20.5%

change of law, it created significant conBook Value

4.5%

2.0%

4.0%

cerns about the regulatory environment

QUARTERLY SALES ($ mill.) E

CalFull and economic growth over the medium and

endar Mar.31 Jun.30 Sep.30 Dec.31 Year long terms. Indeed, both the pound and

2013 1911 1883 2312 1854

7959.9 the euro weakened relative to the U.S. dol2014 1887 1980 2389 1818

8073.9 lar in the aftermath of the vote. This is a

2015 1816 2058 2523 1902

8299.1 significant concern for Royal Caribbean, as

2016 1918 2100 3000 2082

9100

it receives a substantial proportion of its

2017 2100 2200 3050 2150

9500

sales from Europe, and currency headEARNINGS PER SHARE A

CalFull winds have tended to hinder growth in

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

recent years in the dollar value of the com2013

.35

.11

1.65

.03

2.14 pany’s sales.

2014

.12

.62

2.19

.50

3.43 We expect strong profit growth out to

2015

.20

.84

2.84

.94

4.82

2016

.46

1.20

3.20

1.14

6.00 the end of the decade, largely due to

2017

.65

1.45

3.45

1.45

7.00 new ships. The quantum-class ship Ovation of the Seas and the oasis-class ship

B

QUARTERLY

DIVIDENDS

PAID

CalFull Harmony of the Seas both entered service

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

during the second quarter. Harmony of the

2012

.20

.10

-.24

.54 Seas is the largest ship ever entered into

2013

.12

.12

-.25

.49 Royal Caribbean’s fleet. It includes 5,450

2014

.25

.25

.30

-1.10

2015

.60

.30

.375

.375 1.35 berths (occupancy units), some of which

are large suites and some amenities that

2016

.375

.375

exceed those of older ships, such as a bar

manned by robotic bartenders that mix

drinks. Most importantly for RCL shareholders, the new ship classes tend to improve profit margins, as they yield higher

revenue per berth while being more cost

efficient. The company has many more

ships on order, most of which are expected

to enter service between 2018 and 2020.

Thus, capital expenditures are expected to

be relatively modest next year, but then

ramp up in 2018. Furthermore, TUI

Cruises, a joint venture 50% owned by

Royal Caribbean, will be initiating four

new ships over the next four years.

These shares are best suited to longterm-oriented accounts. The stock has

an Average rank (3) for Timeliness, and

thus is likely to perform in line with the

broader equity market over the next six to

12 months. However, appreciation potential out to the 2019-2021 stretch is considerably above average, as we project share

net to rise at a double-digit pace over the

next 3 to 5 years, and the valuation is currently modest on a price/earnings ratio

basis.

Adam J. Platt

August 5, 2016

CAPITAL STRUCTURE as of 3/31/16

Total Debt $8702.2 mill. Due in 5 Yrs $6184 mill.

LT Debt $7806.7 mill. LT Interest $270 mill.

(LT int. earned: 5.0x; Total interest coverage: 4.9x.)

(49% of Cap’l)

Leases, Uncapitalized Annual rentals $22.2 mill.

No Defined Benefit Pension Plan

Preferred Stock None

Common Stock 215,241,400 shares

as of 4/22/16

MARKET CAP: $15.7 billion (Large Cap)

CURRENT POSITION 2014

2015 3/31/16

($MILL.)

Cash Assets

189.2

121.6

117.4

Receivables

261.3

238.9

253.3

Inventory (FIFO)

123.5

121.3

121.4

Other

227.0

355.2

400.2

Current Assets

801.0

837.0

892.3

Accts Payable

331.5

302.1

371.9

Debt Due

799.6

899.7

895.5

Other

2718.1 3091.0 3130.5

Current Liab.

3849.2 4292.8 4397.9

(A) Diluted earnings. 2009 and 2010 figures revised to reflect accounting change in Q2 ’11.

Quarterly figures may not sum due to rounding

and/or a change in share count. Excludes non-

8299.1

25.5%

827.0

1077.1

-13.0%

d3456

7767.4

8063.0

7.7%

13.4%

9.9%

26%

9100

22.5%

840

1290

Nil

12.0%

d3000

7000

8800

8.0%

14.5%

11.0%

25%

recurring: ’00, d9¢; ’01, d3¢; ’02, 16¢; ’05, 22¢; tangibles. In ’15: $286.8 million, $1.32 per

’10, 39¢. Next earnings report due late Oct. (B) share. (D) In millions. (E) Sales numbers not

Dividend discontinued November 2008; exact due to rounding.

reinstated August 2011. (C) Includes in-

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

9500

22.5%

860

1505

Nil

12.1%

d2000

6000

9400

10.0%

16.0%

12.5%

23%

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

B+

35

55

50

To subscribe call 1-800-VALUELINE