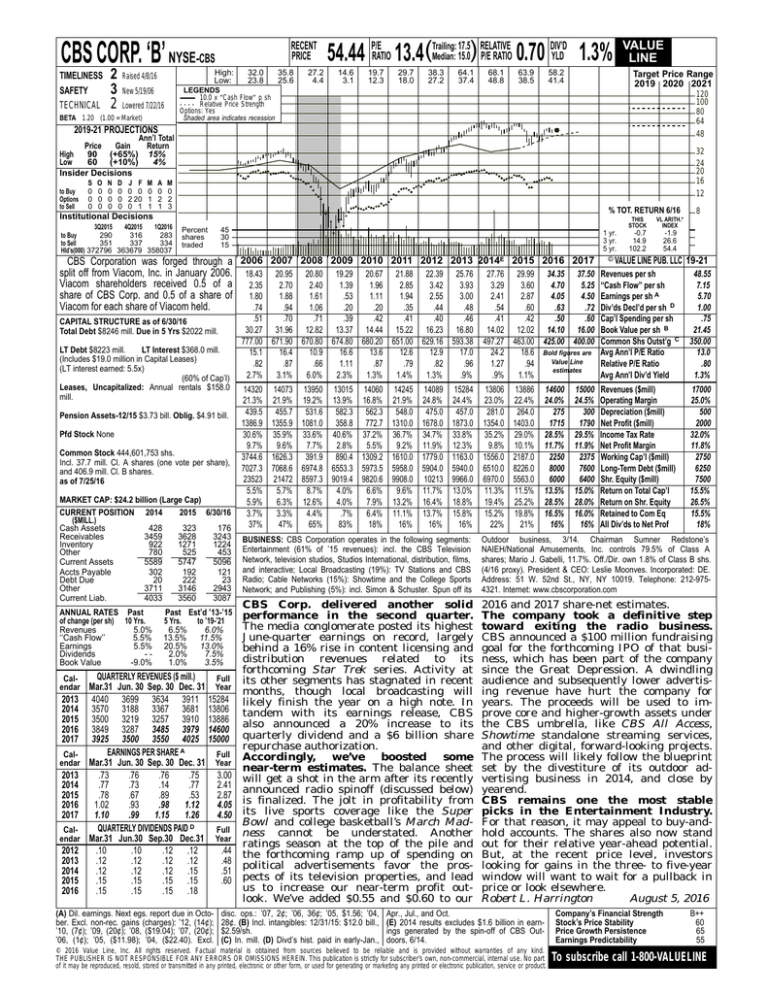

CBS CORP. ‘B’ NYSE-CBS

TIMELINESS

SAFETY

TECHNICAL

2

3

2

RECENT

PRICE

High:

Low:

Raised 4/8/16

32.0

23.8

35.8

25.6

27.2

4.4

17.5 RELATIVE

DIV’D

Median: 15.0) P/E RATIO 0.70 YLD 1.3%

54.44 P/ERATIO 13.4(Trailing:

14.6

3.1

19.7

12.3

29.7

18.0

38.3

27.2

64.1

37.4

68.1

48.8

63.9

38.5

58.2

41.4

Target Price Range

2019 2020 2021

LEGENDS

10.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

Options: Yes

Shaded area indicates recession

New 5/19/06

Lowered 7/22/16

BETA 1.20 (1.00 = Market)

VALUE

LINE

120

100

80

64

48

2019-21 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

90 (+65%) 15%

Low

60 (+10%)

4%

Insider Decisions

to Buy

Options

to Sell

S

0

0

0

O

0

0

0

N

0

0

0

D

0

0

0

J F

0 0

2 20

0 1

M

0

1

1

A

0

2

1

32

24

20

16

12

M

0

2

3

% TOT. RETURN 6/16

Institutional Decisions

3Q2015

4Q2015

1Q2016

290

316

283

to Buy

to Sell

351

337

334

Hld’s(000) 372796 363679 358037

Percent

shares

traded

45

30

15

1 yr.

3 yr.

5 yr.

THIS

STOCK

VL ARITH.*

INDEX

-0.7

14.9

102.2

-1.9

26.6

54.4

8

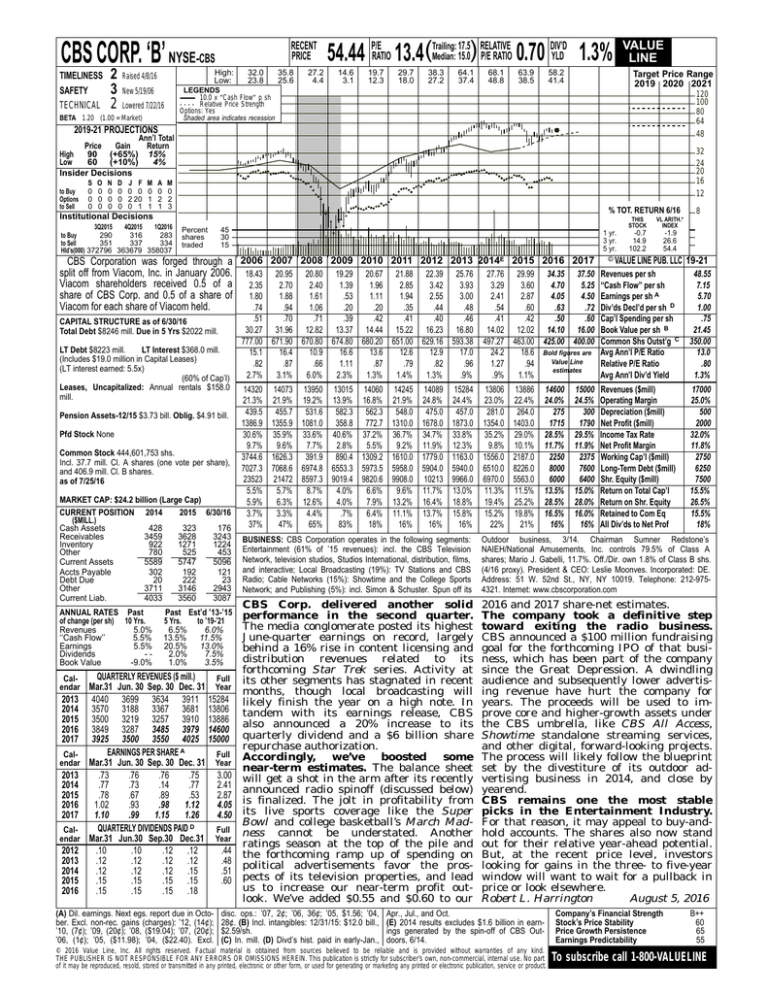

CBS Corporation was forged through a 2006 2007 2008 2009 2010 2011 2012 2013 2014E 2015 2016 2017 © VALUE LINE PUB. LLC 19-21

split off from Viacom, Inc. in January 2006. 18.43 20.95 20.80 19.29 20.67 21.88 22.39 25.76 27.76 29.99 34.35 37.50 Revenues per sh

48.55

Viacom shareholders received 0.5 of a 2.35 2.70 2.40 1.39 1.96 2.85 3.42 3.93

3.29

3.60

4.70

5.25 ‘‘Cash Flow’’ per sh

7.15

share of CBS Corp. and 0.5 of a share of 1.80 1.88 1.61

.53

1.11

1.94

2.55

3.00

2.41

2.87

4.05

4.50 Earnings per sh A

5.70

Viacom for each share of Viacom held.

.74

.94

1.06

.20

.20

.35

.44

.48

1.00

.54

.60

.63

.72 Div’ds Decl’d per sh D

CAPITAL STRUCTURE as of 6/30/16

Total Debt $8246 mill. Due in 5 Yrs $2022 mill.

LT Debt $8223 mill.

LT Interest $368.0 mill.

(Includes $19.0 million in Capital Leases)

(LT interest earned: 5.5x)

(60% of Cap’l)

Leases, Uncapitalized: Annual rentals $158.0

mill.

Pension Assets-12/15 $3.73 bill. Oblig. $4.91 bill.

Pfd Stock None

Common Stock 444,601,753 shs.

Incl. 37.7 mill. Cl. A shares (one vote per share),

and 406.9 mill. Cl. B shares.

as of 7/25/16

MARKET CAP: $24.2 billion (Large Cap)

CURRENT POSITION 2014

2015 6/30/16

($MILL.)

Cash Assets

428

323

176

Receivables

3459

3628

3243

Inventory

922

1271

1224

Other

780

525

453

Current Assets

5589

5747

5096

Accts Payable

302

192

121

Debt Due

20

222

23

Other

3711

3146

2943

Current Liab.

4033

3560

3087

ANNUAL RATES Past

of change (per sh) 10 Yrs.

Revenues

5.0%

‘‘Cash Flow’’

5.5%

Earnings

5.5%

Dividends

-Book Value

-9.0%

Past Est’d ’13-’15

5 Yrs.

to ’19-’21

6.5%

6.0%

13.5% 11.5%

20.5% 13.0%

2.0%

7.5%

1.0%

3.5%

QUARTERLY REVENUES ($ mill.)

Full

Mar.31 Jun. 30 Sep. 30 Dec. 31 Year

2013 4040 3699 3634 3911 15284

2014 3570 3188 3367 3681 13806

2015 3500 3219 3257 3910 13886

2016 3849 3287 3485 3979 14600

2017 3925 3500 3550 4025 15000

EARNINGS PER SHARE A

CalFull

endar Mar.31 Jun. 30 Sep. 30 Dec. 31 Year

2013

.73

.76

.76

.75

3.00

2014

.77

.73

.14

.77

2.41

2015

.78

.67

.89

.53

2.87

2016

1.02

.93

.98

1.12

4.05

2017

1.10

.99

1.15

1.26

4.50

QUARTERLY DIVIDENDS PAID D

CalFull

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

2012

.10

.10

.12 .12

.44

2013

.12

.12

.12 .12

.48

2014

.12

.12

.12 .15

.51

2015

.15

.15

.15 .15

.60

2016

.15

.15

.15 .18

Calendar

(A) Dil. earnings. Next egs. report due in October. Excl. non-rec. gains (charges): ’12, (14¢);

’10, (7¢); ’09, (20¢); ’08, ($19.04); ’07, (20¢);

’06, (1¢); ’05, ($11.98); ’04, ($22.40). Excl.

.51

.70

.71

.39

.42

.41

.40

.46

30.27 31.96 12.82 13.37 14.44 15.22 16.23 16.80

777.00 671.90 670.80 674.80 680.20 651.00 629.16 593.38

15.1

16.4

10.9

16.6

13.6

12.6

12.9

17.0

.82

.87

.66

1.11

.87

.79

.82

.96

2.7%

3.1%

6.0%

2.3%

1.3%

1.4%

1.3%

.9%

.41

.42

.50

.60

14.02 12.02 14.10 16.00

497.27 463.00 425.00 400.00

24.2

18.6 Bold figures are

Value Line

1.27

.94

estimates

.9%

1.1%

Cap’l Spending per sh

Book Value per sh B

Common Shs Outst’g C

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

.75

21.45

350.00

13.0

.80

1.3%

14320 14073 13950 13015 14060 14245 14089 15284

21.3% 21.9% 19.2% 13.9% 16.8% 21.9% 24.8% 24.4%

439.5 455.7 531.6 582.3 562.3 548.0 475.0 457.0

1386.9 1355.9 1081.0 358.8 772.7 1310.0 1678.0 1873.0

30.6% 35.9% 33.6% 40.6% 37.2% 36.7% 34.7% 33.8%

9.7%

9.6%

7.7%

2.8%

5.5%

9.2% 11.9% 12.3%

3744.6 1626.3 391.9 890.4 1309.2 1610.0 1779.0 1163.0

7027.3 7068.6 6974.8 6553.3 5973.5 5958.0 5904.0 5940.0

23523 21472 8597.3 9019.4 9820.6 9908.0 10213 9966.0

5.5%

5.7%

8.7%

4.0%

6.6%

9.6% 11.7% 13.0%

5.9%

6.3% 12.6%

4.0%

7.9% 13.2% 16.4% 18.8%

3.7%

3.3%

4.4%

.7%

6.4% 11.1% 13.7% 15.8%

37%

47%

65%

83%

18%

16%

16%

16%

13806

23.0%

281.0

1354.0

35.2%

9.8%

1556.0

6510.0

6970.0

11.3%

19.4%

15.2%

22%

Revenues ($mill)

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

17000

25.0%

500

2000

32.0%

11.8%

2750

6250

7500

15.5%

26.5%

15.5%

18%

BUSINESS: CBS Corporation operates in the following segments:

Entertainment (61% of ’15 revenues): incl. the CBS Television

Network, television studios, Studios International, distribution, films,

and interactive; Local Broadcasting (19%): TV Stations and CBS

Radio; Cable Networks (15%): Showtime and the College Sports

Network; and Publishing (5%): incl. Simon & Schuster. Spun off its

Outdoor business, 3/14. Chairman Sumner Redstone’s

NAIEH/National Amusements, Inc. controls 79.5% of Class A

shares; Mario J. Gabelli, 11.7%. Off./Dir. own 1.8% of Class B shs.

(4/16 proxy). President & CEO: Leslie Moonves. Incorporated: DE.

Address: 51 W. 52nd St., NY, NY 10019. Telephone: 212-9754321. Internet: www.cbscorporation.com

CBS Corp. delivered another solid

performance in the second quarter.

The media conglomerate posted its highest

June-quarter earnings on record, largely

behind a 16% rise in content licensing and

distribution revenues related to its

forthcoming Star Trek series. Activity at

its other segments has stagnated in recent

months, though local broadcasting will

likely finish the year on a high note. In

tandem with its earnings release, CBS

also announced a 20% increase to its

quarterly dividend and a $6 billion share

repurchase authorization.

Accordingly,

we’ve

boosted

some

near-term estimates. The balance sheet

will get a shot in the arm after its recently

announced radio spinoff (discussed below)

is finalized. The jolt in profitability from

its live sports coverage like the Super

Bowl and college basketball’s March Madness cannot be understated. Another

ratings season at the top of the pile and

the forthcoming ramp up of spending on

political advertisements favor the prospects of its television properties, and lead

us to increase our near-term profit outlook. We’ve added $0.55 and $0.60 to our

2016 and 2017 share-net estimates.

The company took a definitive step

toward exiting the radio business.

CBS announced a $100 million fundraising

goal for the forthcoming IPO of that business, which has been part of the company

since the Great Depression. A dwindling

audience and subsequently lower advertising revenue have hurt the company for

years. The proceeds will be used to improve core and higher-growth assets under

the CBS umbrella, like CBS All Access,

Showtime standalone streaming services,

and other digital, forward-looking projects.

The process will likely follow the blueprint

set by the divestiture of its outdoor advertising business in 2014, and close by

yearend.

CBS remains one the most stable

picks in the Entertainment Industry.

For that reason, it may appeal to buy-andhold accounts. The shares also now stand

out for their relative year-ahead potential.

But, at the recent price level, investors

looking for gains in the three- to five-year

window will want to wait for a pullback in

price or look elsewhere.

Robert L. Harrington

August 5, 2016

disc. ops.: ’07, 2¢; ’06, 36¢; ’05, $1.56; ’04,

28¢. (B) Incl. intangibles: 12/31/15: $12.0 bill.,

$2.59/sh.

(C) In. mill. (D) Divd’s hist. paid in early-Jan.,

13886

22.4%

264.0

1403.0

29.0%

10.1%

2187.0

8226.0

5563.0

11.5%

25.2%

19.8%

21%

14600

24.0%

275

1715

28.5%

11.7%

2250

8000

6000

13.5%

28.5%

16.5%

16%

Apr., Jul., and Oct.

(E) 2014 results excludes $1.6 billion in earnings generated by the spin-off of CBS Outdoors, 6/14.

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

15000

24.5%

300

1790

29.5%

11.9%

2375

7600

6400

15.0%

28.0%

16.0%

16%

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

B++

60

65

55

To subscribe call 1-800-VALUELINE