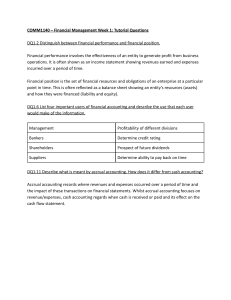

Week 1 Tutorial Questions DQ1.2 Distinguish between financial performance and financial position. The financial position of a company is measured by the performance it takes in company financial statements: a positive and growing cash flow statement; growing profits in the profit and loss statement; and a balance of assets, liabilities, and owner's equity in the balance sheet. Financial performance is a subjective measure of how well a firm can use assets from its primary mode of business and generate revenues. The term is also used as a general measure of a firm's overall financial health over a given period DQ1.6 List four important users of financial accounting and describe the use that each user would make of the information. - Suppliers - Vendors or suppliers may ask for financial statements as part of their credit application process. Suppliers may require credit history or evidence of profitability before issuing credit or increasing credit to a requested amount. - Banks - Lenders and other similar financial institutions will almost always require financial statements as part of the business loan process. Lenders will need to see verifiable proof via financial accounting that a company is in good operational health prior to issue a loan (or as part of determining what the cost, covenants, or interest rate of the loan will be). - Investors - Before investing in a company, investors often seek financial reports prepared using financial accounting guidance to understand how the company has been doing and to set expectations about the future of the company. - Regulatory Agencies - Public companies are required to submit financial statements to governing bodies such as the Securities and Exchange Commission. These financial statements must be prepared in accordance with financial accounting rules, and companies face fines or exchange delisting if they do not comply with reporting requirements. DQ1.11 Describe what is meant by accrual accounting. How does it differ from cash accounting? Accrual accounting - You record expenses and sales when they take place, instead of when cash changes hands. This way of accounting shows the amounts you owe to people and the amounts owing to you. Cash accounting does not record payables and receivables, while accrual accounting does. Revenue $60000 Less: Expense Interest ($40000 x 0.05) = $2000 Wages ($12000/$2400) = $14400 Depreciation ($8000/4) = $2000 Other = $10000 Profit = $31600 1. Total revenue accured = $60 000 (work performed for customers) 2. Total Expense incurred = $2000 (Interest of loan) + $14400 (wages) + $2000 (Depreciation of equiptment) + $10000 (other expenses) = $28400 3. Profit = $60 000 - $28 400 = $31 600 P1.11 Match each item with the financial statement that it would appear in by ticking the appropriate column. Item Asset Inventory Yes Cleaning expenses Cash at Bank Marketing expenses Buildings yes Income taxes payable Loans from banks Accounts payable Retained profits Accounts receivable yes Income tax expense Costs of goods sold Sales Revenue Liability Shareholders’ Revenue Equity Expense Yes yes yes yes yes Yes yes yes yes yes