The economy and the

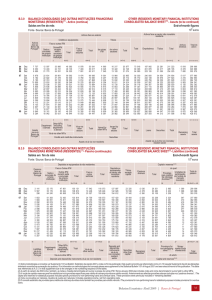

advertisement

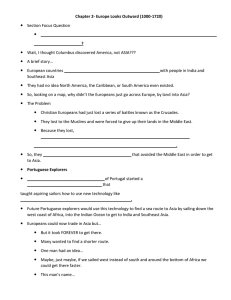

The economy and the banking sector: recent developments VÍTOR CONSTÂNCIO January 2006 • Recent performance of the economy and prospects – Factors behind the period of slow growth • Challenges to the Banking Sector – Regulatory changes and effects of the economic environment – Risk management (credit, liquidity, capital) • Structural problems and long term economic potential GDP growth rates (%) 5 4 Portugal 3 Euro Area(*) 2 1 0 Diferential Portugal vs. Euro Area -1 -2 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Factors behind the period of slow growth – Cyclical pattern of slight overheating and subsequent deceleration associated with joining a monetary union coming from a regime of higher inflation – Pro-cyclical fiscal policy – External demand shocks – Significance of the oil shock – Competitiveness problems in the context of enlargement and globalisation Investiment and domestic savings rate (% of GDP) 30 35 Investment rate 30 28 26 24 22 25 Savings rate 20 18 20 16 14 15 12 05 20 04 20 03 20 02 20 01 20 00 20 99 98 97 96 95 94 10 93 10 Short term interest rates Macroeconomic policy stance 20 18 16 14 12 10 8 6 4 2 0 1991 1990 1992 1993 1995 2001 -3 2000 2002 2003 2004 -2 1997 1999 -1 0 1 Primary deficit (ciclical adjusted without one-off measures) 2 Stability and growth programme (a) As a percentage of GDP 3,0 Main direct effects of consolidation measures 2,5 Revenue Expenditure 2,0 1,1 1,0 0,4 0,5 0,3 0,2 0,0 -0,1 -1,0 -0,6 -0,5 -0,3 -0,3 -1,8 -2,0 -3,0 2005 2006 2007 2008 2009 Accumulated Source: Stability and growth programme, June 2005 (a) Yearly, direct effects of discretionary measures included in the SGP. Growth rates of GDP, Domestic Demand and External Demand directed to the Portuguese economy 15 13 External demand 11 9 Domestic demand 7 5 GDP 3 1 -1 -3 20 00 20 01 20 02 20 03 20 04 20 05 99 98 97 96 95 94 93 92 91 90 -5 Growth rates of external demand and portuguese exports 14 12 10 External Demand 8 6 4 Exports 2 0 -2 -4 -6 96 97 98 99 2000 2001 2002 2003 Exports market quota 2004 2005 Competitiveness Indicators: relative ULC’s, CPI and export prices with the 13 main trading partners (1995=100) 120 120 115 ULC's (total) 115 110 ULC's (manufacturing)110 105 105 CPI 100 100 95 90 Relative export prices 95 90 85 85 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 (Source: BP AMECOe OECD) Technological content of Exports (% of total ) Low technology High technology 1985-89 2000-01 1985-89 2000-01 Variation Euro Area 38 30 14 21 7 Ireland 49 14 30 46 16 Holand 42 31 19 35 16 Finland 59 38 9 32 23 Germany 26 21 15 21 6 France 38 28 14 21 7 Austria 51 37 12 18 6 Portugal 82 61 5 14 9 Italy 47 44 12 13 1 Belgium 54 41 9 12 3 Spain 57 41 6 11 5 ECB Occasional Paper “Competitiveness and export performance of the euro area” No. 30, 2005 Composition of Exports 1985-1989 2000-2004 Variação Agriculture & Food, Wood,Cork, Paper , Leather, Textiles, Clothing, Footwear 61,1 % 40,2% -20,9 p,p Electronics, Machines, Transport equipment, Chemicals, Energy 27,0 % 45,8% +18,8 p,p Other 11,8 % 14,0% +2,2 p,p Bank of Portugal’s Economic Forecasts 2004 2005 2006 2007 1.3 0.3 0,8 1,0 Private Consumption 2.3 1.8 1.2 1.1 Public Consumption 2.6 1.1 0.7 0.4 Gross Fixed Investment 0.2 -3.1 -1.1 -0.8 2.1 0.6 0.6 0.6 Exports of goods and services 5.4 1.8 4.0 5.2 Imports of goods and services 6.8 2.4 2.8 3.2 Inflation rate (HICP) 2.5 2.1 2.5 2.3 Growth rates (%) GDP Domestic Demand • Recent performance of the economy and prospects – Factors behind the period of slow growth • Challenges to the Banking Sector – Regulatory changes and effects of the economic environment – Risk management (credit, liquidity, capital) • Structural problems and long term economic potential Credit to households and non-financial firms Return on Equity (ROE) (a) 18 14 12 10 8 (a): ROE defined as net profit over average own funds (consolidated accounts) 04 20 03 20 02 20 01 20 00 20 99 19 98 19 97 19 96 19 95 19 94 6 19 Percentagemg 16 Net Interest Inome (in % of average Total Assets) 4.5 4.0 3.5 % 3.0 2.5 2.0 1.5 20 04 20 03 20 02 20 01 20 00 19 99 19 98 19 97 19 96 19 95 19 94 1.0 Fees and commissions in % of average Total Assets 0.80 0.75 0.65 0.60 0.55 0.50 0.45 0.40 04 20 03 20 02 20 01 20 00 20 99 19 98 19 97 19 96 19 95 19 94 0.35 19 Percentageage 0.70 Staff Costs in % of average Total Assets 1.5 1.4 1.3 1.2 1.1 1.0 Consolidated accounts 04 20 03 20 02 20 01 20 00 20 99 19 98 19 97 19 96 19 95 19 19 94 0.9 Cost / Income Ratio (in %) 64 63 62 61 60 59 58 57 56 55 1998 1999 2000 2001 2002 2003 2004 Interbank liabilities (net of interbank assets) In % of Total Assets 10 9 8 7 Total Banking Sector 6 5 4 Domestic Banks 3 2 1 0 1999 2000 2001 2002 2003 2004 Ratio of high liquid assets over interbank liabilities 140 130 130.6 131.8 121.6 120 124.6 110 104.3 106.6 100.7 98.9 100 101.4 93.4 88.7 90 91.5 87.4 86.8 80 Dez. 1998 Dez. 1999 Dez. 2000 Dez. 2001 Dez. 2002 Dez. 2003 Note: High liquid assets include Interbank Assets (Banks and Central Banks) and Public Sector securities. Dez. 2004 Non Performing Loans in % of Total Credit 7.0 7.0 Total Households - total Households - housing Non Financial Firms 6.0 5.0 6.0 5.0 4.0 4.0 3.0 3.0 2.0 2.0 1.0 1.0 0.0 Dez-97 Dez-98 Dez-99 Dez-00 Dez-01 Dez-02 Dez-03 0.0 Dez-04 HOUSEHOLDS INDEBTEDNESS AND INTEREST PAID As a pe rce ntage of dis pos able incom e 7.0 120 Indebtedness 6.5 80 6.0 60 5.5 40 5.0 20 4.5 0 4.0 Per cent 100 1998 1999 2000 2001 2002 2003 2004 2005E Per cent Interest paid (right-hand scale) The aggregate debtto-assets ratio increased but net wealth is estimated at a comfortable 400 percent of disposable income. Household debt is mainly comprised of housing mortgages, with direct coverage by nonfinancial assets (housing – in particular for owner occupation). HOUSE PRICES IN PORTUGAL year-on-year grow th rates 10 Hous e prices - nom inal year-on-year growth rates 8 Hous e prices - real year-on-year growth rates Percentage 6 4 2 0 Dez-94 Dez-95 Dez-96 Dez-97 -2 -4 Source: Conf idencial Imobiliário New sletter. Dez-98 Dez-99 Dez-00 Dez-01 Dez-02 Dez-03 Dez-04 Total Provisions in % of Non Performing loans 150 140 130 120 110 100 90 80 70 Dez.95 Dez.96 Dez.97 Dez.98 Dez.99 Dez.00 Dez.01 Dez.02 Dez.03 Dez.04 Regulatory Capital Ratio (own funds) 15 14 13 12 11 10 9 8 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Capital Access Index (2005) 1. U.K. 2. Hong-Kong 3. Singapore 4. USA 5. Sweden 6. Denemark 7. Australia 8. Norway 9. Finland 10. Ireland 10. Canada 12. Switzerland 13. Netherlands 14. New 15.Germany 16.Malasya 17. Spain 18. Chile 19.Japan 20.France 21.Estonia 22.Austria 23.South Korea 24.South Africa 25.Taiwan 26.Portugal 27.Israel 28.Belgium 29.Greece 30.Thailand 31.Italy Source: Milken Institute, USA 8,01 7,84 7,77 7,75 7,62 7,61 7,6 7,47 7,46 7,42 7,42 7,39 7,2 7,04 6,93 6,88 6,8 «Ranks 121 6,78 6,76 countries 6,62 according to 6,59 the ability of 6,41 6,37 new and 6,36 existing 6,34 6,31 entrepreneurs 6,19 to finance their 6,17 strategies and 5,85 5,71 investments for 5,66 job creation and capital formation» • Recent performance of the economy and prospects – Factors behind the period of slow growth • Challenges to the Banking Sector – Regulatory changes and effects of the economic environment – Risk management (credit, liquidity, capital) • Structural problems and long term economic potential Growth competitiveness index ( WORLD FORUM 2005) Total Quality of Institutions Technological absortion Macroeconomic environment Finland 1 5 2 4 USA 2 18 1 23 Sweden 3 17 4 12 Denmark 4 2 5 3 Taiwan 5 26 3 17 Singapore 6 4 10 1 Iceland 7 3 9 11 Switzerland 8 9 6 13 Norway 9 6 13 2 10 10 14 14 Portugal 22 15 20 37 Spain 29 38 27 24 Ireland 26 13 31 7 Greece 46 43 37 51 Australia .................................................. World Bank Indicators of «Governance» (2004) 0 20 40 60 80 Germany Portugal Spain Poland Voice and accountability Political stability Germany Portugal Spain Poland Government efficiency Germany Portugal Spain Poland Quality of regulation Germany Portugal Spain Poland Rule of law Poland Control of corruption Germany Portugal Spain Poland Source: World Bank “ Governance Indicators for 1996-2004” , 2005 Germany Portugal Spain 100 Index of economic freedom (Fraser Institute 2003) Hong Kong Singapore USA New Zealand Switzerland U.K. Canada Ireland Australia Luxembourg Unit. Arab Estonia Netherlands Iceland Austria Denmark Finland Germany Belgium Chile Costa Rica Sweden Bahrain Taiwan Norway Botswana Japan Spain Portugal Cyprus France Greece Lithuania Malta 34º in127 countries 0 1 2 3 4 5 6 7 8 9 10 OECD Regulation Index (1998-2003) Source:OECD «PRODUCT MARKET REGULATION IN OECD COUNTRIES: 1998 TO 2003» OECD Regulation Index (1998-2003) Source:OECD «PRODUCT MARKET REGULATION IN OECD COUNTRIES: 1998 TO 2003» OECD Regulation Index (1998-2003) Source:OECD «PRODUCT MARKET REGULATION IN OECD COUNTRIES: 1998 TO 2003» • Recent performance of the economy and prospects – Factors behind the period of slow growth • Challenges to the Banking Sector – Regulatory changes and effects of the economic environment – Risk management (credit, liquidity, capital) • Structural problems and long term economic potential