Nathan Tepley, Brandon Sauter, Yuwei Tang, Danielle Seamon

advertisement

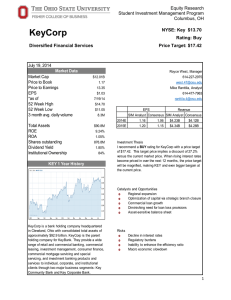

Nathan Tepley, Brandon Sauter, Yuwei Tang, Danielle Seamon Overview American Express Keycorp Wells Fargo CitiGroup Conclusion Company AmericanExpress WellsFargo CitiGroup Keycorp CurrentPrice (asof10/30/15) TargetPrice Upside InitialPurchasePrice SIMWeight Change 73.26 81.58 11.36% 75.7 3.12% 0.00bps 54.14 66.87 23.51% 35.19 4.28% 0.00bps 53.17 58.22 9.50% 52.58 4.58% 0.00bps 12.42 14.88 19.81% 13.91 3.52% 0.00bps Total S&P500Weight Under/Overweight 15.50% 16.19% -0.69bps S&P 500 Weight o 16.19% SIM Weight o 15.50% Underweight o 69 Basis points Recommendation oHOLD Interest rates rising in December Strengthening economy o But Long bull market • • • • Ticker:NYSE:AXP CurrentPrice:$73.26(October 30th 2015) InitialPrice:$75.70à $317,940 TargetPrice:$81.58(11.36%upside potential) • Recommendation:HOLD CompanyDescription: AmericanExpressCompanyisaglobal paymentandtravel company.Thecompany’sPrincipal Productsandservicesare chargeandcreditpaymentcardsproducts andtravel-related servicesoffered toconsumers andbusinessaround theworld. 12MonthSharePrice Economic/MacroDrivers • • • • USDisposable Income PersonalSavings Consumer Confidence Consumer Spending Growth Advantages Risks • Closed Loop network • Affluent Customer Base • Profitable Performance • Credit Risk • Fraud • Negative Economic Drivers KeyCommunity Bankservesindividualsandsmalltomid- sized businessesby offeringservicesincludingdeposit,investment,lending, creditcardandpersonalizedwealthmanagementproductsandbusiness advisory services. MarketProfile KeyCorporate Bankofferstoitsclientsbankingandcapitalmarkets products includingsyndicatedfinance,debtandequitycapitalmarkets, commercialpayments,equipmentfinance,commercialmortgagebanking, CMBS,derivatives,foreignexchange,financialadvisory, andpublicfinance. 52WeekRange $12.04-$15.7 P/E 12.5 Beta 1.35 Dividend Yield 2.10% ROE 8.84% ROA 1.01% MarketCap $11B 40% SharesOutstanding 835M 30% Asset $93.8B Employees 13590 ATM 1287 Branches 994 2015Revenue 60% 50% 20% 10% 0% Key Community Bank Key Corporate Bank Other Opportunities Merge and acquisition Regional expansion Pending interest rate Risks Uncertainties in global economy Regulation burdens KeyCorp S&p500 52WeekRange:$12.04-$15.7 CurrentPrice:$12.42 TargetPrice:$14.88 UpsidePotential:19.81% Recommendation:HOLD · · · · Ticker:NYSE:WFC CurrentPrice:$54.14 (October 30th 2015) InitialPrice:$35.19 →$274,474 TargetPrice:$66.87 (23.51%upside) · Recommendation:HOLD CompanyDescription: WellsFargo,founded in1852,isadiversified provider of financialservicestoindividuals, businessesandinstitutions. Thethreemainsegmentsofthebusiness are:Community Banking, WholesaleBanking, andWealth,Brokerageand Retirement.Thecompanyoperatesout of8,700locationswith 12,500ATMsandofficesin36countries. Advantages Risks Headquarters located in Earthquake prone San Francisco, California Economic slowdown/downturn Good dividend yield with room to grow Strengthening economy o Increased spending, saving and lending o Long bull market SensitivityAnalysis TerminalGrowthRate 66.87 9.00% 9.25% 9.50% 9.75% Strong competitive advantages DiscountRate 10.00% 10.25% 10.50% 10.75% 11.00% 11.25% 11.50% 11.75% 12.00% 2.00% 83.15 80.18 77.40 74.80 72.37 70.08 67.93 65.91 64.00 62.19 60.48 58.85 57.31 2.25% 84.93 81.79 78.88 76.16 73.61 71.23 68.99 66.88 64.90 63.03 61.25 59.58 57.99 2.50% 86.84 83.53 80.46 77.61 74.94 72.45 70.11 67.92 65.86 63.91 62.08 60.34 58.70 2.75% 88.90 85.40 82.16 79.16 76.36 73.75 71.31 69.02 66.87 64.85 62.94 61.14 59.44 3.00% 91.13 87.42 84.00 80.83 77.88 75.14 72.58 70.19 67.95 65.84 63.86 61.99 60.23 3.25% 93.56 89.61 85.98 82.62 79.51 76.63 73.95 71.44 69.10 66.90 64.84 62.89 61.06 3.50% 96.21 91.99 88.12 84.56 81.27 78.23 75.41 72.78 70.32 68.02 65.87 63.85 61.95 3.75% 99.11 94.59 90.45 86.66 83.17 79.96 76.97 74.21 71.63 69.22 66.97 64.86 62.88 4.00% 102.31 97.43 92.99 88.95 85.23 81.82 78.66 75.74 73.03 70.51 68.15 65.94 63.88 WellsFargo · Recommendation:HOLD · · · Alreadyat4.28% Couldslightly raiseposition Upsideisoveralong period MarketProfile 52WeekRange $46.95- $60.34 P/E 12.25 Beta 1.45 Dividend Yield 0.30% ROE 6.59% ROA 0.78% MarketCap $161.7B SharesOutstanding 2.98B Asset $1.8B Employees 239,000 Company Description Citigroup is a multinational banking and financial conglomerate that is the result of a $70 billion merger between Citicorp and Travelers Group in 1998. Today, Citigroup does business in four different regions — North America; Europe, Middle East and Africa (EMEA); Latin America; and Asia — in two primary business segments — Citicorp and Citi Holdings. • Ticker:NYSE:C • CurrentPrice:$54.28(November 23rd,2015) • InitialPrice:$52.58 à $446,936 • TargetPrice:$58.22(9.5%upside potential) • Recommendation:HOLD Advantages Risks • Biggest international presence • Cost cuts • Speculated interest rate hike • Past economic performance • Chinese economy