FINANCIAL SECTORS STOCK PRESENTATION SUMMER 2015

advertisement

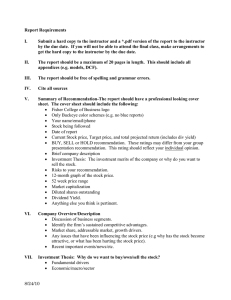

FINANCIAL SECTORS STOCK PRESENTATION SUMMER 2015 Graham Tucker Rita Xu Table of Content: I. Overview II. Wells Fargo III. KeyCorp IV. Citigroup V. SunTrust VI. American Express VII. Conclusion 1 OVERVIEW Recap of Sector Recommendation KEYS: SIM: 16.6% S&P Financials:16.7% • Overweight 40 percent basis points to capture returns • Rising interest rate in September • Hedge against possible regulatory risk OSU SIM FUND VS. S&P 500 Market Cycle Market Cycle Out of Synchronization • QE kept interest rates ar-ficially low, while increased regulatory requirements leading to a decrease in net income margin. • Monetary policy is in direct conflict with regulatory requirements/fiscal policy with financial ins-tu-ons in the middle. • Target infla-on s-ll below op-mal levels, QE offsets natural demand-­‐pull infla-on, decrease in oil offsets cost-­‐push infla-on for elas-c goods. Federal Reserve Ink Blot (Source: FOMC mee-ng, 06/17/15) • FOMC revisi-ng slow interest rate step-­‐up on a mee-ng-­‐to-­‐mee-ng basis. • Treasury futures/fed funds futures markets imply step up in November/December. 2 Wells Fargo Company Overview Market'Por*olio'(6/30/2015) !52$Week!Range! 46.44$58.26 Price/Earning!(7m)! 13.75 Price/Booking 1.74 EPS! 4.09 Beta! 0.83 Dividend!Yield! 2.49% ROE!(7m)! 13.1% ROA!(7m)! 1.4% Market!Cap.! 289.59B Shares!outstanding! 5.15B Total!Assets! 1.7T Employees! 266,000 • Largest market share 9.8% • Diversified Financial Services • Cross-­‐selling strategy and focuses on customer-­‐centric. • Upcoming rising interest rates will improve the economic condi-on. • Rela-vely low P/E, but keep growing revenue and EPS. Trilling 12 Months WFC Price • WFC has outperformed the S&P500 over the last twelve months due to overall favorable economic condi-on. • It is in 52-­‐weeks high of $58.52, but s-ll goes up. • Price target $65.26 (11.5% upside poten-al) Growth Drivers • Earnings of $5.7 billion • Diluted earnings per common share of $1.03 • Net interest income up 4% YoY and 3% LQ, Noninterest income down 2% both YoY and LQ • Average loans up 5% YoY and 1% LQ • Average deposits up 8% YoY and 1% LQ • Credit quality remained strong with net charge-­‐offs of 30 bps of average loans Valuation and Recommendation • Current Price: $58.55 • Target Price: $65.26 • Unit Cost: $35.19 • % Asset: 4.52% • HOLD 3 KeyCorp KeyCorp (KEY) 52-­‐week range $11.55-­‐$15.70 KEY Company Brief Shares Outstanding 848.31M Beta 1.4 Market Capitalization $12.77B TTM P/E 15.24 Forward P/E 15.42 Book value per share $12.12 EPS 1 Dividend Yield .30 (2.00%) Branches 994 Employees 13,853 ROE 8.31% Financial Analysis Value Drivers • Acquired Pacific Crest Investments in 2014. • Disciplined capital management (interest income for 2014 increased by 1.4% while non-­‐interest expense decreased 2.2%. • Dives-ture of sovereign debt (currently holding small posi-ons in Ireland and Spain debt). • Equity/Fixed Income/Deriva-ves trading increased by 2.6%, securi-es lending increased by 41.3% • KEY’s es-mated Capital Ra-o is 10.7% under Basel III, currently at 11.3%. KEY earnings by LOB Earnings by Line of Business (2014) Community Bank (24.4%) Corporate Bank (51.9%) Trust and Investment Services (23%) Other (1.7%)) (KEY) Revenue Figure 12. Line of Business Results (Source: 2014 KeyCorp 10-K) Year ended December 31, dollars in millions REVENUE FROM CONTINUING OPERATIONS (TE) Key Community Bank Key Corporate Bank Other Segments Total Segments Reconciling Items Total INCOME (LOSS) FROM CONTINUING OPERATIONS ATTRIBUTABLE TO KEY Key Community Bank Key Corporate Bank Other Segments Total Segments Reconciling Items Total 2014 2013 2012 2,217 $ 1,630 271 4,118 (4) $ 4,114 $ 2,316 $ 1,536 263 4,115 (1) 4,114 $ 2,308 $ 1,499 353 4,160 (16) 4,144 234 $ 497 226 957 (18) 939 $ 205 $ 475 220 900 (30) 870 $ 162 $ 425 204 791 44 835 $ $ $ $ Change 2014 vs. 2013 Amount Percent (99) 94 8 3 (3) — (4.3)% 6.1 3.0 .1% N/M — 29 22 6 57 12 69 14.1% 4.6 2.7 6.3 N/M 7.9% (KEY) 2015 Q2 Earnings Call Highlights(07/16/15) • Missed EPS es-mates by .01 (posted .27), however beat revenue es-mates of $1.05B with $1.08B (4.7% increase from Q2 2014). • Investment banking fees increased 42.4%. • Capital Ra-os Under Basel III high 11.3%, es-mated 10.6% for 2015. • Will begin origina-ng mortgage loans again (last done in 2006). • Stock repurchase (8 million shares in 2015 Q2). • Leveraged for short-­‐term, divested sovereign debt, low exposure to oil & gas, reduc-on in net charge-­‐offs. DCF Valuation • WACC: 10.6% • Growth Rate: 3% • Tax Rate: 27% WFC Implied Share Price Weight • Target Price: $16.61 (9.7% upside poten-al) DCF 16.55 75% P/E Absolute 16.81 25% • Consensus: $16.55 Target Price 16.61 100% • Current Price $15.18 • Recommenda-on: HOLD 4 Citi Group Citi Group VALUATION • 52-­‐week range: $60.53-­‐ $46.60 • Beta: 1.36 • Current Price: $60.44 • Target Price: $63.74 • Upside Poten-al: (5.6%) C DCF P/E Absolute Implied Share Price Weight 64.80 75% 60.56 25% 5 SunTrust (STI) SunTrust VALUATION • 52-­‐week range: $33.97-­‐45.53 • Beta: 1.09 • Current Price: 44.82 • Current Price: 46.50 • Upside Poten-al: (3.7%) STI DCF P/E Absolute Target Price Implied Share Price Weight 46.50 75% 45.61 25% 46.21 100% 6 American Express (AXP) Performance of Various Banks AXP DCF Valuation American)Express)(AXP)) Consolidated+Statement+of+Income+(USD+$) (In+Millions,+except+Per+Share+data) Terminal Discount Rate = Terminal FCF Growth = Net Income 5,890 NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 45,659 54,522 100,181 10.01% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA Shares Outstanding (in million) Current Price Implied equity value/share Upside/(Downside) to DCF 14.1 17.0 3.2 3.7 5,440 6,128 9.8% 4.0% 6,352 46% 54% 100% 6,479 6,609 6,741 6,876 7,013 7,154 Terminal Value Free Cash Yield 15.2 18.4 3.3 3.7 13.5 16.3 3.2 3.7 5.58% 19.0 Terminal EV/EBITDA 4.1 78.79 premarket after preannouncement 95.32 21.0% • • • • • 138,865 Terminal P/E 1,051 $ $ 7,297 Current Price: $78.79 Target Price: $95.32 EPS: $5.71 BUY P/E: 13.83 52 Weeks Rage: $75.75-­‐$94.89 7 RECOMMENDATION Stock Recommendation SIM Portfolio (Maintain 100 bps overweight) S&P 500 Financial Sector GICS Sub (As of 07/19/15) Industry Ticker Current Target Upside Potential Recommendation Citigroup Inc. Banks (4.53%) C $54.71 $63.54 13.90% Hold KeyCorp Banks (4.04%) KEY $14.92 $16.55 9.85% Hold Wells Fargo Banks (4.30%) WFC $56.19 $58.15 3.37% Hold SunTrust Banks Banks (3.82%) STI Consumer Finance AXP $43.17 $45.28 3.70% Sell $77.42 $85.96 9.93% Buy American Express Co. Q&A