Quantitative Risk Analyst

advertisement

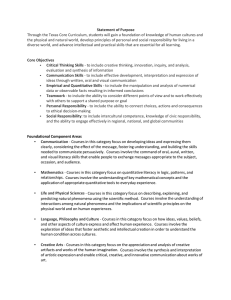

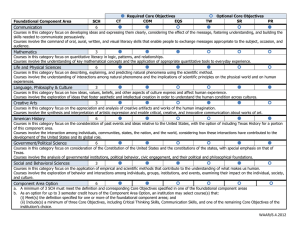

Quantitative Risk Analyst 657a639ec92355 DESCRIPTION Cleveland-based KeyCorp is one of the nation's largest bank-based financial services companies, with assets of approximately $87 billion. Key companies provide investment management, retail and commercial banking, consumer finance, and investment banking products and services to individuals and companies throughout the United States and, for certain businesses, internationally. The company's businesses deliver their products and services through branches and offices; a network of 1,576 ATMs; telephone banking centers 800-KEY2YOU® (800-539-2968); and a website, Key.com®, that provides account access and financial products 24 hours a day. Quantitative Rotational Analysts will start with several weeks of foundational training to broaden your financial accounting, finance theory, cash flow analysis, financial modeling, presentation, and business writing skills. Rotations will begin upon completion of the foundational training, and continue for 12-18 months, each rotation being 6 months in length. A member of the Risk Management team and other Analysts will serve as your mentors while working in the Program. Rotational areas may include, but are not limited to: Credit Portfolio Management Credit Risk Management Market Risk Management Model Risk Control Operational Rick Quantitative Risk Analysis Upon successfully completing the Program, you will have the opportunity for placement based on business needs, demonstrated skill, your interests, and performance throughout the Program. Essential Job Functions: - Analytics and reporting - Working with regulatory reporting - Assess and monitor risk and risk control processes across all risk areas - Understand and validate models - Participate in model and report development - Demonstrate ability to perform research and analysis with integrity and accuracy - Ability to monitor and evaluate problems across a broad spectrum of risk Qualifications: - Bachelor's degree in Mathematics, Statistics, Financial Engineering, Business Analytics, Economics, or related field of study - Outstanding academic achievement (3.5 or above GPA preferred, 3.3 minimum required) - Strong accounting and financial acumen - Good analytical and decision making skills - Exceptional interpersonal and relationship-building skills - Effective oral and written communication skills - Relevant work or internship experience, a plus This position is NOT eligible for employment visa sponsorship for non-U.S. citizens. KeyCorp is an Equal Opportunity Employer M/F/D/V