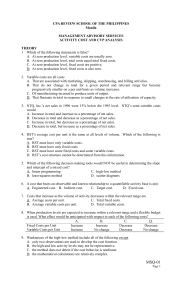

Comprehensive Cost-Volume-Profit Problem - Unit Basis ACCT 2102 - Handout 3-1

advertisement

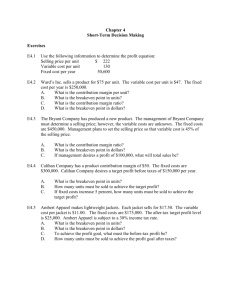

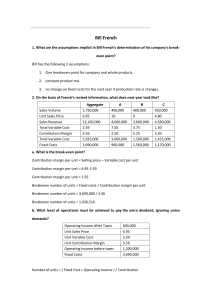

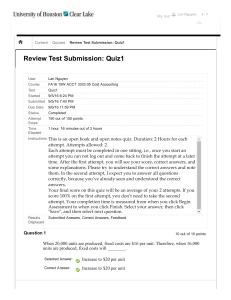

Comprehensive Cost-Volume-Profit Problem - Unit Basis ACCT 2102 - Handout 3-1 The Robinson Lawn Chair Company produces and sells a single high-priced lawn chair and in fiscal 1999 the company produced and sold 30,000 units. The 1999 income statement of the company reported the following: Robinson Lawn Chair Company Income Statement For Fiscal Year 1999 Total $'s Sales Variable Costs Contribution Margin Fixed Costs Income Before Taxes Tax Expense Income After Taxes $1,800,000 $1,350,000 450,000 $240,000 210,000 63,000 147,000 Note: total sales and production: 30,000 units Determine the following items: 1. Calculate the per unit figures for each item from the information provided above. Determine which of these figures is needed for performing C-V-P analysis. (Note, for example, that fixed costs per unit are of no use in determining breakeven points since it is total fixed costs that are needed for calculations.) 2. Compute the breakeven point in units for fiscal 1999. 3. Determine the company's margin of safety in units for fiscal 1999. 4. Determine the company's degree of operating leverage at the current level of operations. If the company's sales in units were to increase 30%, how much would profits before taxes increase in percentage percentageterms? terms? 5. Compute the sales level required in units to achieve a level of profits before taxes of $270,000. 6. Based on the original data above, determine the sales level required if the company desires a profit after taxes of $210,000. It is believed that the tax rate will remain at current levels. 7. Assume the company is expecting to experience a shortage of its main raw material. This situation is expected to result in an increase in the company's manufacturing costs of $3 per unit. Under this circumstance, and assuming that the company does not believe that it can increase its selling price, determine the company's breakeven point and new safety margin. 8. Management has decided to raise the price of its product to $65 per unit. It also will spend an additional $102,000 per year foradvertising. Although it has never paid commissions before, the company has decided to begin paying sales personnel $1 per unit for every unit sold. Determine the new breakeven point. Also determine the safety margin of the company under this plan if sales only reach 27,000 units. Note: in calculating your solution, ignore question #7 and solve this question starting with the original data above. Comprehensive Cost-Volume-Profit Problem - Unit Basis Handout 3-1 Solution Question #1: Sales Variable Costs Contribution Margin Fixed Costs Income Before Taxes Tax Expense Income After Taxes Total $'s $1,800,000 1,350,000 450,000 $240,000 210,000 63,000 147,000 Per Unit Figures** $60.00 45.00 15.00 8.00 7.00 2.10 4.90 **All per unit figures based on 30,000 units Relevant figures for breakeven analysis: CM per unit & Total Fixed costs. - the CM per unit = $15 & the Total Fixed Costs = $240,000 Question #2: Breakeven Point = $240,000/$15 per unit = 16,000 units Question #3: Safety Margin = 30,000 units - 16,000 units = 14,000 units Question #4: Degree of Operating Leverage = Total Contribution Margin/Total Income Before Taxes = $450,000/$210,000 = 2.14 Percentage increase in Profits = 30% x 2.14 = 64.2% (with 30% increase in sales) Question #5: Sales Level Required = ($240,000 + $270,000)/$15 per unit = 34,000 units Question #6: Tax Rate = $63,000/$210,000 = .30 or 30%. Retention Rate = (1-Tax Rate) = (1-.30) = .70 or 70% Income Before Taxes = Targeted Income After Tax/Retention Rate Required = ($210,000)/.70 = $300,000 Sales Level Required = ($240,000 + $300,000)/$15 per unit = 36,000 units Question #7: New Breakeven Point = $240,000/($15-3) per unit = 20,000 units Safety Margin = 30,000 units - 20,000 units = 10,000 units Question #8: New Breakeven Point = ($240,000+ $102,000)/($65-45-1) per unit = 18,000 units Safety Margin = 27,000 units - 18,000 units = 9,000 units