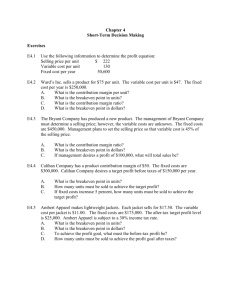

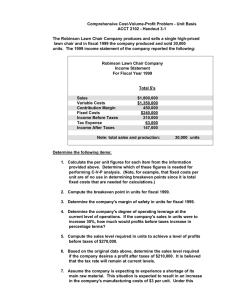

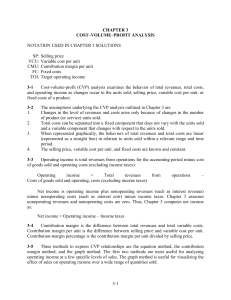

Bill French 1. What are the assumptions implicit in Bill French's determination of his company's breakeven point? Bill has the following 3 assumptions: 1. One breakeven point for company and whole products 2. constant product mix 3. no change on fixed costs for the next year if production rate is changes. 2. On the basis of French's revised information, what does next year look like? Sales Volume Unit Sales Price Sales Revenue Total Variable Cost Contribution Margin Total Variable Cost Fixed Costs Aggregate 1,750,000 6.95 12,160,000 3.39 3.56 5,925,000 3,690,000 A 400,000 10 4,000,000 7.50 2.50 3,000,000 960,000 B 400,000 9 3,600,000 3.75 5.25 1,500,000 1,560,000 C 950,000 4.80 4,560,000 1.50 3.30 1,425,000 1,170,000 a. What is the break-even point? Contribution margin per unit = Selling price – Variable cost per unit Contribution margin per unit = 6.95-3.39 Contribution margin per unit = 3.56 Breakeven number of units = Fixed costs / Contribution margin per unit Breakeven number of units = 3,690,000 / 3.56 Breakeven number of units = 1,036,516 b. What level of operations must be achieved to pay the extra dividend, ignoring union demands? Operating Income After Taxes Unit Sales Price Unit Variable Cost Unit Contribution Margin Operating Income before taxes Fixed Costs 600,000 6.95 3.39 3.56 1,200,000 3,690,000 Number of units = ( Fixed Cost + Operating Income ) / Contribution Number of units = 4,890,000 / 3.56 = 1,373,595 c. What level of operations must be achieved to meet union demands, ignoring bonus dividends? Operating Income after taxes Unit Sales Price Unit Variable Cost Unit Contribution Margin Operating Income before taxes Fixed Costs Total 450,000 6.95 3.73 3.22 900,000 3,690,000 4,590,000 Number of units = 4,590,000 / 3.22 = 1,434,375 d. What level of operations must be achieved to meet both union demands & bonus dividends? Operating Income after taxes Unit Sales Price Unit Variable Cost Unit Contribution Margin Operating Income before taxes Fixed Costs Total 600,000 6.95 3.73 3.22 1,200,000 3,690,000 4,890,000 Number of units = 4,890,000 / 3.22 = 1,528,125 3. Can the breakeven analysis help the company decide whether to alter the existing product emphasis? What can the company afford to invest for additional “C” capacity? Breakeven analysis can help the company to decide whether to alter the existing product emphasis. Company can afford to invest 1,965,000 for C product. Product C Sales Volume 950,000 Unit Sales Price 4.80 Unit Sales Revenue 4,560,000 Unit Variable Cost 1.50 Total Variable Cost 1,425,000 Contribution 3,135,000 Fixed Costs 1,170,000 Affordable Investment 1,965,000 4. Calculate each of the three products’ break even points using the data. Why is the sum of these three volumes not equal to the 1,100,000 unit’s aggregate breakeven volume? Because each products unit contribution margin differs. Sales Volume Unit Sales Price Sales Revenue Variable Cost Contribution Mar. Total Variable Cost Fixed Costs Breakeven Units Aggregate 1,500,000 7.20 10,800,000 4.50 2.70 6,750,000 2,970,000 1,100,000 A 6000000 10 6,000,000 7.50 2.50 4,500,000 960,000 384,000 B 4000000 9 36000000 3.75 5.25 1,500,000 1,560,000 297,143 C 500,000 2.40 1,200,000 1.50 0.90 750,000 450,000 500,000 5. Is this type of analysis of any value? For what can it be used? This type of analysis is valuable for deciding product emphasis, unit prices, etc..