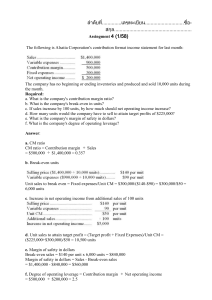

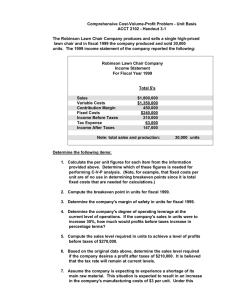

CPA REVIEW SCHOOL OF THE PHILIPPINES Manila MANAGEMENT ADVISORY SERVICES ACTIVITY COST AND CVP ANALYSIS THEORY 1 Which of the following statements is false? A. At zero production level, variable costs are usually zero. B. At zero production level, total costs equal total fixed costs. C. At zero production level, fixed costs are positive. D. At zero production level, fixed costs is also zero. 2. Variable costs are all costs A. That are associated with marketing, shipping, warehousing, and billing activities. B. That do not change in total for a given period and relevant range but become progressively smaller on a per unit basis as volume increases. C. Of manufacturing incurred to produce units of output. D. That fluctuate in total in response to small changes in the rate of utilization of capacity. 3. NTQ, Inc.’s net sales in 1996 were 15% below the 1995 level. NTQ’s semi-variable costs would A. Increase in total and increase as a percentage of net sales. B. Decrease in total and decrease as a percentage of net sales. C. Increase in total, but decrease as a percentage of net sales. D. Decrease in total, but increase as a percentage of net sales. 4. RST’s average cost per unit is the same at all levels of volume. Which of the following is true? A. RST must have only variable costs. B. RST must have only fixed costs. C. RST must have some fixed costs and some variable costs. D. RST’s cost structure cannot be determined from this information. 5. Which of the following decision-making tools would NOT be useful in determining the slope and intercept of a mixed cost? A. linear programming C. high-low method B. least-squares method D. scatter diagrams 6. A cost that bears an observable and known relationship to a quantifiable activity base is a(n) A. Engineered cost. B. Indirect cost. C. Target cost. D. Fixed cost. 7. Costs that increase as the volume of activity decreases within the relevant range are A. Average costs per unit. C. Total fixed costs. B. Average variable costs per unit. D. Total variable costs. 8. When production levels are expected to increase within a relevant range and a flexible budget is used. What effect would be anticipated with respect to each of the following costs? A. B. C. D. Fixed Costs per Unit Increase Increase Decrease Decrease Variable Costs per Unit Increase No change Decrease No change 9. Weaknesses of the high-low method include all of the following except A. only two observations are used to develop the cost function. B. the high and low activity levels may not be representative. C. the method does not detect if the cost behavior is nonlinear. D. the mathematical calculations are relatively complex. MSQ-01 Page 1 10. The scatter diagram method of cost estimation A. is influenced by extreme observations B. requires the use of judgment C. uses the least-squares method D. is superior to other methods in its ability to distinguish between discretionary and committed fixed costs 11. The number of variables used in simple regression analysis is: A. two B. three C. one D. more than three 12. Regression analysis is superior to other cost behavior techniques because it A. Examines only one variable. C. Proves a cause and effect relationship. B. Produces measures of probable error. D. Is not a sampling technique. 13. The first to be undertaken in a simple regression analysis approach is A. To calculate the coefficient correlation. B. To make the least squares computation. C. To plot two variables in a scatter diagram. D. To find the standard error of estimate. 14. If the coefficient of correlation between two variables is zero, how might a scatter diagram of these variables appear? A. Random points. B. A least squares line that slopes up to the right. C. A least squares line that slopes down to the right. D. Under this condition a scatter diagram could not be plotted on a graph. 15. The relevant range is A. a relatively wide range of sales where total variable costs remain the same B. a relatively wide range of sales where all costs remain the same C. a relatively narrow range of production where total variable costs remain the same D. a relatively wide span of production where total fixed costs are expected to remain the same 16. Cost-volume-profit analysis is most important for the determination of the A. Volume of operation necessary to break-even B. Relationship between revenues and costs at various levels of operations C. Variable revenues necessary to equal fixed costs D. Sales revenue necessary to equal variable costs. 17. The sum of the costs necessary to effect a one-unit increase in the activity level is a(n) A. Margin of safety. C. Marginal cost. B. Opportunity cost. D. Incremental cost. 18. Which of the following assumptions does NOT pertain to cost-volume-profit analysis? A. The units produced will equal the units sold B. Inventories are constant C. All costs are classified as fixed or variable D. Sales mix may vary during the related period E. The total revenues function is linear. 19. In a cost-volume-profit graph A. the total revenue line crosses the horizontal axis at the breakeven point. B. beyond the breakeven sales volume, profits are maximized at the sales volume where total revenues equal total costs. C. an increase in unit variable costs would decrease the slope of the total cost line. D. an increase in the unit selling price would shift the breakeven point in units to the left. E. an increase in the unit selling price would shift the breakeven point in units to the right. MSQ-01 Page 2 20. As an accountant, the most useful information you can get from break-even chart is the A. Relationship among revenues, variable costs, and fixed costs at various levels of activity. B. Volume or output level at which the enterprise breaks even. C. Amount of sales revenue needed to cover enterprise fixed costs. D. Amount of sales revenue needed to cover enterprise variable costs. 21. In a cost-volume-profit graph, the slope of the total revenue curve represents A. the selling price per unit. D. total contribution margin B. the contribution margin per unit E. total revenues. C. the variable cost per unit 22. In a profit-volume graph, the slope of the profit curve represents A. the selling price per unit D. total contribution margin B. the contribution margin per unit E. total revenues. C. the variable cost per unit 23. If a company’s variable costs are 70% of sales, which formula represents the computation of dollar sales that will yield a profit equal to 10% of the contribution margin when S equals sales in dollars for the period and FC equals total fixed costs from the period? A. S = 0.2 FC C. S = 0.27 FC B. S = FC 0.2 D. S = FC 0.27 24. Cost-volume-profit analysis is a key factor in many decisions, including choice of product lines, pricing of products, marketing strategy, and utilization of productive facilities. A calculation used in CVP analysis is the break-even point. Once the break-even point has been reached operating income will increase by the A. Sales price per unit for each additional unit sold. B. Contribution margin per unit for each additional unit sold. C. Fixed cost per unit for each additional unit sold. D. Gross margin per unit for each additional unit sold. 25. When used in cost-volume-profit analysis, sensitivity analysis A. Determines the most profitable mix of products to be sold. B. Allows the decision maker to introduce probabilities in the evaluation of decision alternatives. C. Is done through various possible scenarios and computes the impact on profit of various predictions of future events. D. Is limited because in cost-volume-profit analysis, costs are not separated into fixed and variable components. 26. At its present level of operations, a small manufacturing firm has total variable costs equal to 75 percent of sales and total fixed costs equal to 15 percent of sales. Based on variable costing, if sales change by $1.00, income will change by A. $0.25. B. $0.10. C. $0.75. D. can't be determined from the information given. 27. A company’s breakeven point in sales dollars may be affected by equal percentage increases in both selling price and variable costs per unit (assume all other factors are constant within the relevant range.) The equal percentage changes in selling price and variable cost per unit will cause the breakeven point in sales dollars to A. Decrease by less than the percentage increase in selling price. B. Decrease by more than the percentage increase in the selling price. C. Increase by the percentage change in variable cost per unit. D. Remain unchanged. MSQ-01 Page 3 28. The most likely strategy to reduce the breakeven point would be to A. Increase both the fixed costs and the contribution margin. B. Decrease both the fixed cost and the contribution margin. C. Decrease the fixed costs and increase the contribution margin. D. Increase the fixed costs and decrease the contribution margin. 29. A company increased the selling price of its product from $1.00 to $1.10 a unit when total fixed costs increased from $400,000 to $480,000 and variable cost per unit remained unchanged. How will these changes affect the breakeven point? A. The breakeven point in units will be increased. B. The breakeven point in units will be decreased. C. The breakeven point in units will remain unchanged. D. The effect cannot be determined from the information given. 30. According to CVP analysis, a company could never incur a loss that exceeded its total A. variable costs. B. fixed costs. C. costs. D. contribution margin. 31. Two companies produce and sell the same product in a competitive industry. Thus, the selling price of the product for each company is the same. Company 1 has a contribution margin ratio of 40% and fixed costs of $25 million. Company 2 is more automated, making its fixed costs 40% higher than those of Company 1. Company 2 also has a contribution margin ratio that is 30% greater than that of Company 1. By comparison, Company 1 will have the <List A> breakeven point in terms of dollar sales volume and will have the <List B> dollar profit potential once the indifference point in dollar sales volume is exceeded. List A List B A. Lower Lesser B. Lower Greater C. Higher Lesser D. Higher Greater 32. Which of the following is a true statement about sales mix? A. Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the high contribution margin product. B. Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the lower contribution margin product. C. Profits will remain constant with an increase in total dollars of sales if the total sales in units remains constant. D. Profits will remain constant with a decrease in total dollars of sales if the sales mix also remains constant. 33. Saints Co. sells three chemicals: Simpol, Plutex, and Coplex. Simpol is the most profitable product while Coplex is the least profitable. Which one of the following events will definitely decrease the firm’s overall B.E.P. for the upcoming accounting period? A. An increase in the overall market of Plutex. B. A decrease in Coplex’s selling price. C. An increase in anticipated sales of Simpol relative to the sales of Plutex and Coplex. D. An increase in Simpol raw materials cost. 34. A very high degree of operating leverage indicates a firm A. has high fixed costs B. has a high net income C. has high variable costs D. is operating close to its breakeven point 35. Love Corp. is operationally a highly leveraged company, that is, it has high fixed costs and low variable costs. As such, small changes in sales volume result in A. Proportionate change in net income. C. Negligible change in net income. B. Large changes in net income. D. No change in net income. MSQ-01 Page 4 PROBLEMS 1. Bradley Co. budgets its total production costs at $220,000 for 75,000 units of output and $275,000 for 100,000 units of output. Since additional facilities are needed to produce 100,000 units, fixed costs are budgeted at 20% more than for 75,000 units. What is Bradley's budgeted fixed cost at 100,000 units? A. 165,000 B. 156,000 C. 66,000 D. 16,500 2. Smart Company is relocating its facilities. The company estimates that it will take three trucks to move office contents. If the per truck rental charge is $1,000 plus 25 cents per mile, what is the expected cost to move 800 miles? A. $1,000 B. $1,200 C. $2,400 D. $3,600 3. The following cost functions were developed for manufacturing overhead costs: Manufacturing Overhead Cost Cost Function Electricity $100 + $20 per direct labor hour Maintenance $200 + $30 per direct labor hour Supervisors’ salaries $10,000 per month Indirect materials $16 per direct labor hour If July production is expected to be 1,000 units requiring 1,500 direct labor hours, estimated manufacturing overhead costs would be A. $109,300 B. $99,000 C. $76,300 D. $10,366 4. The Austin Manufacturing Company wants to develop a cost estimating equation for its monthly cost of electricity. It has the following data: Month Cost of Electricity Direct Labor Hours January $6,750 1,500 April 7,500 1,700 July 8,500 2,000 October 7,250 1,600 Using the high-low method, what is the best equation? A. Y = $750 + $5.00X D. Y = $2,000 + $3.50X B. Y = $750 + $3.50X E. Y = $1,500 + $5.00X C. Y = $1,500 + $3.50X 5. Matias Corporation wishes to market a new product for P12.00 a unit. Fixed costs to manufacture this product are P800,000 for less than 500,000 units and P1,200,000 for 500,000 or more units. Contribution margin is 20%. How many units must be sold to realize a net income from this product of P500,000? A. 433,333 B. 500,000 C. 666,667 D. 708,333 6. Total production costs of prior periods for a company are listed as follows. Assume that the same cost behavior patterns can be extended linearly over the range of 3,000 to 35,000 units and that the cost driver for each cost is the number of units produced. Production in units per month 3,000 9,000 16,000 35,000 Cost X $23,700 $52,680 $86,490 $178,260 Cost Y 47,280 141,840 252,160 551,600 What is the average cost per unit at a production level of 8,000 units for cost X? A. $5.98 B. $5.85 C. $7.90 D. $4.83 7. Ultra Vogue Co. sells 50,000 units of “yo” a top-of-the-line garden sprinkler. These were taken from the company’s records: Accounts receivable, P129,000. Contribution margin ratio, 49%. Days sales outstanding, 15 days. Profit for the period was P485,040. The ending receivables balance is the average balance during the year. Assume a 360-day year. All sales are on credit. Determine the company’s break-even revenue. A. P2,106,122 B. P1,032,000 C. P3,096,000 D. P1,517,040 MSQ-01 Page 5 8. Sago Co. uses regression analysis to develop a model for predicting overhead costs. Two different cost drivers (machine hours and direct materials weight) are under consideration as the independent variable. Relevant data were run on a computer using one of the standard regression programs, with the following results: Coefficient Machine hours Direct materials weight Y intercept 2,500 4,600 B 5.00 2.60 R2 0.70 0.50 What regression equation should be used? A. Y = 2,500 + 5.0X C. Y = 4,600 + 2.6X B. Y = 2,500 + 3.5X D. Y = 4,600 +1.3X 9. Y = P575,000 + P8.50X represents the behavior of maintenance costs (Y) as a function of machine hours (X). Thirty (30) monthly observations were used to develop the foregoing regression equation. The related coefficient of determination was 0.90. If 2,500 machine hours are worked in one month, the related point estimate of total variable maintenance costs would be A. P23,000 B. P21,250 C. P25,250 D. P19,125 10. Tonykinn Company is contemplating of marketing a new product. Fixed costs will be $800,000 for production of 75,000 units or less and $1,200,000 if production exceeds 75,000 units The variable cost ratio is 60% for the first 75,000. Contribution margin percentage will increase to 50% for units in excess of 75,000. If the product is expected to sell for $25 per unit, how many units must Tonykinn sell to breakeven? A. 120,000 B. 111,000 C. 96,000 D. 80,000 11. A company manufactures a single product. Estimated cost data regarding this product and other information for the product and the company are as follows: Sales price per unit $40 Total variable production cost per unit $22 Sales commission (on sales) 5% Fixed costs and expenses Manufacturing overhead $5,598,720 General and administrative $3,732,480 Effective income tax rate 40% The number of units the company must sell in the coming year in order to reach its breakeven point is A. 388,800 units B. 518,400 units C. 583,200 units D. 972,000 units 12. A company is concerned about its operating performance, as summarized below: Sales ($12.50 per unit) $300,000 Variable costs 180,000 Net operating loss (40,000) How many additional units should have been sold in order for the company to break even in 1992? A. 32,000 B. 16,000 C. 12,800 D. 8,000 13. Scottso Enterprises has fixed costs of $120,000. At a sales volume of $400,000, return on sales is 10%. At a $600,000 volume, return on sales is 20%. What is the break-even volume? A. $160,000 B. $210,000 C. $300,000 D. $420,000 14. A retail company determines its selling price by marking up variable costs 60%. In addition, the company uses frequent selling price markdowns to stimulate sales. If the markdowns average 10%, what is the company’s contribution margin ratio? A. 27.5% B. 30.6% C. 37.5% D. 41.7% MSQ-01 Page 6 15. A company with $280,000 of fixed costs has the following data: Product A Product B Sales price per unit $5 $6 Variable costs per unit $3 $5 Assume three units of A are sold for each unit of B sold. How much will sales be in dollars of product B at the breakeven point? A. $200,000 B. $240,000 C. $280,000 D. $840,000 16. Singsing, Inc. manufactures and sells key rings embossed with college names and slogans. Last year, the key rings sold for P75 each, and the variable costs to manufacture them were P22.50 per unit. The company needed to sell 20,000 key rings to break-even. The net income last year was P50,400. The company expects the following for the coming year: The selling price of the key rings will be P90. Variable manufacturing costs per unit will increase by one-third. Fixed costs will increase by 10%. The income tax rate will remain unchanged. For the company to break-even the coming year, the company should sell A. 21,600 units. B. 2,600 units. C. 21,250 units. D. 19,250 units. 17. Sari-Sari Grocery is currently open only on Monday to Saturday. It is considering opening on Sundays. The annual incremental costs of Sunday opening is estimated at P124,800. Its gross margin is 20%. It estimates that 60% of Sunday sales to customers would be on other days if its stores were not open on Sundays. The Sunday sales that would be necessary for Sari-sari to attain the same weekly operating income is A. P19,500. B. P30,000. C. P29,250. D. P20,000. 18. NCB, Inc. manufactures computer tables. It has an investment of P1,750,000 in assets and expects a 25% return on investment. Its total fixed production costs for 2,000 units is P550,000 plus an additional P150,000 for selling and administrative expenses. The variable cost to manufacture is P1,500 per table. The selling price per table should be A. P2,068.75 B. P1,850.00 C. P2, 531.25 D. P2,725.00 19. Nette & Co. has sales of P400,000 with variable costs of P300,000, fixed costs of P120,000, and an operating loss of P20,000. By how much would Nette need to increase its sales in order to achieve a target operating income of 10% of sales? A. P400,000 B. P462,000 C. P500,000 D. P800,000 20. During 1996, RPS Corporation supplied hospitals with a comprehensive diagnostic kit for P120. At a volume of 80,000 kits, RPS has fixed cost of P1,000,000 and a profit before income taxes of P200,000. Due to an adverse legal decision, RPS’s 1997 liability insurance increased by P1,200,000 over 1996. Assuming the volume and other costs are unchanged, what should be the 1997 price be if RPS is to make the same P200,000 profit before income taxes? A. P135. B. P150. C. P120. D. P240. 21. Merchandisers, Inc. sells Product O to retailers for P200. The unit variable cost is P40 with a selling commission of 10%. Fixed manufacturing costs total P1,000,000 per month while fixed selling and administrative costs total P420,000. The income tax rate is 30%. The target sales if after tax income is P123,200 would be A. 10,950 units. B. 15,640 units. C. 13,750 units. D. 11,400 units. 22. Story Manufacturing incurs annual fixed costs of $250,000 in producing and selling "Tales." Estimated unit sales for 2001 are 125,000. An after-tax income of $75,000 is desired by management. The company projects its income tax rate at 40 percent. What is the maximum amount that Story can expend for variable costs per unit and still meet its profit objective if the sales price per unit is estimated at $6? A. $3.37 B. $3.59 C. $3.00 D. $3.70 MSQ-01 Page 7 23. CGW Corporation sells Product T at a unit price of P5 deriving annual gross sales of P50,000. The variable cost to produce T is P4.50 per unit and total fixed costs is P10,000. If it increases T’s unit price to P8, a decrease of sales to only 4,000 units would result. The effect of the price increase on CGW’s net income from the sales of Product T will be a: A. P9,000 increase. B. P18,000 decrease. C. P4,000 increase. D. No effect. 24. Austin Manufacturing, which is subject to a 40% income tax rate, had the following operating data for the period just ended. Selling price per unit $ 60 Variable cost per unit 22 Fixed costs 504,000 Management plans to improve the quality of its sole product by: (1) replacing a component that costs $3.50 with a higher-grade unit that costs $5.50 and (2) acquiring a $180,000 packing machine. Austin will depreciate the machine over a 10-year life with no estimated salvage value by the straight-line method of depreciation. If the company wants to earn after-tax income of $172,800 in the upcoming period, it must sell A. 19,300 units. B. 21,316 units. C. 22,500 units. D. 23,800 units. 25. Planners have determined that sales will increase by 25% next year, and that the profit margin will remain at 15% of sales. Which of the following statements is correct? A. Profit will grow by 25%. B. The profit margin will grow by 15%. C. Profit will grow proportionately faster than sales. D. Ten percent of the increase in sales will become net income. 26. Lindsay Company reported the following results from sales of 5,000 units of Product A for June: Sales $200,000 Variable costs (120,000) Fixed costs (60,000) Operating income $ 20,000 Assume that Lindsay increases the selling price of Product A by 10 percent in July. How many units of Product A would have to be sold in July to generate an operating income of $20,000? A. 4,000 B. 4,300 C. 4,500 D. 5,000 27. A product has a selling price of P5 and variable cost of P3.50 per unit. The effect of a P0.50 per unit increase in cost is to increase the break-even level of activity by A. 50% B. 33-1/3% C. 14.3% D. P1.50 per unit. 28. LXQ Turo Turo stores are open for 15 hours a day (from 6:00 a.m. to 9:00 p.m.). It sells packaged meals at a price of P40 per meal. Variable cost per meal is P30 while total fixed costs for operation of all the stores amounted to 200,000 monthly. It is thinking to reduce its store hours to only 12 hours a day as this would reduce fixed costs (utilities and wages) by P60,000 a month. It is expected that the reduced store hours would result in loss of 1,500 packed meals monthly sales. The reduction in store hours would result in A. A prospective increase in monthly operating income of P45,000. B. A prospective decrease in monthly operating income. C. A prospective increase in monthly operating income of P60,000. D. No change in monthly operating income. 29. ABC Company breaks even at $300,000 sales and earns $30,000 at $350,000 sales. Which of the following is true? A. Fixed costs are $20,000. B. Profit at sales of $400,000 would be $80,000. C. The selling price per unit is $3. D. Contribution margin is 60% of sales. MSQ-01 Page 8 30. A company has sales of $500,000, variable costs of $300,000, and pretax profit of $150,000. If the company increased the sales price per unit by 10%, reduced fixed costs by 20%, and left variable cost per unit unchanged, what would be the new breakeven point in sales dollars? A. $88,000 B. $100,000 C. $110,000 D. $125,000 31. The Machan Manufacturing Company’s year-end income statement is as follows: Sales (20,000 units) $360,000 Variable costs 220,000 Contribution margin $140,000 Fixed costs 105,000 Net income $ 35,000 Management is unhappy with the results and plans to make some changes for next year. If management implements a new marketing program, fixed costs are expected to increase by $19,200 and variable costs to increase by $1 per unit. Unit sales are expected to increase by 15 percent. What is the effect on income? A. decrease of $21,200 E. no change B. increase of $1,800 E. increase of $14,800 C. increase of $13,800 32. Wheels Corp. employs 45 sales personnel to market its sedan cars. The average car sells for P690,000 and a 6% commission is paid to the sales person. It is considering changing the scheme to a commission arrangement that would pay each person a package of P30,000 plus a commission of 2% of the sales made by the person. The amount of total monthly car sales at which Wheels Corp. would be indifferent (answer may be rounded off) as to which plan to select is A. P45,000,000 B. P36,500,000 C. P33,750,000 D. P22,500,000 33. Two companies are expected to have annual sales of 1,000,000 decks of playing cards next year. Estimates for next year are presented below: Company 1 Company 2 Selling price per deck $ 3.00 $3.00 Cost of paper deck 0.62 0.65 Printing ink per deck 0.13 0.15 Labor per deck 0.75 1.25 Variable overhead per deck 0.30 0.35 Fixed costs $960,000 $252,000 Given these data, which of the following responses is correct? (In units) A. B. C. D. Breakeven point for Co. 1 800,000 800,000 533,334 533,334 Breakeven point for Co. 2 420,000 420,000 105,000 105,000 Volume at which profits of Co. 1 and Co. 2 are equal 1,180,000 1,000,000 1,000,000 1,180,000 Questions 34 and 35 are based on the following information. A company sells two products, X and Y. The sales mix consists of a composite unit of two units of X for every five units of Y (2:5). Fixed costs are $49,500. The unit contribution margins for X and Y are $2.50 and $1.20, respectively. 34. Considering the company as a whole, the number of composite units to break even is a. 1,650 b. 4,500 c. 8,250 d. 22,500 35. If the company had a profit of $22,000, the unit sales must have been A. B. C. Product X 5,000 13,000 23,800 Product Y 12,500 32,500 59,500 D. 32,500 13,000 MSQ-01 Page 9 36. Product Cott has sales of $200,000, a contribution margin of 20%, and a margin of safety of $80,000. What is Cott’s fixed cost? A. $16,000 B. $24,000 C. $80,000 D. $96,000 37. Bell Company has a 25% margin of safety. Its before-tax return on sales is 6%, and its tax rate is 40%. Assuming that current sales are $120,000, what is Bell’s total fixed costs. A. $36,000 C. $84,000 B. $21,600 D. $60,000 Questions 38 and 39 are based on the following information. The marketing department of Hennessy Co. proposed a price cut on its leading brand, a product called “Henry.” From the accounting records these are available: Price per unit P 92.00 Discount to customers 10% Direct cost per unit P 52.60 Variable operating expense per unit P 5.60 Proposed price cut per unit P 10.00 Estimated sales volume before price cut 1,220 pcs. 38. How much is the estimated contribution margin that will be lost due to price cut, assuming the same pre-price cut sales volume? A. P13,000 B. P10,980 C. P18,000 D. P17,990 39. For the same Hennessy Co., in the immediately preceding number, what is the additional volume required after the price cut to get the same contribution margin before the price cut? Round off to the nearest whole unit. A. 1,000 units B. 500 units C. 704 units D. 409 units Questions 40 through 42 are based on the following information. Almo Company manufactures and sells adjustable canopies that attach to motor homes and trailers. The market covers both new unit purchasers as well as replacement canopies. Almo developed its business plan based on the assumption that canopies would sell at a price of $400 each. The variable costs for each canopy were projected at $200, and the annual fixed costs were budgeted at $100,000. Almo's after-tax profit objective was $240,000; the company's effective tax rate is 40%. While Almo's sales usually rise during the second quarter, the May financial statements reported that sales were not meeting expectations. For the first 5 months of the year, only 350 units had been sold at the established price, with variable costs as planned, and it was clear that the aftertax profit projection would not be reached unless some actions were taken. Almo's president assigned a management committee to analyze the situation and develop an alternative course of action. The following was presented to the president. Reduce the sales price by $40. The sales organization forecasts that with the significantly reduced sales price, 2,700 units can be sold during the remainder of the year. Total fixed and variable unit costs will stay as budgeted. 40. Assuming no changes were made to the selling price or cost structure, how many units must Almo sell to break even? A. 167 B. 250 C. 500 D. 1,700 41. Assuming no changes were made to the selling price or cost structure, how many units must Almo sell to achieve its after-tax profit objective? A. 1,250 B. 1,700 C. 2,000 D. 2,500 42. If management decides to reduce the selling price by $40, what will Almo's after-tax profit be? A. $157,200 B. $160,800 C. $241,200 D. $301,200 MSQ-01 Page 10 ANSWER KEY Theory 1. D 2. D 3. D 4. A 5. A 6. A 7. A 8. D 9. D 10. B 11. A 12. C 13. B 14. A 15. D 16. B 17. C 18. D 19. D 20. A 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. A B D B C A D C D C A B C D B Problems 1. A 2. D 3. A 4. C 5. D 6. A 7. A 8. A 9. B 10. B 11. C 12. D 13. C 14. B 15. B 16. D 17. B 18. A 19. A 20. A 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. D C A C A A A A D A A C A B B B B B C C 41. D 42. C MSQ-01 Page 11