How Do You Make Money in the White Space

advertisement

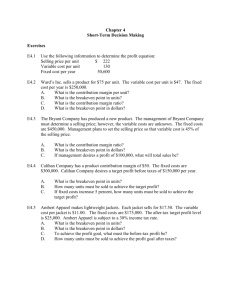

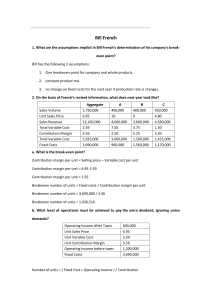

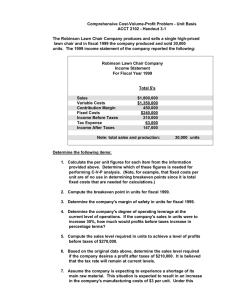

Exercise 6 Economics of the Business – How Do You Make Money in the White Space? Your mining of the value chain (Exercise 5) should present a view of the “white space” for your business. In this section, we ask you to begin to quantify the space and to estimate the time and resources it will take to fill that space. These preliminary assessments will provide the foundation for the development of your financial statements, including income statement, balance sheet, cash flow, and break-even point. Please provide: A realistic estimate of approximate sales and market share for your product or service in the market area which your venture can attain in each of your first five years: Product/Service Sales and Market Share 1 Total Market: Units Dollars Est Sales: Units Dollars Est. Market Share (percent): Est. Market Growth: Units Dollars Source of Data: Researcher: Confidence in Data: 2 Year 3 4 5 Checkpoint Consider whether you suffer from mousetrap myopia or whether you lack enough experience to tackle the venture at this stage. It is possible that if your venture does not stand up to this evaluation you may simply not be as far along as you had thought. Remember, the single largest factor contributing to stillborn ventures and to those who will ripen as lemons is lack of opportunity focus. If you were unable to fill in the chart on Product/Service Sales and Market Share on the previous page, or do not have much idea of how to answer them, it is possible that you need to do more work before proceeding with this venture. An assessment of the costs and profitability of your product or service: _______________________Product/Service Costs and Profitability_____________________ Product/Service: Sales Price: Sales Level: Dollars/Unit Production Costs (i.e., labor and material costs) or Purchase Costs Gross Margin Fixed Costs Profit Before Taxes Profit After Taxes Percent of Sales Price/Unit An assessment of the minimum resources required to “get the doors open and revenue coming in,” the costs, dates required, alternative means of gaining control of (but not necessarily owning) these, and what this information tells you: ________________________________Resource Needs________________________________ Minimum Needed Plant, Equipment, and Facilities (remember, you only have to control the asset, not own it) Product/Service Development (include raw materials and inventory) Market Research Setup of Sales and Distribution (e.g., brochures, demos, and mailers One time Expenditures (e.g., legal costs) Lease Deposits and Other Prepayments (e.g, utilities) Overhead (e.g., salaries, rent, and insurance Cost($) Date Required Probable Source Sales Costs (e.g., trips to trade shows Other Startup Costs Total COMMENTS A rough estimate of requirements for manufacturing and/or staff, operations, facilities, including: - An assessment of the major difficulties for such items as equipment, labor skills and training, and quality standards in the manufacture of your product(s) or the delivery of your service(s): - An estimate of the number of people who will be required to launch the business and the key tasks they will perform: - An assessment of how you will deal with these difficulties and your estimate of the time and money needed to resolve them and begin scalable production: An identification of the cash flow and cash conversion cycle for your business over the first 15 months (including a consideration of leads/lags in getting sales, producing your product or service, delivering your product or service, and billing and collecting cash). Show as a bar chart the timing and duration of each activity below: ______Cash Flow, Conversion Cycle, and Timing of Key Operational Activities_______ Developments of Forecasts Manufacturing Sales Orders Billing: Invoice Collect Selling Season _____________________________________________________________ 1 2 3 4 5 6 7 8 9 Months 10 11 12 13 14 15 A preliminary, estimated cash flow statement for the first year, including considerations of resources needed for startup and your cash conversion cycle: An estimation of (1) the total amount of asset and working capital needed in peak months and (2) the amount of money needed to reach positive cash flow, the amount of money needed to reach breakeven, and an indication of the months when each will occur: Create a breakeven chart similar to the following: Retrieved February 11, 2010 from http://www.bizbound.com/breakeven.htm To calculate the number of units required to breakeven: $ Selling Price – Variable Costs = $ Contribution Margin/Unit Fix Costs/ $ Contribution Margin = Units to Breakeven An estimate of the capital required for asset additions and operating needs (and the months in which these will occur) to attain the sales level projected in five years: