Cost Behavior and Cost-Volume-Profit Analysis

advertisement

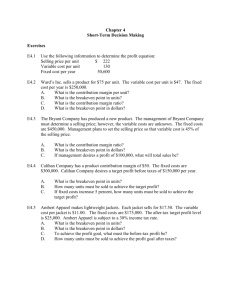

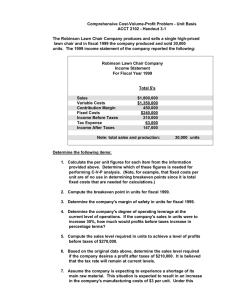

Cost Behavior and Cost-Volume-Profit Analysis Chapter 11 Cost Behavior Cost behavior is the manner in which a cost changes as some related activity changes An understanding of cost behavior is necessary to plan and control costs A relevant range is the range over which we are interested in the cost’s behavior Cost Behavior Variable cost Cost is constant on a per unit basis, but the total cost varies directly with changes in activity Materials, fuel, etc. Fixed cost Cost is constant in total, but varies inversely with changes in activity Salaries, property taxes, straight-line depreciation, etc. Cost Behavior Step cost Cost which is fixed over small ranges of activity, but varies across wider ranges Supervision costs, labor costs, etc. Mixed cost Cost has both a fixed and a variable component Utility costs in which you pay a fixed amount to have the service available to you, and a variable charge based on how much you use the utility; rental costs in which you pay a fixed amount per period plus a variable amount based on usage, etc. Cost Behavior Mixed costs must be separated into their fixed and variable components in order to predict changes in the cost High-low method Simple regression Multiple regression Cost Behavior High-low method Compares the points of highest and lowest activities, and their related costs, and calculates the formula for a straight line connecting the two points Dividing the incremental cost by the incremental units of activity gives the variable cost per unit of activity The variable cost per unit is substituted into the cost formula to determine the fixed cost Total cost = fixed cost + variable cost per unit * number of units of activity Cost Behavior High point $ Low point Difference $ Cost 18,000 12,000 6,000 Units of activity 10,000 6,000 4,000 $6,000 / 4,000 = $1.50 per unit At the low point: $12,000 = Fixed cost + $1.50 per unit * 6,000 units $3,000 = Fixed cost Total cost = $3,000 + $1.50 per unit * number of units Applications of Cost Behavior Concepts Contribution margin Excess of sales over variable costs Contribution is the incremental amount of each sale that is available to cover fixed costs and provide a profit Knowing the contribution margin allows us to predict changes in net income that will result from a change in sales volume Applications of Cost Behavior Concepts Sales Variable costs Contribution margin Fixed costs Net income Total Percentage Per unit* $ 1,000,000 100% $ 1,000 600,000 60% 600 $ 400,000 40% $ 400 300,000 $ 100,000 * - assume 1,000 units are sold Applications of Cost Behavior Concepts Contribution margin percentage Proportion of each sales dollar that is available to cover fixed costs and provide a profit If sales increase by $100,000, profit will increase by $40,000 ($100,000 * 40%) Contribution margin per unit Dollar amount that each unit contributes toward covering fixed costs and providing a profit If 50 more units are sold, profit will increase by $20,000 (50 units * $400) Applications of Cost Behavior Concepts Breakeven point Volume of sales needed to earn no profit or no loss Revenues = total costs Fixed cost + target profit Contribution margin per unit = number of units Fixed cost + target profit Contribution margin percentage = dollars of sales Applications of Cost Behavior Concepts The breakeven formulas allow us to play “what if” games What happens if Sales price is increased (or decreased) Variable costs are replaced by fixed costs Volume increases Additional amounts spent on advertising will increase sales volume Etc. Applications of Cost Behavior Concepts Margin of safety The excess of current sales volume over the breakeven point In units Current unit sales – breakeven unit sales In percentage (Current sales – breakeven sales) / current sales The sales figures may be in dollars or units Applications of Cost Behavior Concepts Operating leverage Measures the relative mix of fixed and variable costs Contribution margin / operating income Can determine the change in operating income that will result from a change in sales by multiplying the % change in sales by the operating leverage High operating leverage implies high risk, high reward Applications of Cost Behavior Concepts Breakeven calculations in a multi-product environment Assume the mix of products sold remains constant Determine the contribution margin for a “basket” of goods (the normal sales mix) Calculate the breakeven point as the number of “baskets” needed to break even Applications of Cost Behavior Concepts Product Laptops Printers Scanners Normal Contribution Total sales mix per unit contribution 6 $ 70 $ 420 2 30 60 1 20 20 $ 500 If fixed costs are $800,000, the breakeven point is $800,000 / 500 = 1,600 "baskets" 9,600 laptops 3,200 printers 1,600 scanners