3 points 2

advertisement

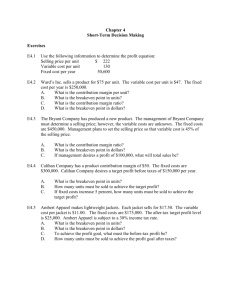

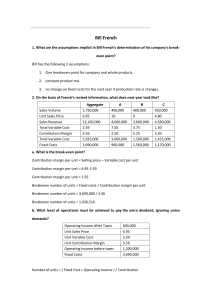

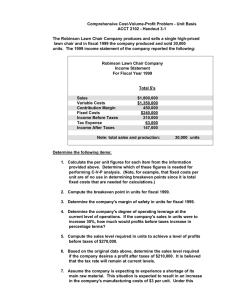

Choc. Creme Cruller Boston Creme Jelly Glazed 1 POINT 1 POINT 1 POINT 1 POINT 1 POINT 2 POINTS 2 POINTS 2 POINTS 2 POINTS 2 POINTS 3 POINTS 3 POINTS 3 POINTS 3 POINTS 3 POINTS 4 POINTS 4 POINTS 4 POINTS 4 POINTS 4 POINTS 5 POINTS 5 POINTS 5 POINTS 5 POINTS 5 POINTS 1 POINT This is what a fixed cost graph looks like. -------------------------- 2 POINTS This is what a mixed cost graph looks like. ---------- --------- 3 POINTS These are the three most common cost behavior classifications What is fixed, mixed and variable 4 POINTS This is what happens to a fixed cost per unit as production increases – show graph | \ \ -----------(best I can do….) 5 POINTS ________ costs vary in direct proportion to units produced. What is variable? 1 POINT Electricity usage in a factory would be what type of cost behavior? What is variable? 2 POINTS The production supervisor’s salary in a factory would be what type of cost behavior? What is fixed? 3 POINTS If Sales are $1,000,000, variable costs are $700,000, and fixed costs are $200,000, what is the contribution margin in dollars? What is $300,000? 4 POINTS If Sales are $1,000,000, variable costs are $700,000, and fixed costs are $200,000, what is the contribution margin ratio? What is 30%? 5 POINTS If Sales are $1,000,000, contribution margin ratio is 28%, what is the dollar amount of variable costs if fixed costs are $200,000? What is 720,000? 1 POINT Sales-Variable costs = What is contribution margin? 2 POINTS If fixed costs increase, breakeven will ______ increase 3 POINTS If variable costs decrease, breakeven will _____ decrease 4 POINTS If selling price decreases, breakeven will ______ Increase 5 POINTS Fixed costs are $45,000, sales price per unit is $10, variable cost per unit is $5. Breakeven is ______. What is 9,000 units? 1 POINT This type of costing is where cost of goods sold includes DM, DL and variable FOH. What is variable costing? 2 POINTS This type of costing is where cost of goods sold includes DM, DL and FOH. What is absorption costing? 3 POINTS A distribution of sales amongst various products is referred to as _____ mix. What is sales? 4 POINTS This is formula to calculate break even in sales with a target profit. (Fixed costs + Target profit)/Unit contribution margin 5 POINTS This method calculates fixed and variable cost using various production levels. What is the hi-lo method? 1 POINT 2 POINTS 3 POINTS 4 POINTS Render an opinion on the fairness of financial statements. 5 POINTS This is where management gives their opinion of the financial statements and can be completely biased. CATEGORY: Sales Mix MAKE YOUR WAGER! ANSWER: Sales mix for product A and B is 70%/30%. Fixed costs are $500,000. Product A has a sales price of $200 and variable cost of $150, product B has a sales price of $150 and a variable cost of $100. What is the breakeven point in units for A and B? QUESTION A= 7000 B = 3000