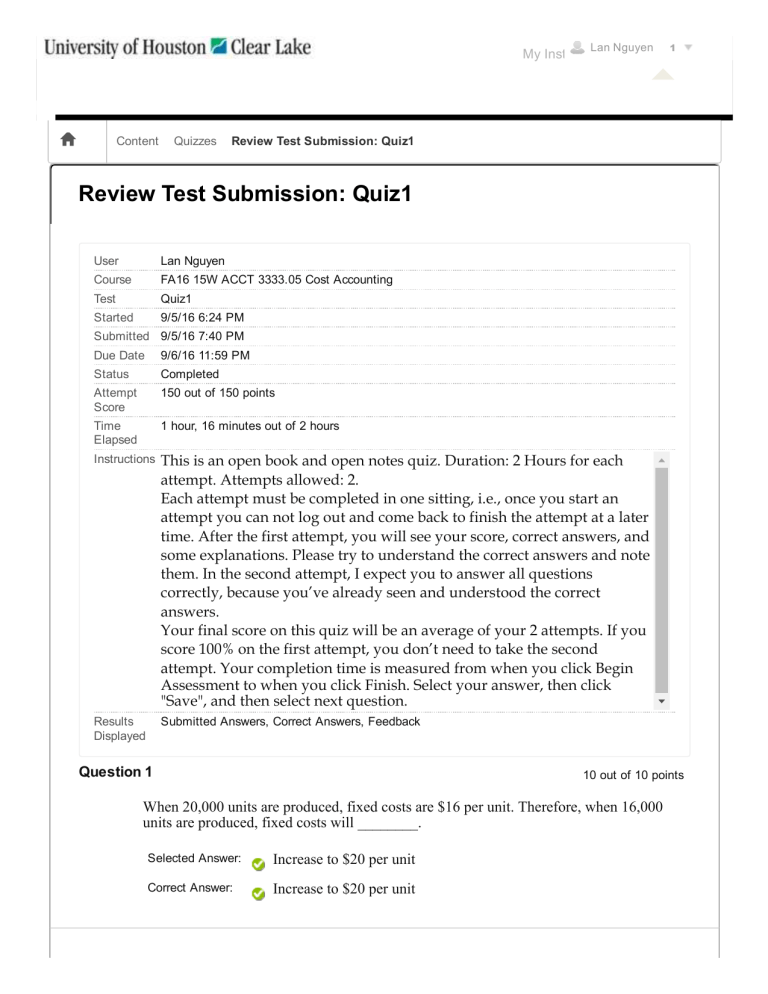

Lan Nguyen My Institution H Content Quizzes 1 Courses Review Test Submission: Quiz1 Review Test Submission: Quiz1 User Lan Nguyen Course FA16 15W ACCT 3333.05 Cost Accounting Test Quiz1 Started 9/5/16 6:24 PM Submitted 9/5/16 7:40 PM Due Date 9/6/16 11:59 PM Status Completed Attempt Score 150 out of 150 points Time Elapsed 1 hour, 16 minutes out of 2 hours Instructions This is an open book and open notes quiz. Duration: 2 Hours for each attempt. Attempts allowed: 2. Each attempt must be completed in one sitting, i.e., once you start an attempt you can not log out and come back to finish the attempt at a later time. After the first attempt, you will see your score, correct answers, and some explanations. Please try to understand the correct answers and note them. In the second attempt, I expect you to answer all questions correctly, because you’ve already seen and understood the correct answers. Your final score on this quiz will be an average of your 2 attempts. If you score 100% on the first attempt, you don’t need to take the second attempt. Your completion time is measured from when you click Begin Assessment to when you click Finish. Select your answer, then click "Save", and then select next question. Results Displayed Submitted Answers, Correct Answers, Feedback Question 1 10 out of 10 points When 20,000 units are produced, fixed costs are $16 per unit. Therefore, when 16,000 units are produced, fixed costs will ________. Selected Answer: Increase to $20 per unit Correct Answer: Increase to $20 per unit Question 2 10 out of 10 points A company reported revenues of $375,000, cost of goods sold of $118,000, selling expenses of $11,000, and total operating costs of $70,000. Gross margin for the year is ________. Selected Answer: $257,000 Correct Answer: $257,000 Question 3 10 out of 10 points Tally Corp. sells softwares during the recruiting seasons. During the current year, 11,000 softwares were sold resulting in $440,000 of sales revenue, $110,000 of variable costs, and $48,000 of fixed costs. If sales increase by $60,000, operating income will increase by ________. Selected Answer: $45,000 Correct Answer: $45,000 Response Feedback: Price = $440,000 / 11,000 = $40.00 Sales in softwares = $60,000 / $40.00 = 1,500 softwares Contribution Margin = $40 ­ $10 = $30 per software Operating income increase = 1,500 softwares × $30.00 per = $45,000 Question 4 10 out of 10 points The Marietta Company has fixed costs of $60,000 and variable costs are 75% of the selling price. To realize profits of $10,000 from sales of 50,000 units, the selling price per unit ________. Selected Answer: must be $5.60 Correct Answer: must be $5.60 Response Feedback: Question 5 Breakeven sales = ($60,000 + $10,000) / 0.25 = $280,000 Selling price = $280,000 / 50,000 units = $5.60 per unit 10 out of 10 points Tony Manufacturing produces a single product that sells for $80. Variable costs per unit equal $30. The company expects total fixed costs to be $78,000 for the next month at the projected sales level of 2,500 units. In an attempt to improve next month at the projected sales level of 2,500 units. In an attempt to improve performance, management is considering a number of alternative actions. Each situation is to be evaluated separately. Suppose that management believes that a 10% reduction in the selling price will result in a 10% increase in sales. If this proposed reduction in selling price is implemented ________. Selected Answer: operating income will decrease by $9,500 Correct Answer: operating income will decrease by $9,500 Reduction in revenues = $80 × 10% = $8 × 2,500 units = ($20,000) Increase in contribution = 2,500 units × 10% = 250 units × ($72 − $30) = 10,500 Change in operating income ($9,500) Response Feedback: Question 6 10 out of 10 points Star Jewelry sells 500 units resulting in $75,000 of sales revenue, $28,000 of variable costs, and $18,000 of fixed costs. The number of units that must be sold to achieve $40,000 of operating income is ________. Selected Answer: 617 units Correct Answer: 617 units Response Feedback: ($75,000 − $28,000) / 500 = $94 The number of units that must be sold to achieve $40,000 of operating income = ($18,000 + $40,000) / $94 = 617 units Question 7 10 out of 10 points Winnz sells 8,000 units resulting in $100,000 of sales revenue, $35,000 of variable costs, and $45,000 of fixed costs. To achieve $150,000 in operating income, sales must total ________. Selected Answer: $300,000 Correct Answer: $300,000 Response Feedback: Question 8 ($150,000 + $45,000) / 65% = $300,000 in sales 10 out of 10 points Globus Autos sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs. If variable costs decrease by $1 per unit, the new margin of safety is ________. Selected Answer: $68,235 $68,235 Correct Answer: Response Feedback: Variable cost per unit = $20,000 / 8,000 = $2.50 Contribution margin percentage = [$10 − ($2.50 − $1.00)] / $10 = 85% New breakeven point = [$10 − ($2.50 − $1.00)] / $10 = 85%; $10,000 / 0.85 = $11,765 Old breakeven point = $10 ­ 2.50 = $7.50 / $10 = 75%; $10,000 / 0.75 = $13,333 Margin of safety = $80,000 ­ $11,765 = $68,235 Question 9 10 out of 10 points Maize Plastics manufactures and sells 50 bottles per day. Fixed costs are $30,000 and the variable costs for manufacturing 50 bottles are $10,000. Each bottle is sold for $1,000. How would the daily profit be affected if the daily volume of sales drop by 10%? Selected Answer: Profits are reduced by $4,000 Correct Answer: Profits are reduced by $4,000 Question 10 10 out of 10 points How many units would have to be sold to yield a target operating income of $23,000, assuming variable costs are $25 per unit, total fixed costs are $2,000, and the unit selling price is $30? Selected Answer: 5,000 units Correct Answer: 5,000 units Response Feedback: Desired sales = ($2,000 + $23,000) / ($30 − $25) = 5,000 units Question 11 10 out of 10 points Star Jewelry sells 500 units resulting in $75,000 of sales revenue, $28,000 of variable costs, and $18,000 of fixed costs. Breakeven point in units is ________ (approximately). Selected Answer: 192 units Correct Answer: 192 units Response Feedback: Contribution margin per unit = ($75,000 − $28,000) / 500 = $94 Breakeven point = $18,000 / $94 = 191.49 units. Hence breakeven is approximately 192 units. Question 12 10 out of 10 points If a company has a degree of operating leverage of 3.0 and sales increase by 25%, then ________. Selected Answer: profit will increase by 75% Correct Answer: profit will increase by 75% Response Feedback: 3.0 × 25% = 75% increase Question 13 10 out of 10 points When 20,000 units are produced, variable costs are $8 per unit. Therefore, when 10,000 units are produced ________. Selected Answer: Variable costs will remain at $8 per unit Correct Answer: Variable costs will remain at $8 per unit Question 14 10 out of 10 points The following information pertains to the Emerald Corp: Beginning work­in­process inventory $75,000 Ending work­in­process inventory $85,000 Beginning finished goods inventory $175,000 Ending finished goods inventory $200,000 Cost of goods manufactured $1,200,000 What is cost of goods sold? Selected Answer: $1,175,000 Correct Answer: $1,175,000 Question 15 10 out of 10 points Tally Corp. sells softwares during the recruiting seasons. During the current year, 11,000 softwares were sold resulting in $440,000 of sales revenue, $110,000 of variable costs, and $48,000 of fixed costs. Contribution margin per software is ________. Selected Answer: $30.00 Correct Answer: $30.00 Response Feedback: ($440,000 − $110,000) / 11,000 = $30 per software Monday, September 19, 2016 10:16:14 PM CDT ← OK