The Federal Reserve and Fiscal versus. Monetary Policy

advertisement

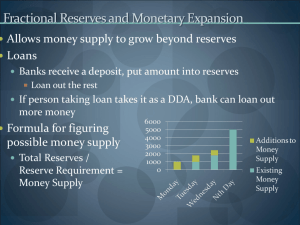

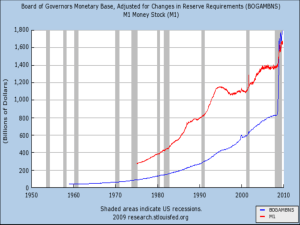

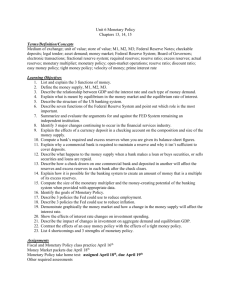

FOMC GDP Review http://research.stlouisfed.org/pageoneeconomics/uploads/newsletter/2013/PageOneCE0513. pdf Objectives Identify monetary policy tools available to the Federal Reserve System; describe the relationship between bank reserves, interest rates, and the economic goals of maximum employment and price stability; describe the key components of the Federal Reserve’s dual mandate; identify the ways in which monetary policy tools can be used to achieve economic objectives; and analyze policy strategies given economic conditions The Fed’s Toolbox The Fed’s Toolbox What tools does the Federal Reserve System have at its disposal? The Fed’s Toolbox Slide 1: Vocabulary Bank reserves – The sum of cash that banks hold in their vaults and the deposits they maintain with Federal Reserve Banks. Required reserves – Funds that a depository institution must hold in reserve against specified deposits as vault cash or deposits with Federal Reserve Banks. Excess reserves – The amount of funds held by a depository institution in its account at a Federal Reserve Bank in excess of its required reserve balance. Interest – The price of using someone else's money. Interest rate – The percentage of the amount of a loan that is charged for a loan. It is also the percentage paid on a savings account. What would happen if a bank wanted to make a loan but did not have enough excess reserves to do so? The Fed’s Toolbox Slide 2: Vocabulary Federal funds market – The market in which banks can borrow or lend reserves, allowing banks temporarily short of their required reserves to borrow from banks that have excess reserves. Federal funds rate – The interest rate at which a depository institution lends funds that are immediately available to another depository institution overnight. Federal Reserve System – The central bank system of the United States. Central bank – An institution that oversees and regulates the banking system and quantity of money in the economy. The Fed’s Toolbox Slide 3: Monetary Policy Tools Monetary policy – The actions of a central bank to influence the cost and availability of money and credit to achieve the national economic goals. • Discount rate – The interest rate charged by the Federal Reserve to banks for loans obtained through the Fed's discount window. • Open market operations – The buying and selling of government securities through primary dealers by the Federal Reserve in order to control the money supply. • Reserve requirements – Funds that banks must hold in cash, either in their vaults or on deposit at a Federal Reserve Bank. (last changed in 1992) • Interest on reserves – Interest paid by Federal Reserve Banks on required and excess reserves held by banks at Federal Reserve Banks. The Fed’s Toolbox Slide 6: Expansionary Policy Money Primary Federal Dealers Reserve Fed Buys Bonds Investors Banks Bank Reserves Increase Bonds Expansionary monetary policy – Actions taken by the Federal Reserve to increase the growth of the money supply and the amount of credit available. Interest Rates Decrease Borrowing Increases Questions What would happened to the level of reserves in the banking system if the Fed purchases government securities? What likely happens to interest rates when more excess reserves are available for loans in the banking system? How will consumers and businesses likely respond? How will producers respond? The Fed’s Toolbox Slide 7: Contractionary Policy Bonds Primary Federal Fed Sells Bonds Dealers Reserve Investors Banks Bank Reserves Decrease Money Contractionary monetary policy – Actions taken by the Federal Reserve to decrease the growth of the money supply and the amount of credit available. Interest Rates Increase Borrowing Decreases The Fed’s Toolbox Slide 8: Dual Mandate Dual mandate – The Federal Reserve’s responsibility to use monetary policy to promote maximum employment and price stability. • Price stability – A low and stable rate of inflation maintained over an extended period of time. The Fed has a longer-run goal of 2 percent inflation. • Maximum employment – The Fed does not have a specific unemployment target, but it does regularly publish its forecast for the longer-run rate of unemployment. Questions Inflation Given the Fed’s ability to influence the level of reserves in the banking system, how do you think the Fed can provide price stability? Employment How do you think the Fed can influence employment? Questions Does the Fed set the federal funds rate? How does the Fed influence the federal funds rate? Does the Fed set the discount rate, the rate banks pay to borrow reserves from the Fed? Is the discount rate usually higher or lower than the federal funds rate? Interest on Reserves Since 2008, the Federal Reserve has paid interest on reserve balances held at a Federal Reserve Bank. Both required and excess reserves can earn interest. Banks can choose to either hold reserves on deposit at a Federal Reserve Bank and earn interest or use their excess reserves to make loans to businesses and individuals and charge interest. The Federal Reserve can influence banks’ decisions to hold reserves at the Fed or lend to customers by increasing or decreasing the interest rate paid on excess reserves. Interest Questions What would likely happen to the incentive for banks to lend money if the Federal reserve were to increase the interest rate it pays on reserves? Headline: Unemployment Soars While Deflation Fears Grow What should the Fed do? Headline: Prices Rising: Inflation Worries Grow What should the Fed do? What is the name of the market in which banks can borrow or lend reserves, allowing banks temporarily short of their required reserves to borrow from banks that have excess reserves? a. The bank reserve market b. The federal funds market c. The excess reserves market d. The required reserves market Last week the Second Bank of Middleville borrowed reserves from the Federal Reserve’s discount window. For the use of this money, the Second Bank of Middleville will now be required to pay which of the following rates? a. The reserve rate b. The discount rate c. The federal funds rate d. The monetary rate Assume the Second Bank of Middleville has $100,000 in total deposits and has a required reserves ratio of 15 percent. How much does the Second Bank of Middleville have in excess reserves? a. $15,000 b. $85,000 c. $100,000 d. $150,000 If the Federal Reserve purchases a total of $50,000 in government securities through two different primary dealers, what will happen to the level of money/reserves in the banking system? a. Money/reserves will increase by $50,000. b. Money/reserves will increase by $100,000. c. Money/reserves will decrease by $50,000. d. Money/reserves will decrease by $100,000. Keynes versus Hayek Keynes vs. Hayek Round two http://research.stlouisfed.org/pageoneeconomics/uploads/newsletter/2011/201103_Classroo mEdition.pdf