Monetary Policy: Tools

advertisement

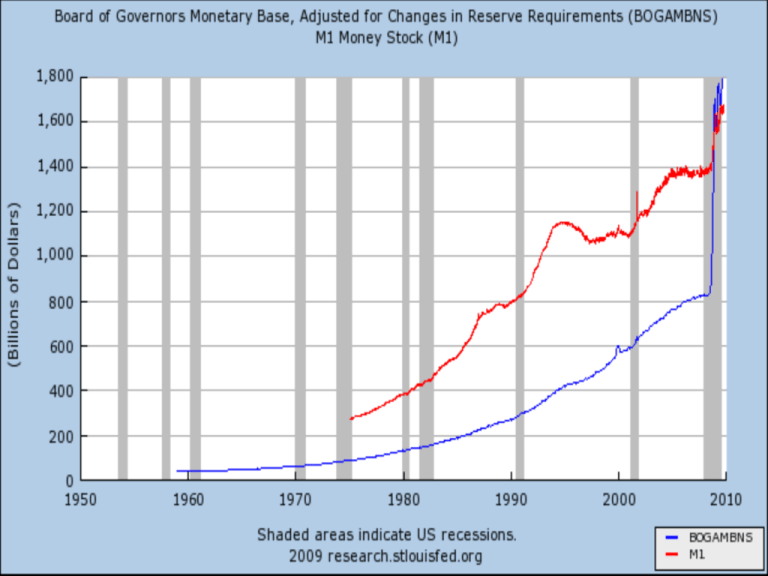

Tools of Monetary Policy • Open market operations • Discount rate borrowed reserves – LENDER OF LAST RESORT • Reserve requirements – Affect the money multiplier…don’t touch/don’t matter • Federal funds rate—the interest rate on overnight loans of reserves from one bank to another – Primary indicator of the stance of monetary policy Determined by Supply and Demand reserves • As federal funds rate decreases, …the opportunity cost of holding excess reserves falls … the quantity of reserves demanded rises Downward sloping demand curve Supply of reserves by Fed: Nonborrowed + borrowed reserves Cost of borrowing from the Fed is the discount rate •If iff < id, banks won’t borrow from the Fed; • Borrowed reserves are zero Supply curve is vertical •As iff rises above id, banks will borrow more and more at id • The supply curve is horizontal (perfectly elastic) at id Demand for reserves by banks: •Banks will hold any amount of excess reserves at ier BuyEaseSellTighten • Open market purchase federal funds rate falls • Open market sale federal funds rate rises • Impact of discount rate on federal funds rate • Impact of reserve requirement on federal funds rate Response to an Open Market Purchase Response to a Reduction in the Discount Rate Response to a Change in Required Reserves Open Market Operations • Dynamic open market operations • Defensive open market operations – Repurchase agreements – Matched sale-purchase agreements • TRAPS (Trading Room Automated Processing System) • Primary dealers Advantages of Open Market Operations •The Fed has complete control •Flexible and precise •Easily reversed •Quickly implemented Discount Policy Primary credit—standing lending facility • Secondary credit • Seasonal credit • Lender of last resort to prevent financial panics … moral hazard problem Cannot be controlled by the Fed; the decision maker is the bank Discount facility keeps the federal funds rate from rising too far above the target Reserve Requirements • No longer binding for most banks • Can cause liquidity problems • Increases uncertainty • Recommendations to eliminate How the Federal Reserve’s Operating Procedures Limit Fluctuations in the Federal Funds Rate