Money and Banking

advertisement

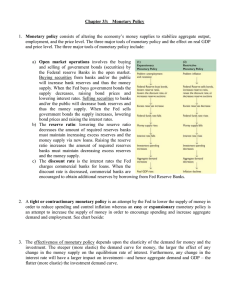

Fractional Reserves and Monetary Expansion Allows money supply to grow beyond reserves Loans Banks receive a deposit, put amount into reserves Loan out the rest If person taking loan takes it as a DDA, bank can loan out more money Formula for figuring possible money supply Total Reserves / Reserve Requirement = Money Supply Changes in Money Supply If people withdraw money, money supply is changed New formula is used ▲Reserves = Reserve Requirement x ▲Money Supply Tools of Monetary Policy Tools impact amount of reserves in the system Impacts monetary expansion process Easy Money Policy Fed allows money supply to grow Interest rates fall Helps stimulate economy Tight Money Policy Restricts growth Increases interest rates Slows economic growth Tools of Monetary Policy Reserve Requirement Fed can change this rate Lower reserve requirement, more money can be loaned Open Market Operations Buying and selling of government securities in financial markets Operations conducted by Federal Open Market Committee Set targets, tell trading desk to take over Tools of Monetary Policy Discount Rate Give loans to other institution at a lower rate 2 reasons a bank would request a loan Keep reserves steady Seasonal demands Discount window – teller’s window banks use to request funds Deposit collateral Loan is shown as increase in MBR Both member and non-member banks can borrow from the Fed Other Tools of Monetary Policy Moral Suasion Use of persuasion to impact people’s opinion of economy Selective Credit Controls Rules pertaining to loans for specific commodities or purposes Seldom used today