Time has value - Oman College of Management & Technology

advertisement

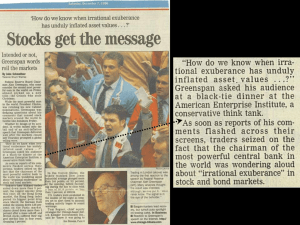

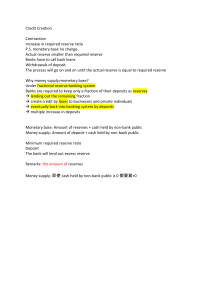

Ch. 01: Money and Banking Money Money, also referred to as the money supply, is defined as anything that is generally accepted in payment for goods or services or in the repayment of debts. Money is linked to changes in economic variables that affect all of us and are important to the health of the economy. Money Vs. Barter • Making exchanges takes longer in a barter system: not only do you have to find something you want, but you have to have something the seller wants as well. This is called a double coincidence of wants. • Some goods are more readily accepted than other goods. Historically, goods that have evolved into money are: gold, silver, copper, cattle, rocks, and shells. What Gives Money its Value? • Our money has value because of its general acceptability. • We accept paper dollars because we know that other people will accept dollars later when we try to spend them. • Money has value to people because it is widely accepted in exchange for other goods that are valuable. Defining the Money Supply • M1 is sometimes referred to as the narrow definition of the money supply or as transactions money. • M1 consists of currency held outside banks, checkable deposits, and traveler’s checks. Defining the Money Supply: M2 • M2 is sometimes referred to as the broad definition of the money supply. • M2 is made up of M1 plus small-denomination time deposits, savings deposits, money market accounts, overnight repurchase agreements, and overnight eurodollar deposits held by US residents. How Banking Developed • Early bankers used goldsmith’s warehouse receipts. • Early bankers began to issue receipts for more gold than they had on hand. • This was the beginning of fractional reserve banking. The Federal Reserve System • The central bank of the United States. The Fed, as it is commonly called, regulates the U.S. monetary and financial system. The Federal Reserve System is composed of a central governmental agency in Washington, D.C. The federal Reserve System has following duties 1.Conducting monetary policy. 2. Regulating banking institutions and protecting the credit rights of consumers 3.Maintaining the stability of the financial system 4. Providing financial services to the U.S. government The Money Creation Process • The sum of bank deposits at the Fed and the bank’s cash vault is total bank reserves. • The Fed mandates member commercial banks to hold a certain fraction of their checkable deposits in reserve form. This fraction is called the required reserve ratio. • The difference between a bank’s total reserves and its required reserves is its excess reserves. Functions of Money • Medium of Exchange: – Eliminates the trouble of finding a double coincidence of needs (reduces transaction costs) – Promotes specialization • A medium of exchange must – – – – – be easily standardized be widely accepted be divisible be easy to carry not deteriorate quickly Functions of Money (cont’d) • Unit of Account: – used to measure value in the economy – reduces transaction costs • Store of Value: – used to save purchasing power over time. – other assets also serve this function – Money is the most liquid of all assets but loses value during inflation Evolution of the Payments System Commodity Money: valuable, easily standardized and divisible commodities (e.g. precious metals, cigarettes). Fiat Money: paper money decreed by governments as legal tender. Checks: an instruction to your bank to transfer money from your account Electronic Payment (e.g. online bill pay). E-Money (electronic money): – Debit card – Stored-value card (smart card) – E-cash Why Study Money • Monetary policy is the control of the money supply. It is conducted by the Central bank. CB uses interest rates and other instruments to control the money supply. The Purpose of Mon. Pol. Is to control inflation which is the rate of change of the price level. Why Study Money (cont’d) • Fiscal policy is the management of the govt. budget: government spending and taxation. – Budget deficit is the excess of expenditures over revenues for a particular year – Budget surplus is the excess of revenues over expenditures for a particular year – Any deficit must be financed by borrowing. 5 Core Principles of Money & Banking Time has value Risk requires compensation Information is the basis for decisions Markets set prices and allocate resources Stability improves welfare 1. Time has value • If you work you will get paid by time. You pay interest on loans based on the time of the loan. • As a result of interest, time affects the value of financial transactions, e.g., bonds . • 2. Risk requires compensation The world is filled with uncertainty; some possibilities are welcome (doubling the value of your house) and some are not (you lose your job). 3. Information is the basis for decisions. • Most of us collect information before making decisions, and the more important the decision the more information we collect. Banks spend time to collect information about the borrowers to give loans to high quality borrowers only. • The collecting and processing of information is the foundation of the financial system. 4. Markets set prices and allocate resources. • Markets are the core of the economic system; they are the place, physical or virtual, where firms go to issue stocks and bonds, and where individuals go to purchase assets. • Financial markets are essential to the economy, channeling its resources and minimizing the cost of gathering information and making transactions. Well-developed financial markets are a necessary precondition for healthy economic growth 5. Stability improves welfare. • Reducing volatility reduces risk. Only government policymakers can reduce some risks. By stabilizing the economy as a whole monetary policymakers eliminate risks that individuals can’t and so improve everyone’s welfare in the process. • Stabilizing the economy is the primary function of central banks. A stable economy grows faster than an unstable one