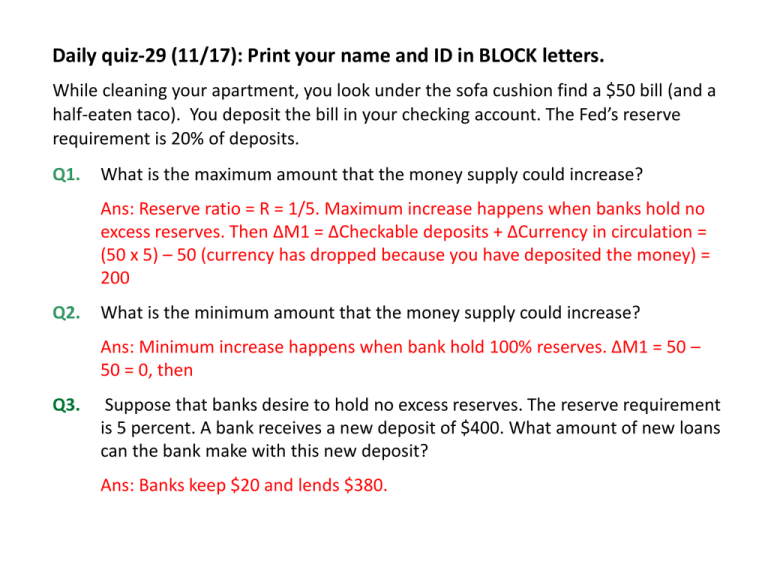

Daily quiz-29 (11/17): Print your name and ID in BLOCK letters.

advertisement

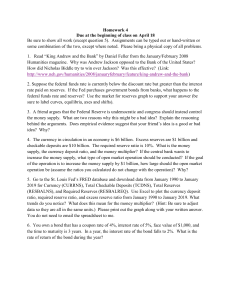

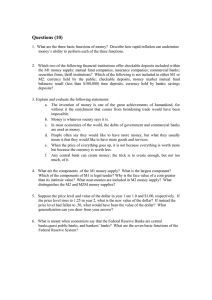

Daily quiz-29 (11/17): Print your name and ID in BLOCK letters. While cleaning your apartment, you look under the sofa cushion find a $50 bill (and a half-eaten taco). You deposit the bill in your checking account. The Fed’s reserve requirement is 20% of deposits. Q1. What is the maximum amount that the money supply could increase? Ans: Reserve ratio = R = 1/5. Maximum increase happens when banks hold no excess reserves. Then ∆M1 = ∆Checkable deposits + ∆Currency in circulation = (50 x 5) – 50 (currency has dropped because you have deposited the money) = 200 Q2. What is the minimum amount that the money supply could increase? Ans: Minimum increase happens when bank hold 100% reserves. ∆M1 = 50 – 50 = 0, then Q3. Suppose that banks desire to hold no excess reserves. The reserve requirement is 5 percent. A bank receives a new deposit of $400. What amount of new loans can the bank make with this new deposit? Ans: Banks keep $20 and lends $380.