Unit 8 Monetary Policy

advertisement

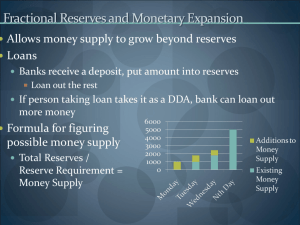

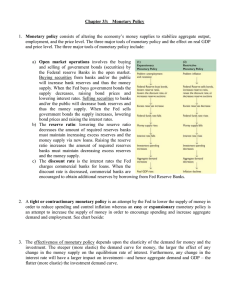

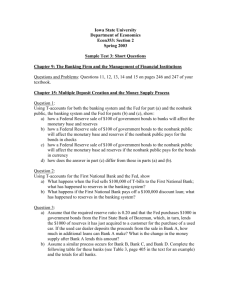

Unit 6 Monetary Policy Chapters 13, 14, 15 Terms/Definition/Concepts Medium of exchange; unit of value; store of value; M1, M2, M3; Federal Reserve Notes; checkable deposits; legal tender; asset demand; money market; Federal Reserve System; Board of Governors; electronic transactions; fractional reserve system; required reserves; reserve ratio; excess reserves; actual reserves; monetary multiplier; monetary policy; open-market operations; reserve ratio; discount ratio; easy money policy; tight money policy; velocity of money; prime interest rate Learning Objectives 1. List and explain the 3 functions of money. 2. Define the money supply, M1, M2, M3. 3. Describe the relationship between GDP and the interest rate and each type of money demand. 4. Explain what is meant by equilibrium in the money market and the equilibrium rate of interest. 5. Describe the structure of the US banking system. 6. Describe seven functions of the Federal Reserve System and point out which role is the most important. 7. Summarize and evaluate the arguments for and against the FED System remaining an independent institution. 8. Identify 3 major changes continuing to occur in the financial services industry. 9. Explain the effects of a currency deposit in a checking account on the composition and size of the money supply. 10. Compute a bank’s required and excess reserves when you are given its balance-sheet figures. 11. Explain why a commercial bank is required to maintain a reserve and why it isn’t sufficient to cover deposits. 12. Describe what happens to the money supply when a bank makes a loan or buys securities, or sells securities and loans are repaid. 13. Describe how a check drawn on one commercial bank and deposited in another will affect the reserves and excess reserves in each bank after the check clears. 14. Explain how it is possible for the banking system to create an amount of money that is a multiple of its excess reserves. 15. Compute the size of the monetary multiplier and the money-creating potential of the banking system when provided with appropriate data. 16. Identify the goals of Monetary Policy. 17. Describe 3 policies the Fed could use to reduce employment. 18. Describe 3 policies the Fed could use to reduce inflation. 19. Demonstrate graphically the money market and how a change in the money supply will affect the interest rate. 20. Show the effects of interest rate changes on investment spending. 21. Describe the impact of changes in investment on aggregate demand and equilibrium GDP. 22. Contrast the effects of an easy money policy with the effects of a tight money policy. 23. List 4 shortcomings and 3 strengths of monetary policy. Assignments Fiscal and Monetary Policy class practice April 16th Money Market packets due April 18th Monetary Policy take home test: assigned April 18th, due April 19th Other required assessments