Cost Allocation: Joint Products and By

advertisement

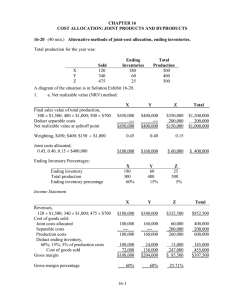

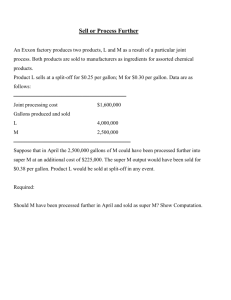

Cost Allocation: Joint Products and By-products Key terms: – Joint products – two or more outputs produced simultaneously by a single manufacturing process using common input – Split-off point – the stage of processing where joint products are separated. – Joint cost – costs of processing two or more products prior to the split-off point; common cost – Byproducts– products that result incidentally from the joint products - Separable cost – cost after the split-off point Joint Product Cost Allocation Consider the following example of an oil refinery. We will assume only two products, gasoline and oil. Joint Product Cost Allocation Joint Product Costs Joint Input Oil Joint Production Process Final Sale Separate Processing Costs Gasoline Split-Off Point Separate Processing Separate Processing Separate Processing Costs Final Sale Joint Products and Byproducts Main Products Joint Products Byproducts High Low Sales Value By-Products Joint Costs Joint Input Joint Production Process Major Product Major Product By-products Split-Off Point Relatively low value or quantity when compared to major products Explain why joint costs should be allocated to individual products. Why Allocate Joint Costs? • to compute inventory cost and cost of goods sold • to determine cost reimbursement under contracts • for insurance settlement computations • for rate regulation • for litigation purposes Approaches to Allocating Joint Costs Two basic ways to allocate joint costs to products are: Approach 1: Physical measure Approach 2: Market-based Allocating Joint Costs Approach 1 a. Physical-Units Method Approach 2 Joint Product Costs a. Relative- SalesValue Method b. Net-RealizableValue Method c. Gross margin Percent method Physical-Units Method Relative-SalesValue Method Net-RealizableValue Method Gross margin Percent Method Allocation based on a physical measure of the joint products at the split-off point. Allocation based on the relative values of the products at the split-off point. Allocation based on final sales values less separable processing costs. Allocation based on a constant gross margin for all products. Physical-Units Method Joint conversion cost = $225,000 Joint material cost = $275,000 Oil 240,000 gallons Gasoline 360,000 gallons Joint Production Process Split-Off Point Physical Measure Method Example $200,000 joint cost 20,000 pounds A 48,000 pounds B 12,000 pounds C Product A $50,000 Product B $120,000 Product C $30,000 Market-based Data Sales value at splitoff method Estimated net realizable value (NRV) method Constant gross-margin percentage NRV method Allocating Joint Costs Example 1,000 units of A at a selling price of P100 = P100,000 1,500 units of B at a selling price of P300 = P450,000 2,000 units of C at a selling price of P200 = P400,00 Joint processing cost is P200,000 Splitoff point Allocating Joint Costs Example Sales Value Allocation of Joint Cost 100 ÷ 950 450 ÷ 950 400 ÷ 950 A P100,000 B P450,000 C P400,000 Total P950,000 21,053 Gross margin P 78,947 94,737 84,210 P355,263 P315,790 200,000 P750,000 Sales Value at Splitoff Method Example Assume all of the units produced of B and C were sold. 250 units of A (25%) remain in inventory. What is the gross margin percentage of each product? Sales Value at Splitoff Method Example Product A Revenues: 750 units × P100 Cost of goods sold: Joint product costs P21,053 Less ending inventory P21,053 × 25% 5,263 Gross margin P75,000 15,790 P59,210 Sales Value at Splitoff Method Example Product A: (P75,000 – P 15,790) ÷ 75,000 = 79% Product B: (P450,000 – P94,737) ÷ P450,000 = 79% Product C: (P400,000 – $84,210) ÷ P400,000 = 79% Estimated Net Realizable Value (NRV) Method Example Assume that MBA-TEP Company can process products A, B, and, C further into A1, B1, and C1. The new sales values after further processing are: A1: 1,000 × P120 = P120,000 B1: 1,500 × P330 = P495,000 C1: 2,000 × $210 = P420,000 Estimated Net Realizable Value (NRV) Method Example Additional processing (separable) costs are as follows: A1: P35,000 B1: P50,000 C1: P55,000 What is the estimated net realizable value of each product at the splitoff point? Estimated Net Realizable Value (NRV) Method Example Product A1: P120,000 – P35,000 = P85,000 Product B1: P495,000 – P50,000 = P445,000 Product C1: P420,000 – P55,000 = P365,000 How much of the joint cost is allocated to each product? Estimated Net Realizable Value (NRV) Method Example To A1: 85,000 ÷ 895,000 × P200,000 = P18,994 To B1: 445,000 ÷ 895,000 × P200,000 = P99,441 To C1: 365,000 ÷ 895,000 × P200,000 = P81,564 Estimated Net Realizable Value (NRV) Method Example A1 B1 C1 Total Allocated joint costs P 18,994 99,442 81,564 P200,000 Separable costs P 35,000 50,000 55,000 P140,000 Inventory costs P 53,994 149,442 136,564 P340,000 Constant Gross-Margin Percentage NRV Method This method entails three steps: Step 1: Compute the overall gross-margin percentage. Step 2: Use the overall gross-margin percentage and deduct the gross margin from the final sales values to obtain the total costs that each product should bear. Constant Gross-Margin Percentage NRV Method Step 3: Deduct the expected separable costs from the total costs to obtain the joint-cost allocation. Constant Gross-Margin Percentage NRV Method What is the expected final sales value of total production during the accounting period? Product A1: P 120,000 Product B1: 495,000 Product C1: 420,000 Total P1,035,000 Constant Gross-Margin Percentage NRV Method Step 1: Compute the overall gross-margin percentage. Expected final sales value P1,035,000 Deduct joint and separable costs 340,000 Gross margin P695,000 Gross margin percentage: P695,000 ÷ P1,035,000 = 67.15% Constant Gross-Margin Percentage NRV Method Step 2: Deduct the gross margin. Sales Gross Cost of Value Margin Goods sold Product A1: P120,000 P 80,580 P 39,421 Product B1: 495,000 332,392 162,608 Product C1: 420,000 282,030 137,971 Total P 1,035,000 P695,000 P340,000 Constant Gross-Margin Percentage NRV Method Step 3: Deduct separable costs. Cost of Separable Joint costs goods sold costs allocated Product A1: P 39,421 P 35,000 P 4,421 Product B1: 162,608 50,000 112,608 Product C1: 137,971 55,000 82,971 Total P340,000 P140,000 P200,000 Explain why the sales value at splitoff method is preferred when allocating joint costs. Choosing a Method Why is the sales value at splitoff method widely used? It measures the value of the joint product immediately. It does not anticipate subsequent management decisions. It uses a meaningful basis. It is simple. Choosing a Method The purpose of the joint-cost allocation is important in choosing the allocation method. The physical-measure method is a more appropriate method to use in rate regulation. Avoiding Joint Cost Allocation Some companies refrain from allocating joint costs and instead carry their inventories at estimated net realizable value. Explain why joint costs are irrelevant in a sell-or-process-further decision. Irrelevance of Joint Costs for Decision Making Assume that products A, B, and C can be sold at the splitoff point or processed further into A1, B1, and C1. Selling Selling Additional Units price price costs 1,000 A: P100 A1: P120 P35,000 1,500 B: P300 B1: P330 P50,000 2,000 C: P200 C1: P210 P55,000 Irrelevance of Joint Costs for Decision Making Should A, B, or C be sold at the splitoff point or processed further? Product A: Incremental revenue P20,000 – Incremental cost P35,000 = (P15,000) Product B: Incremental revenue P45,000 – Incremental cost P50,000 = (P5,000) Product C: Incremental revenue $20,000 – Incremental cost P55,000= (P35,000) Accounting for Byproducts Method A: The production method recognizes byproducts at the time their production is completed. Method B: The sale method delays recognition of byproducts until the time of their sale. End of Report Thank you