Joint Cost Accounting: Definitions & Allocation Methods

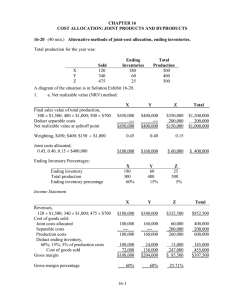

advertisement

Joint Cost – result of an event that results in more than one product or service simultaneously. • • • • • • • • • • • Joint costs are incurred prior to the splitoff. The focus is accumulating costs incurred on the joint products. Joint costs are the costs of a production process that yields multiple products simultaneously. Joint costs are allocated for reporting to tax authorities. Litigation may be a reason that joint costs are allocated to individual products. Joint costs are allocated to main products, but not to by-products. Allocating joint costs based upon a physical measure ignores the revenuegenerating ability of individual products. Physical Measure and Monetary Allocation Joint costs are allocated to joint products to obtain a cost per unit for financial statement purposes. Joint cost allocation is useful for product costing. Joint costs are useful for determining inventory cost for accounting purposes. Separable Cost – all costs incurred beyond the splitoff point that are assignable to one or more individual products. • • Separable costs are incurred beyond the splitoff point that are assignable to each of the specific products identified at the splitoff point. Separable costs include manufacturing, marketing, distribution, and other costs. Joint Costing – costs are assigned to individual products as disassembly of the product occurs and a single production process yields two or more products. • Focus on allocating costs to individual products at the splitoff point. Splitoff Point – is the juncture in a joint production process when two or more products became separately identifiable. • At or beyond the splitoff point, decisions relating to the sale or further processing of each identifiable product can be made independently of decisions about the other products. Main Products and Byproducts – when a single manufacturing process yields two products, one of which has a relatively high sales value compared to the other. • • • • • Differentiated by the amount of total sales value. Byproduct increases in sales values due to a new application. Main product becomes technologically obsolete. Byproduct loses its market due to a new invention. Product classifications may change over time. Joint Products – when a joint production process yields two or more products with high total sales values. • • The juncture in a joint production process when two products become separable is the splitoff point. If the value of a joint product drops significantly, it could also be viewed as a byproduct. Physical Measures – allocate using tangible attributes of the products, such as pounds, gallons, barrels, etc. • Allocates joint costs to joint products on the basis of the relative weight, volume, or other physical measure at the splitoff point of total production of the products. Market-Based Measures – allocate using market-derived data (dollars) Methods of allocating costs using market-based data: ▪ ▪ ▪ Sales value at splitoff method Estimated net realizable value method The constant gross-margin percentage method Sales Value at Splitoff Method - Uses the sales value of the entire production of the accounting period to calculate allocation percentage, ignores inventories. Net Realizable Value Method - Allocates joint costs to joint products on the basis of relative NRV of total production of the joint products. • NRV = Final Sales Value – Separable Costs Constant Gross Margin NRV Method Allocates joint costs to joint products in a way that the overall gross-margin percentage is identical for the individual products. • Joint Costs are calculated as a residual amount Method Selection: • If selling price at splitoff is available, o • If selling price at splitoff is not available, o • use the NRV Method Physical-Measures Method or the Constant Gross-Margin Method could be used Joint Costs are sunk Separable Costs need to be evaluated for relevance individually Byproducts – products with a relatively low sales value. • Main product - When one product has a high total sales value compared with the total sales value of other products of the process. Ex. timber processed into lumber Joint product - When a joint production process yields two or more products with high total sales value compared with the total sales value of other products. Ex. crude oil processed into gasoline and kerosene Byproduct - Products of a joint production process that have low total sales value compared with the total sales value of the main product or joint products. Ex. woodchips created when timber processed into lumber Two methods for accounting for byproducts • The products of a joint production process that have low total sales values compared with the total sales value of the main product are called byproducts. Production Method – • recognizes byproduct inventory as it is created, and sales and costs at the time of sale Sales Method – Despite this, some firms choose not to allocate joint costs at all! In Sell-or-Process Further decisions, joint costs are irrelevant. Joint products have been produced, and a prospective decision must be made: to sell immediately or process further and sell later • • Not all products yielded from joint product processing have some positive value to the firm. If simplicity is the primary consideration, o • use the Sales Value at Splitoff Method Outputs with a negative sales value are added to a joint production cost and allocated to joint or main products. recognizes no byproduct inventory, and recognizes only sales at the time of sales: byproduct costs are not tracked separately Reason to allocate joint cost: • • • rate regulation requirements, if applicable cost of goods sold computations insurance settlement cost information requirements Cost of goods sold and ending inventory valuation is necessary for reports to shareholders and for the inland revenue service. For internal costing and cost of goods sold computations for internal reporting purposes. Example: These computations are necessary for division profitability analysis. Reimbursement under contracts. Example: A firm produces multiple products or services-and uses the same resources and facilities to produce the products or services. But not all the firm's products are under the contract. The firm must allocate the cost of these shared facilities or resources to reflect the portion used by the product under the contract. Insurance settlement computations. Example: Where a business with multiple products or services claim losses under an insurance policy and wants to calculate the loss. The insurance company and the insured must agree on the value of the loss. Rate regulation. When companies are subject to rate regulation, the allocation of joint costs can be a significant factor in determining the regulated rates. Example: Crude oil and natural gas are produced out of a common well. The net realizable value approach is used to account for scrap and by-products when the net realizable value is significant. Monetary allocation measures recognize the revenue generating ability of each product in a joint process. Joint Process - a single process in which one product cannot be manufactured without producing others. • • • Joint Products Byproducts Scrap Two incidental products of a joint process are byproduct and scrap. If a company obtains two salable products from the refining of one ore, the refining process should be accounted for as a joint process. 3 monetary measures used to allocate Joint Cost to Products are: • sales value at split-off • net realizable value at split-off • approximated net realizable value at split-off Under the realized value approach, no value is recognized for by-products or scrap until they are actually sold. Categories of Joint Process Outputs: 1. Outputs with a positive sales value. 2. Outputs with a zero sales value. Not-for-profit entities are required to allocate joint costs among fund-raising, program, and administrative functions. Product – any output with a positive sales value, or an output that enables a firm to avoid incurring costs. • Value can be high or low. Net realizable value is considered to be the best measure of the expected contribution of each product to the coverage of joint costs. The net realizable value approach requires that the net realizable value of by-products and scrap be treated as a reduction in joint costs allocated to primary products. If incremental revenues beyond split-off exceed incremental costs, a product should be processed further. If incremental revenues beyond split-off are less than incremental costs, a product should be sold at the split-off point. Net realizable value equals product sales revenue at split-off minus any costs necessary to prepare and dispose of the product. Reasons to for Allocating Joint Costs: • Required for GAAP and taxation purposes. • Cost values may be used for evaluation purposes. • Cost-based contracting • Insurance settlements • Required by regulators • Litigation