Cost Allocation

advertisement

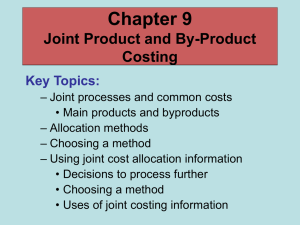

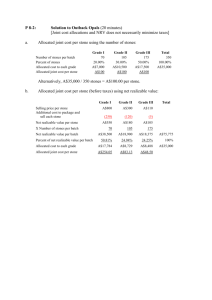

EMBA Presentation November 17,2012 COST ALLOCATION Cost Allocations Involve: Common Costs Joint Costs Purposes of Cost Allocation To provide information for economic decision making To motivate managers To justify costs for reimbursement To measure income and use of assets Criteria for Allocation of Costs Cause and effect Benefits received Fairness or equity Ability to bear Steps in Cost Allocation Define the cost objects Accumulate common costs Choose a method for assigning costs Allocation of Joint Costs Sales value at split-off Physical measure Estimated net realizable value Physical Units Method Board feet Weighting Allocation of joint costs Select White Knotty Total 450,000 750,000 300,000 1,500,000 30% 50% 20% 100% $ 90,000 $ 150,000 $ 60,000 $ 300,000 60,000 90,000 15,000 165,000 Total costs $ 150,000 $ 240,000 $ 75,000 $ 465,000 Cost per board foot $ $ $ $ Separate costs 0.33 0.32 0.25 0.31 Sales Value at Spin Off Method Select (450,000 x..35)(750,000 x.40)(300,000 x .19) Knotty Total $ 157,500 $ 300,000 $ 75,000 $ 532,500 Weighting Allocation of joint costs White 30% 56% 14% 100% $ 88,732 $ 169,014 $ 42,254 $ 300,000 Separate costs 60,000 90,000 15,000 165,000 Total costs $ 148,732 $ 259,014 $ 57,254 $ 465,000 Cost per board foot $ 0.33 $ 0.35 $ 0.19 $ 0.31 Net Realizable Value Method Select (405,000 x.40)(675,000 x.55)(270,000 x .25) 60,000 Total 90,000 15,000 165,000 $ 102,000 $ 281,250 $ 52,500 $ 435,750 Weighting Allocated joint costs Knotty $ 162,000 $ 371,250 $ 67,500 $ 600,750 Less separate costs NRV at split off White 23% 65% 12% 100% $ 70,224 $ 193,632 $ 36,145 $ 300,000 Add separate costs 60,000 90,000 15,000 165,000 Total costs $ 130,224 $ 283,632 $ 51,145 $ 465,000 Cost per board foot $ 0.29 $ 0.38 $ 0.17 $ 0.31 Comparison of the Three Methods Method Select White Knotty Total Physical units .33 .32 .25 .31 Split off .33 .35 .19 .31 NRV .29 .38 .17 .31 So, which is the best method? None . . . they are all arbitrary Pros and Cons Physical units – is easy to calculate Split-off – may not be appropriate if there is no market at the split-off point NRV – assumes that the greater the end sales dollars, the better it can bear the joint cost Allocation of Common Costs Direct Method Step-down Method Reciprocal Method Direct Method Allocations Admin/HR Information Services Government Corporate Total Administrative Head Percent 40 0.53333 35 0.46667 75 1.00000 Information Services Hours Percent 3,000 0.33333 6,000 0.66667 9,000 1.00000 Direct Method A/HR Costs IS $ 600,000 $ 2,400,000 All A/HR: (.53333, .46667 ) (600,000) All IS: (.33333, .66667) Totals $ GOVT 0 $ CORP 0 $ 0 320,000 280,000 800,000 1,600,000 0 $1,120,000 $1,880,000 0 (2,400,000) 0 $ Step Down Allocations Admin/HR Information Services Government Corporate Total Administrative Head Percent 25 0.25000 40 0.40000 35 0.35000 100 1.00000 Information Services Hours Percent 3,000 0.33333 6,000 0.66667 9,000 1.00000 Step Down Method – A/HR First A/HR Cost A/HR (.25, .40, .35) $ 600,000 $ GOVT $ 2,400,000 (600,000) IS (.33333. .66667) Totals IS 150,000 $ CORP 0 $ 0 240,000 210,000 850,000 1,700,000 0 $1,090,000 $1,910,000 0 (2,550,000) 0 $ Reciprocal Allocations Admin/HR Information Services Government Corporate Total Administrative Head Percent 25 0.25000 40 0.40000 35 0.35000 100 1.00000 Information Services Hours Percent 1,000 0.10000 3,000 0.30000 6,000 0.60000 10,000 1.00000 Reciprocal Method A/HR Costs IS $ 600,000 GOVT $2,400,000 A/HR (.25, .40, .35) (861,538) IS (.10, .30, .60) 261,538 (2,615,385) Totals $ $ 0 CORP 215,385 A = 600,000 + .10 IS IS = 2,400,000 + .25 A IS = 2,400,000 +1 50,000 + .025 IS .9750 IS = 2,550,000 IS = 2,615,385 A = 600,000+.10 (2,615,385) A = 861,538 0 344,615 301,538 784,615 1,569,231 $1,129,230 $1,870,769 Comparison of Results Method Government Corporate Direct $1,120,000 $1,880,000 Stepdown Adm first $1,098,000 $1,910,000 Stepdown IT first $1,128,000 $1,892,000 Reciprocal $1,129,230 $1,870,769 Pros and Cons of Methods Direct method – easy but ignores how support departments use each other Step down – widely accepted but requires designation of a “first” department Reciprocal – most accurate but not well understood or widely used Summary Reason for cost allocations Allocating joint costs Allocating common costs Copyright by Frank Ilett, 2012