Cost Allocation: Joint Products and Byproducts Chapter 16

advertisement

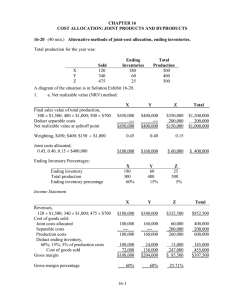

Cost Allocation: Joint Products and Byproducts Chapter 16 Learning Objective 1 Identify the splitoff point(s) in a joint-cost situation. A Better Picture Joint-Cost Basics Joint costs Joint products Byproduct Splitoff point Separable costs Joint Processes JOINT COSTS Costs to operate joint processes FINAL PRODUCT One that is ready for sale without further processing Simultaneously converts a common input into several outcomes COMMON IMPUT JOINT PROCESS FINAL PRODUCT A INTERMEDIAT E PRODUCT A FINAL PRODUCT B SPLIT-OFF POINT Point at which joint-products appear INTERMEDIAT E PRODUCT B INTERMEDIATE PRODUCT A product that requires further processing before it is salable to the public Joint-Cost Basics Raw milk Cream Liquid Skim Joint-Cost Basics Coal Gas Benzyl Tar Learning Objective 2 Distinguish joint products from byproducts. Joint Products and Byproducts Main Products Joint Products Byproducts High Low Sales Value Learning Objective 3 Explain why joint costs should be allocated to individual products. Why Allocate Joint Costs? Specifying and Resolving Contractual Interests and Obligations Determining and Responding to Regulatory Rates Measuring Performance Valuing Inventories for Financial and Tax Reporting Organizations Allocate Joint Costs for Many Reasons Estimating Casualty Losses Valuing Cost of Goods Sold for Financial and Tax Reporting Learning Objective 4 Allocate joint costs using four different methods. Approaches to Allocating Joint Costs Two basic ways to allocate joint costs to products are: Approach 1: Market based Approach 2: Physical measure Approach 1: Market-based Data Sales value at splitoff method Estimated net realizable value (NRV) method Constant gross-margin percentage NRV method Allocating Joint Costs Example 10,000 units of A at a selling price of $10 = $100,000 10,500 units of B at a selling price of $30 = $315,000 11,500 units of C at a selling price of $20 = $230,00 Joint processing cost is $200,000 Splitoff point Sales Value at Splitoff Method Example Sales Value Allocation of Joint Cost 100 ÷ 645 315 ÷ 645 230 ÷ 645 A $100,000 B $315,000 C $230,000 Total $645,000 31,008 Gross margin $ 68,992 97,674 71,318 $217,326 $158,682 200,000 $445,000 Sales Value at Splitoff Method Example Assume all of the units produced of B and C were sold. 2,500 units of A (25%) remain in inventory. What is the gross margin percentage of each product? Sales Value at Splitoff Method Example Product A Revenues: 7,500 units × $10.00 Cost of goods sold: Joint product costs $31,008 Less ending inventory $31,008 × 25% 7,752 Gross margin $75,000 23,256 $51,744 Sales Value at Splitoff Method Example Product A: ($75,000 – $ 23,256) ÷ $75,000 = 69% Product B: ($315,000 – $97,674) ÷ $315,000 = 69% Product C: ($230,000 – $71,318) ÷ $230,000 = 69% Estimated Net Realizable Value (NRV) Method Example Assume that Oklahoma Company can process products A, B, and, C further into A1, B1, and C1. The new sales values after further processing are: A1: B1: C1: 10,000 × $12.00 10,500 × $33.00 11,500 × $21.00 = $120,000 = $346,500 = $241,500 Estimated Net Realizable Value (NRV) Method Example Additional processing (separable) costs are as follows: A1: $35,000 B1: $46,500 C1: $51,500 What is the estimated net realizable value of each product at the splitoff point? Estimated Net Realizable Value (NRV) Method Example Product A1: $120,000 – $35,000 = $85,000 Product B1: $346,500 – $46,500 = $300,000 Product C1: $241,500 – $51,500 = $190,000 How much of the joint cost is allocated to each product? Estimated Net Realizable Value (NRV) Method Example To A1: 85 ÷ 575 × $200,000 = $29,565 To B1: 300 ÷ 575 × $200,000 = $104,348 To C1: 190 ÷ 575 × $200,000 = $66,087 Estimated Net Realizable Value (NRV) Method Example A1 B1 C1 Total Allocated joint costs $ 29,565 104,348 66,087 $200,000 Separable costs $ 35,000 46,500 51,500 $133,000 Inventory costs $ 64,565 150,848 117,587 $333,000 Constant Gross-Margin Percentage NRV Method This method entails three steps: Step 1: Compute the overall gross-margin percentage. Step 2: Use the overall gross-margin percentage and deduct the gross margin from the final sales values to obtain the total costs that each product should bear. Constant Gross-Margin Percentage NRV Method Step 3: Deduct the expected separable costs from the total costs to obtain the joint-cost allocation. Constant Gross-Margin Percentage NRV Method What is the expected final sales value of total production during the accounting period? Product A1: $120,000 Product B1: 346,500 Product C1: 241,500 Total $708,000 Constant Gross-Margin Percentage NRV Method Step 1: Compute the overall gross-margin percentage. Expected final sales value $708,000 Deduct joint and separable costs 333,000 Gross margin $375,000 Gross margin percentage: $375,000 ÷ $708,000 = 52.966% Constant Gross-Margin Percentage NRV Method Step 2: Deduct the gross margin. Sales Gross Cost of Value Margin Goods sold Product A1: $120,000 $ 63,559 $ 56,441 Product B1: 346,500 183,527 162,973 Product C1: 241,500 127,913 113,587 Total $708,000 $375,000 $333,000 ($1 rounding) Constant Gross-Margin Percentage NRV Method Step 3: Deduct separable costs. Cost of Separable Joint costs goods sold costs allocated Product A1: $ 56,441 $ 35,000 $ 21,441 Product B1: 162,973 46,500 116,473 Product C1: 113,587 51,500 62,087 Total $333,000 $133,000 $200,000 Approach 2: Physical Measure Method Example $200,000 joint cost 20,000 pounds A 48,000 pounds B 12,000 pounds C Product A $50,000 Product B $120,000 Product C $30,000 Learning Objective 5 Explain why the sales value at splitoff method is preferred when allocating joint costs. Choosing a Method Why is the sales value at splitoff method widely used? It measures the value of the joint product immediately. It does not anticipate subsequent management decisions. It uses a meaningful basis. It is simple. Choosing a Method The purpose of the joint-cost allocation is important in choosing the allocation method. The physical-measure method is a more appropriate method to use in rate regulation. Avoiding Joint Cost Allocation Some companies refrain from allocating joint costs and instead carry their inventories at estimated net realizable value. Learning Objective 6 Explain why joint costs are irrelevant in a sell-or-process-further decision. Sell or Process Further Split-off point $$$$ Raw materials Joint costs of processing to split-off point Joint products Irrelevance of Joint Costs for Decision Making Assume that products A, B, and C can be sold at the splitoff point or processed further into A1, B1, and C1. Selling Selling Additional Units price price costs 10,000 A: $10 A1: $12 $35,000 10,500 B: $30 B1: $33 $46,500 11,500 C: $20 C1: $21 $51,500 Irrelevance of Joint Costs for Decision Making Should A, B, or C be sold at the splitoff point or processed further? Product A: Incremental revenue $20,000 – Incremental cost $35,000 = ($15,000) Product B: Incremental revenue $31,500 – Incremental cost $46,500 = ($15,000) Product C: Incremental revenue $11,500 – Incremental cost $51,500 = ($40,000) Sell or Process Further Example NW Sawmill cuts logs from which unfinished lumber and scrap (sawdust, chips, bark) are the immediate joint products. The unfinished lumber can be sold “as is” or processed further into finished lumber. The scrap can also be sold “as is” to gardening supply wholesalers or processed further into presto-logs. Data concerning these joint products: Per Log Lumber Scraps Sales value at split-off point $140 $40 Sales value after processing 270 50 Allocated joint product costs 176 24 Cost of further processing 50 20 Sales value after processing Sales value at split-off point Incremental Revenue Cost of further processing Profit (loss) from further processing Per Log Lumber Scraps $270 $50 140 40 $130 $10 50 20 $80 ($10) Learning Objective 7 Account for byproducts using two different methods. By-Product Accounting: the Basics By-products are minor products and alternative methods are not likely to have a material effect on the financial statements for internal or external reporting. Whether to sell the by-product at split-off or process it further usually depends on the highest NPR obtainable, just as for a main product. A: Deduct by-product NRV from costs of main products Two standard methods B: Consider by-product NRV as other revenue Accounting for Byproducts Method A: The production method recognizes byproducts at the time their production is completed. Method B: The sale method delays recognition of byproducts until the time of their sale. Accounting for Byproducts Example Main Products Byproducts (Yards) (Yards) Production 1,000 400 Sales 800 300 Ending inventory 200 100 Sales price $13/yard $1.00/yard No beginning finished goods inventory Accounting for Byproducts Example Joint production costs for joint (main) products and byproducts: Material $2,000 Manufacturing labor 3,000 Manufacturing overhead 4,000 Total production cost $9,000 Accounting for Byproducts Method A Method A: The production method What is the value of ending inventory of joint (main) products? $9,000 total production cost – $400 net realizable value of the byproduct = $8,600 net production cost for the joint products Accounting for Byproducts Method A 200 ÷ 1,000 × $8,600 = $1,720 is the value assigned to the 200 yards in ending inventory. What is the cost of goods sold? Joint production costs Less byproduct revenue Less main product inventory Cost of goods sold $9,000 400 1,720 $6,880 Accounting for Byproducts Method A Income Statement (Method A) Revenues: (800 yards × $13) $10,400 Cost of goods sold 6,880 Gross margin $ 3,520 What is the gross margin percentage? $3,520 ÷ $10,400 = 33.85% Accounting for Byproducts Method A What are the inventoriable costs? Main product: 200 ÷ 1,000 × $8,600 = $1,720 Byproduct: 100 × $1.00 = $100 Journal Entries Method A Work in Process 2,000 Accounts Payable 2,000 To record direct materials purchased and used in production Work in Process 7,000 Various Accounts 7,000 To record conversion costs in the joint process Journal Entries Method A Byproduct Inventory 400 Finished Goods 8,600 Work in Process 9,000 To record cost of goods completed Cost of Goods Sold 6,880 Finished Goods 6,880 To record the cost of the main product sold Journal Entries Method A Cash or Accounts Receivable 10,400 Revenues 10,400 To record the sale of the main product Cash or Accounts Receivable 300 Byproduct Inventory 300 To record the sale of the byproduct Accounting for Byproducts Method B Method B: The sale method What is the value of ending inventory of joint (main) products? 200 ÷ 1,000 × $9,000 = $1,800 No value is assigned to the 400 yards of byproducts at the time of production. The $300 resulting from the sale of byproducts is reported as revenues. Accounting for Byproducts Method B Income Statement (Method B) Revenues: Main product (800 × $13) Byproducts sold Total revenues Cost of goods sold: Joint production costs 9,000 Less main product inventory 1,800 Gross margin $10,400 300 $10,700 $ 7,200 $ 3,200 Accounting for Byproducts Method B What is the gross margin percentage? $3,200 ÷ $10,700 = 29.91% What are the inventoriable costs? Main product: 200 ÷ 1,000 × $9,000 = $1,800 By-product: -0- Journal Entries Method B Work in Process 2,000 Accounts Payable 2,000 To record direct materials purchased and used in production Work in Process 7,000 Various Accounts 7,000 To record conversion costs in the joint process Journal Entries Method B Finished Goods 9,000 Work in Process 9,000 To record cost of goods completed Cost of Goods Sold 7,200 Finished Goods 7,200 To record the cost of the main product sold Journal Entries Method B Cash or Accounts Receivable 10,400 Revenues 10,400 To record the sale of the main product Cash or Accounts Receivable 300 Revenues 300 To record the sale of the byproduct End of Chapter 16