Chapter 16

Chapter 16

Joint Cost

s

Joint

Input

Joint

Costs

Joint Products

Oil

Separate

Processing

Common

Production

Process

Gasoline

Split-Off

Point

Chemicals

Final

Sale

Final

Sale

Separate

Processing

Separable

Product

Costs

Final

Sale

Examples of Joint Cost Situations

Why Allocate Joint Costs?

• to compute inventory cost and cost of goods sold

• to determine cost reimbursement under contracts

• for insurance settlement computations

• for rate regulation

• for litigation purposes

Joint Cost Allocation Methods

• Market-Based – allocate using marketderived data (dollars):

1. Sales value at split-off

2. Net Realizable Value (NRV)

3. Constant Gross-Margin percentage NRV

• Physical Measures – allocate using tangible attributes of the products, such as pounds, gallons, barrels, etc

An Example

• Farmer’s Dairy purchases raw milk from individual farms and processes it until the split-off point, when two products – cream and liquid skim

– emerge. These two products are sold to an independent company, which markets and distributes them to supermarkets

• In May 2009, Farmer’s Dairy processes 110,000 gallons of raw milk. During processing, 10,000 gallons are lost due to evaporation, yielding

25,000 gallons of cream and 75,000 gallons of liquid skim.

• Summary data follows:

Joint Cost - Base Data For Example

Joint Process Overview

Sales Value at Splitoff Method

• Uses the sales value of the entire production of the accounting period to calculate the amount of allocation

• Ignores inventories

Sales Value at Split-off Computation

Physical-Measure Method

• Allocates joint costs to joint products on the basis of the relative weight, volume, or other physical measure at the split-off point of total production of the products

• Let’s use number of gallons produced as the measure to allocate joint costs

Physical Measure Method Computation

Further Processing – Additional Data

• Assume the same data as the base case except that both cream and liquid skim can be processed further

• Cream is processed into Buttercream: 25,000 gallons of cream are further processed into 20,000 gallons of buttercream at additional processing costs of

$280,000. Buttercream sells for $25 per gallon

• Liquid Skim is processed into Condensed Milk: 75,000 gallons of liquid skim are further processed to yield 50,000 gallons of condensed milk at additional processing costs of $520,000. Condensed milk sells for $22 per gallon

• Sales during May were 12,000 gallons of buttercream and 45,000 gallons of condensed milk.

Data for Further Processing

Further Processing Overview

Net Realizable Value (NRV) Method

• Allocates joint costs to joint products on the basis of the relative NRV of total production of the joint products

• NRV = Final Sales Value – Separable Costs

Net Realizable Value Computation

Constant Gross Margin NRV Method

• Allocates joint costs to joint products in a way that forces the overall gross-margin percentage to be identical for the individual products

• It is also based on total production

• Joint Costs are calculated as a residual amount

Constant Gross Margin NRV Computation

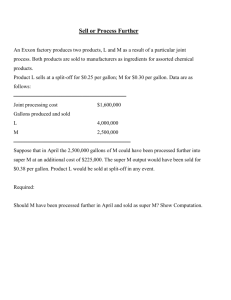

Sell-or-Process Further Decisions

• In Sell-or-Process Further decisions, joint costs are irrelevant since they are “sunk” costs at the decision point

• Decision should be based on whether the incremental revenue due to further processing is greater/less than the separable costs for the same

Sell or Process Further?

Joint Products - Practice

The wood spirits company produces two products, turpentine and methanol, by a joint process.

Joint costs are $120,000 per batch of output. Each batch totals 10,000 gallons, 25% methanol and 75% turpentine.

At split-off, methanol sells for $21/gallon and turpentine sells for $14/ gallon.

Joint Products - Practice (continued)

The company has discovered an new process by which the methanol can be made into a pleasanttasting beverage.

The selling price for this beverage would be $40 per gallon.

The additional processing would cost $12 per gallon s and the company would have to pay excise taxes of 20% on the selling price.

Should the company undertake further processing?