Document 10289738

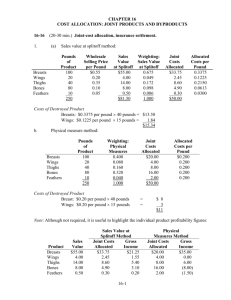

advertisement

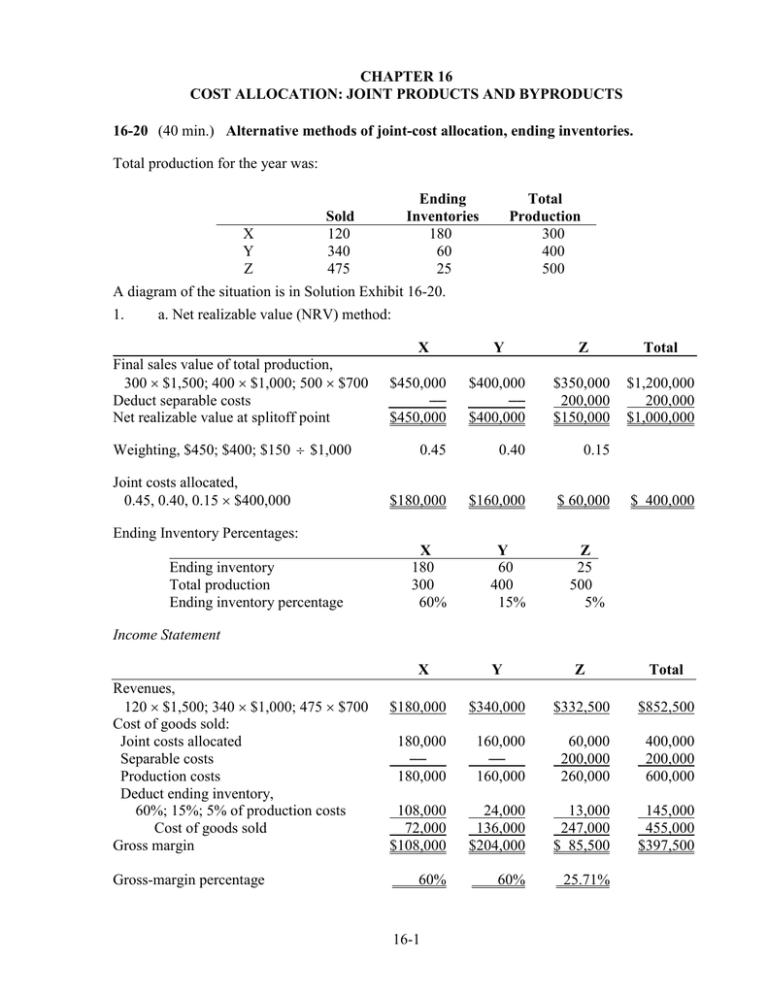

CHAPTER 16 COST ALLOCATION: JOINT PRODUCTS AND BYPRODUCTS 16-20 (40 min.) Alternative methods of joint-cost allocation, ending inventories. Total production for the year was: X Y Z Ending Inventories 180 60 25 Sold 120 340 475 Total Production 300 400 500 A diagram of the situation is in Solution Exhibit 16-20. 1. a. Net realizable value (NRV) method: X Final sales value of total production, 300 × $1,500; 400 × $1,000; 500 × $700 Deduct separable costs Net realizable value at splitoff point Weighting, $450; $400; $150 ÷ $1,000 Joint costs allocated, 0.45, 0.40, 0.15 × $400,000 Y Z Total $450,000 –– $450,000 $400,000 –– $400,000 $350,000 200,000 $150,000 $1,200,000 200,000 $1,000,000 0.45 0.40 0.15 $180,000 $160,000 $ 60,000 X 180 300 60% Y 60 400 15% $ 400,000 Ending Inventory Percentages: Ending inventory Total production Ending inventory percentage Z 25 500 5% Income Statement X Revenues, 120 × $1,500; 340 × $1,000; 475 × $700 Cost of goods sold: Joint costs allocated Separable costs Production costs Deduct ending inventory, 60%; 15%; 5% of production costs Cost of goods sold Gross margin Gross-margin percentage Y Z Total $180,000 $340,000 $332,500 $852,500 180,000 –– 180,000 160,000 –– 160,000 60,000 200,000 260,000 400,000 200,000 600,000 108,000 72,000 $108,000 24,000 136,000 $204,000 13,000 247,000 $ 85,500 145,000 455,000 $397,500 60% 60% 25.71% 16-1 b. Constant gross-margin percentage NRV method: Step 1: Final sales value of prodn., (300 × $1,500) + (400 × $1,000) + (500 × $700) Deduct joint and separable costs, $400,000 + $200,000 Gross margin Gross-margin percentage, $600,000 ÷ $1,200,000 $1,200,000 600,000 $ 600,000 50% Step 2: X Final sales value of total production, 300 × $1,500; 400 × $1,000; 500 × $700 Deduct gross margin, using overall gross-margin percentage of sales, 50% Total production costs Step 3: Deduct separable costs Joint costs allocated Y Z Total $450,000 $400,000 $350,000 $1,200,000 225,000 225,000 200,000 200,000 175,000 175,000 600,000 600,000 — $225,000 — $200,000 200,000 200,000 $(25,000) $ 400,000 The negative joint-cost allocation to Product Z illustrates one “unusual” feature of the constant gross-margin percentage NRV method: some products may receive negative cost allocations so that all individual products have the same gross-margin percentage. Income Statement Revenues, 120 × $1,500; 340 × $1,000; 475 × $700 Cost of goods sold: Joint costs allocated Separable costs Production costs Deduct ending inventory, 60%; 15%; 5% of production costs Cost of goods sold Gross margin Gross-margin percentage X Y Z Total $180,000 $340,000 $332,500 $852,500 225,000 225,000 200,000 200,000 (25,000) 200,000 175,000 400,000 200,000 600,000 135,000 90,000 $ 90,000 50% 30,000 170,000 $170,000 50% 8,750 166,250 $166,250 50% 173,750 426,250 $426,250 50% 16-2 Summary a. NRV method: Inventories on balance sheet Cost of goods sold on income statement b. Y Z Total $108,000 72,000 $ 24,000 136,000 $ 13,000 247,000 $145,000 455,000 $600,000 $135,000 90,000 $ 30,000 170,000 $ 8,750 166,250 $173,750 426,250 $600,000 Constant gross-margin percentage NRV method Inventories on balance sheet Cost of goods sold on income statement 2. X Gross-margin percentages: X 60% 50% NRV method Constant gross-margin percentage NRV Y 60% 50% Z 25.71% 50.00% SOLUTION EXHIBIT 16-20 Joint Costs Separable Costs Product X: 300 tons at $1,500 per ton Joint Processing Costs $400,000 Product Y: 400 tons at $1,000 per ton Processing $200,000 Splitoff Point 16-3 Product Z: 500 tons at $700 per ton 16-23 (20 min.) Joint cost allocation: sell immediately or process further. 1. a. Sales value at splitoff method: Cookies/ Soymeal Soyola/ Soy Oil Total $500 0.556 $400 0.444 $900 $278 $222 $500 Cookies Soyola Total $1,200 300 $ 900 0.75 $500 200 $300 0.25 $1,700 500 $1,200 $ 375 $125 $ 500 Sales value of total production at splitoff, 500lbs × $1; 100 gallons × $4 Weighting, $500; $400 ÷ $900 Joint costs allocated, 0.556; 0.444 × $500 b. Net realizable value method: Final sales value of total production, 600lbs × $2; 400qts × $1.25 Deduct separable costs Net realizable value Weighting, $900; $300 ÷ $1,200 Joint costs allocated, 0.75; 0.25 × $500 2. Revenue if sold at splitoff Process further NRV Profit (Loss) from processing further Cookies/Soy Meal $500a 900 c $400 Soyola/Soy Oil $ 400 b 300 d $(100) a 500 lbs × $1 = $500 100 gal × $4 = $400 c 600 lbs × $2 – $300 = $900 d 400 qts × $1.25 – $200 = $300 b ISP should process the soy meal into cookies because it increases profit by $400 (900-500). However, they should sell the soy oil as is, without processing it into the form of Soyola, because profit will be $100 (400-300) higher if they do. Since the total joint cost is the same under both allocation methods, it is not a relevant cost to the decision to sell at splitoff or process further. 16-4 16-24 (30 min.) Accounting for a main product and a byproduct. 1. Production Method Sales Method Revenues Main product Byproduct Total revenues $640,000a ––__ 640,000 $640,000 28,000d 668,000 Cost of goods sold Total manufacturing costs Deduct value of byproduct production Net manufacturing costs Deduct main product inventory Cost of goods sold Gross margin 480,000 40,000b 440,000 88,000c 352,000 $288,000 480,000 0 480,000 96,000e 384,000 $284,000 a 32,000 × $20.00 8,000 × $5.00 c (8,000/40,000) × $440,000 = $88,000 d b 2. a e 5,600 × $5.00 (8,000/40,000) × $480,000 = $96,000 Production Method $88,000 12,000a Main Product Byproduct Ending inventory shown at unrealized selling price. BI + Production – Sales = EI 0 + 8,000 – 5,600 = 2,400 pounds Ending inventory = 2,400 pounds × $5 per pound = $12,000 16-5 Sales Method $96,000 0