Power Point Presentation

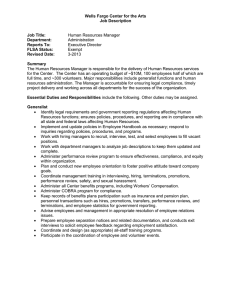

advertisement

BANK OF AMERICA & WELLS FARGO ROSS BABINEC ELLEN DALE LAUREN FACTOR CORPORATE ADDRESS 100 North Tryon Street Charlotte, NC 28255 420 Montgomery Street San Francisco, CA 94104 BANK OF AMERICA MARKET SHARE: 11.8% • Headquartered in Charlotte, NC • World’s largest holding-backed company in terms of assets and revenue • In the next five years, revenue is forecasted to increase by 10% annually to $67.1 billion • Like most banks in the industry it was hit hard by the recession • Operates through three business segments: Global consumer and small business banking(GC&SBB), global corporate and investment banking, and global wealth and investment management BANK OF AMERICA CONT. • GC&SBB is most relevant to the Commercial Banking Industry, and is the source of 80% of its revenue • Within the GC&SBB segment there are four primary businesses • • • • Deposits Card Services Consumer Real Estate Asset Liability Management WELLS FARGO MARKET SHARE: 11.3% • Headquartered in San Francisco, CA • Diversified financial services company that provides banking, insurance, investment, mortgage and consumer finance • Separated into three main segments • Community Banking • Wholesale Banking • Wells Fargo Financial • Largest business segment is commercial banking generating more than 80% of its revenue WELLS FARGO CONT. • Community banking business serves small-business clients as well as retail customers and high net worth individuals • Provides a wide range of products ranging from home mortgages and debit cards to personal trusts • In 2008 Wells Fargo acquired Wachovia • As a result, it became the nation’s largest mortgage lender and the second-largest diversified service firm in the US in terms of deposits COMMERCIAL BANKING • The industry comprises banks that provide financial services to retail and business clients in the form of commercial, industrial and consumer loans • Banks also accept deposits from customers, which are then used as a source of funding for the loans COMMERCIAL BANKING CONT. Primary Activities • Receiving deposits from customers and issuing consumer, commercial and industrial loans Major Products and Services • • • • Business lending Deposits Home equity loans Mortgages EMPLOYMENT PROSPECTS The Bureau of Labor Statistics • The commercial banking industry employs approximately 1,332,000 wage and salary workers in 2008, which is 74 percent of total banking industry. • Most bank employees work in heavily populated States such as New York, California, Illinois, North Carolina, Pennsylvania, and Texas. • Increase in American’s wealth and investments, along with the increase in local branch banking. • Need for skilled workers in areas with high employee turnover. EMPLOYMENT PROSPECTS CONT. IBISWorld • A positive, however small, increase in employment growth. • Troubled Asset Relief Program. • Average rate of revenue increase over five years is approximately 5.5% . RETURN ON EQUITY (PERCENTAGE) Wells Fargo 18 16 14 12 10 8 6 4 2 0 -2 2006 2007 2008 2009 2010 Bank of America 18 16 14 12 10 8 6 4 2 0 -2 2006 2007 2008 2009 2010 STOCK PRICE Wells Fargo Bank of America $60.00 $60.00 $50.00 $50.00 $40.00 $40.00 $30.00 $30.00 $20.00 $20.00 $10.00 $10.00 2006 2007 2008 2009 2010 2006 2007 2008 2009 2010 TOTAL ASSETS 2.5 Bank of America Millions Millions Wells Fargo 2 2.5 2 1.5 1.5 1 1 0.5 0.5 0 0 2006 2007 2008 2009 2010 2006 2007 2008 2009 2010 OPERATIONAL EFFICIENCY: EFFICIENCY RATIO (PERCENTAGE) Wells Fargo Bank of America 60 60 58 58 56 56 54 54 52 52 50 50 48 48 2006 2007 2008 2009 2010 2006 2007 2008 2009 2010 SHARE OF INDUSTRY VALUE (PERCENTAGE) Wells Fargo Bank of America 12 12 10 10 8 8 6 6 4 4 2 2 0 0 2006 2007 2008 2009 2010 2006 2007 2008 2009 2010 SUMMARY OF RATIO’S • In 2008 WF acquired Wachovia, and this significantly increased its share of industry value and total assets, but also caused a significant decrease in operational efficiency and ROE only in 2008, and was able to then significantly increase these numbers to percentages higher than they had been before the acquisition • Bank of America’s stock price and ROE was hit hard by the 2007 financial crises but BOA has slowly been able to come back and redeem themselves since 2008 and has mostly seen positive growth in their ratios SOURCES Bank of America Corporation. "Investor Relations Historical Price Look Up." Bank Of America. Bank Of America Corporation, 30 Mar. 2011. Web. 30 Mar. 2011. <http://investor.bankofamerica.com/phoenix.zhtml?c=71595&p=irolstocklookup&t=HistQuote>. "Information in the Career Guide to Industries." Bureau Of Labor Statistics. United States Department Of Labor, 17 Dec. 2009. Web. 31 Mar. 2011. <http://www.bls.gov/oco/cg/cgs027.htm#outlook>. IBISWorld. "US Commerical Banking Industry Market Research Report." IBISWorld. IBISWorld, 2011. Web. 30 Mar. 2011. <http://www.ibisworld.com/industryus/Majorcompanies.aspx?indid=1288>. Microsoft. "Bank of America Corp - Company Financial Statements (BAC):Interim Balance Sheet." MSN Money. MSN, 2011. Web. 30 Mar. 2011. <http://moneycentral.msn.com/investor/invsub/results/statemnt.aspx?lstStatement=Bala nce&symbol=US%3aBAC&stmtView=Qtr>. Microsoft. "Financial Results Wells Fargo & Co." MSN Money. MSN, 2011. Web. 30 Mar. 2011. <http://moneycentral.msn.com/investor/invsub/results/statemnt.aspx?lstStatement=10Ye arSummary&symbol=WFC>. Morningstar. Morningstar, Inc., n.d. Web. 4 Apr. 2011. <http://www.morningstar.com/>. Wells Fargo. "About Wells Fargo - Stock Price." BigCharts. Wells Fargo, 3 Mar. 2011. Web. 30 Mar. 2011. <http://www.bigcharts.com/custom/wellsfargo-com/wellsfargo.asp>.