Wells Fargo SWOT Analysis: Strengths, Weaknesses, Opportunities

advertisement

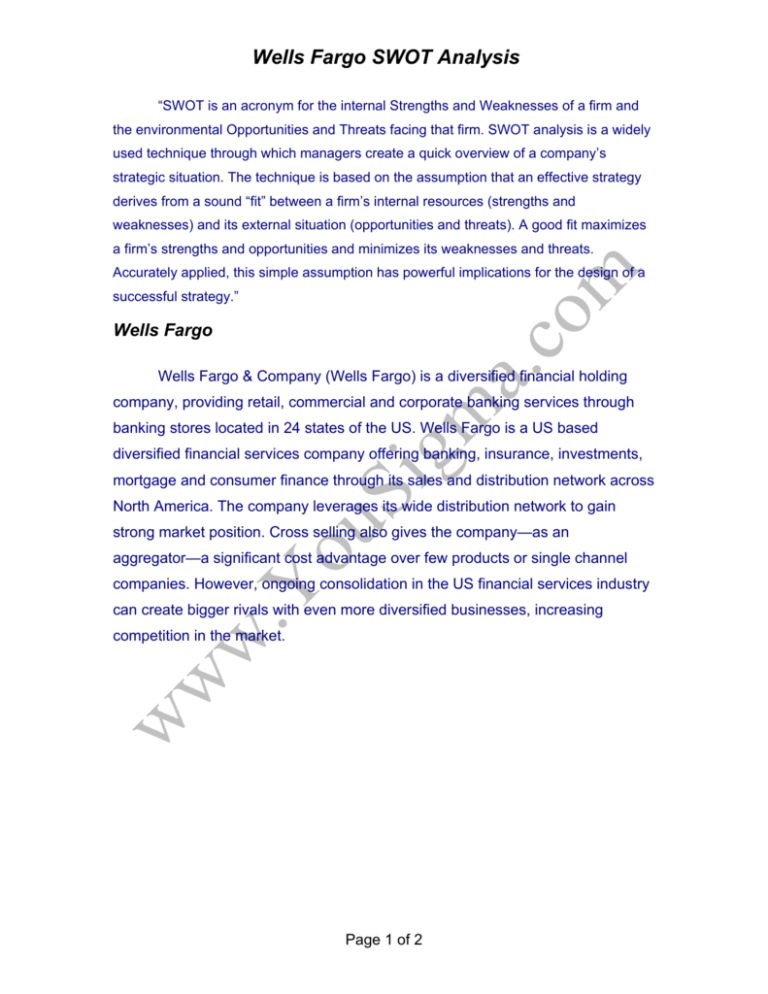

Wells Fargo SWOT Analysis “SWOT is an acronym for the internal Strengths and Weaknesses of a firm and the environmental Opportunities and Threats facing that firm. SWOT analysis is a widely used technique through which managers create a quick overview of a company’s strategic situation. The technique is based on the assumption that an effective strategy derives from a sound “fit” between a firm’s internal resources (strengths and weaknesses) and its external situation (opportunities and threats). A good fit maximizes a firm’s strengths and opportunities and minimizes its weaknesses and threats. Accurately applied, this simple assumption has powerful implications for the design of a successful strategy.” Wells Fargo Wells Fargo & Company (Wells Fargo) is a diversified financial holding company, providing retail, commercial and corporate banking services through banking stores located in 24 states of the US. Wells Fargo is a US based diversified financial services company offering banking, insurance, investments, mortgage and consumer finance through its sales and distribution network across North America. The company leverages its wide distribution network to gain strong market position. Cross selling also gives the company—as an aggregator—a significant cost advantage over few products or single channel companies. However, ongoing consolidation in the US financial services industry can create bigger rivals with even more diversified businesses, increasing competition in the market. Page 1 of 2 Wells Fargo SWOT Analysis Strengths, Weaknesses, Opportunities and Threats (SWOT) Location of Factor TYPE OF FACTOR Favorable Internal Strengths Weaknesses ¾ Wide distribution network ¾ Weakening asset quality amidst high ¾ Cross selling real estate ¾ Diversified earnings exposure distribution across segments External Unfavorable ¾ Limited international presence ¾ Strong Credit ¾ Low customer discipline satisfaction Opportunities ¾ Technology enabled offerings ¾ Growing immigrant population ¾ Growth in the commercial banking industry ¾ Acquisitions Threats ¾ Consolidation in the US banking industry ¾ Regulations on contingent commission ¾ Rising incidents of Online Scams ¾ Meltdown in US Asset backed Securities market Page 2 of 2