Insurance and assurance An insurance ________is a contract

advertisement

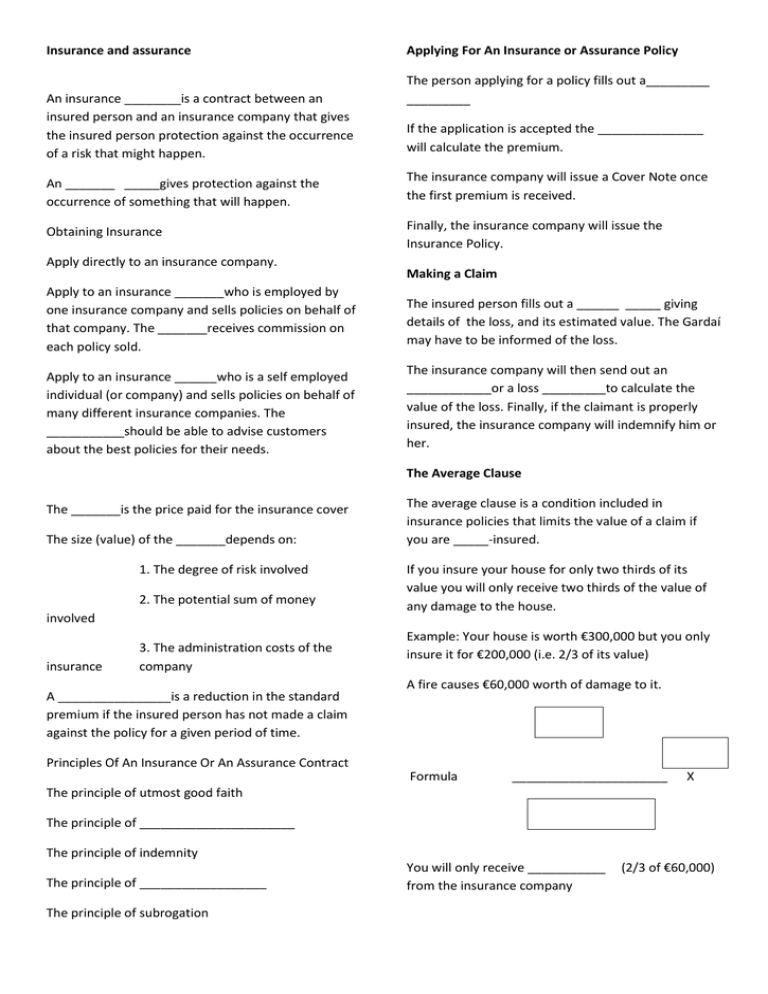

Insurance and assurance An insurance ________is a contract between an insured person and an insurance company that gives the insured person protection against the occurrence of a risk that might happen. Applying For An Insurance or Assurance Policy The person applying for a policy fills out a_________ _________ If the application is accepted the _______________ will calculate the premium. An _______ _____gives protection against the occurrence of something that will happen. The insurance company will issue a Cover Note once the first premium is received. Obtaining Insurance Finally, the insurance company will issue the Insurance Policy. Apply directly to an insurance company. Making a Claim Apply to an insurance _______who is employed by one insurance company and sells policies on behalf of that company. The _______receives commission on each policy sold. The insured person fills out a ______ _____ giving details of the loss, and its estimated value. The Gardaí may have to be informed of the loss. Apply to an insurance ______who is a self employed individual (or company) and sells policies on behalf of many different insurance companies. The ___________should be able to advise customers about the best policies for their needs. The insurance company will then send out an ____________or a loss _________to calculate the value of the loss. Finally, if the claimant is properly insured, the insurance company will indemnify him or her. The Average Clause The _______is the price paid for the insurance cover The size (value) of the _______depends on: 1. The degree of risk involved 2. The potential sum of money involved insurance 3. The administration costs of the company A ________________is a reduction in the standard premium if the insured person has not made a claim against the policy for a given period of time. The average clause is a condition included in insurance policies that limits the value of a claim if you are _____-insured. If you insure your house for only two thirds of its value you will only receive two thirds of the value of any damage to the house. Example: Your house is worth €300,000 but you only insure it for €200,000 (i.e. 2/3 of its value) A fire causes €60,000 worth of damage to it. Principles Of An Insurance Or An Assurance Contract Formula ______________________ X The principle of utmost good faith The principle of ______________________ The principle of indemnity The principle of __________________ The principle of subrogation You will only receive ___________ from the insurance company (2/3 of €60,000) Household Insurance Household insurance policies are usually classified under four headings:. 1.Personal insurance Private ___________insurance The loss is imminently inevitable (bound to happen soon). The damage is gradual, e.g. depreciation of an asset. The occurrence of the risk would be catastrophic for the insurance company. _________protection insurance Travel insurance PRSI / USC 2. Property Insurance Policies Building & ____________ insurance All ________insurance 3. Life Assurance Policies A ____________________policy A whole life policy An __________________ policy _____________ ________– is the value of the life assurance policy if you cash it in early. It is much less than the amount you would receive if you let it run its full course. 4. Motor Insurance Policies _____________policy ______________________________________ policy Business Insurance 1. Buildings Insurance – 2. ‘All Risks Fire Insurance’ - insures against fire, lightning, burst pipes, flooding. 3. ‘_____________ _________insurance’ - covers against loss of profits resulting from having to close the business while the damage is repaired. 4. Theft/Burglary insurance – covers against stock and equipment being stolen 4._________ ___ ______– covers against goods getting stolen/lost while being transported 5. __________ _________insurance – covers members of the public who may get injured/killed while they are on your premises 6. ____________ ___________insurance – this covers any employee who may get injured/killed while at work. 7. _________ _________insurance – covers the business against any claims made by the public who got injured/killed as a result of a faulty product. Fully ____________________policy 8. _______________ ______insurance – covers against any losses the business may suffer as a result of an employee stealing from them or engaging in fraudulent activities or being dishonesty. Non-Insurable Risks An insurance company will refuse insurance if a risk has any or all of the following characteristics: An actuary, due to lack of statistics, cannot calculate the probability of the risk occurring. There are not enough people seeking similar insurance to share the risk. 9. Motor insurance –Third party, Third party fire & theft, Comprehensive