Chapter 6

advertisement

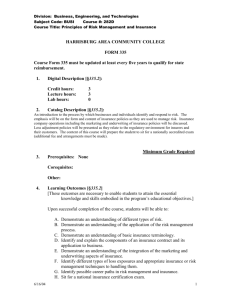

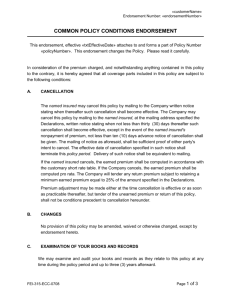

Assignment Six Risk Control and Premium Auditing Loss Prevention • A type of risk control that seeks to lower the frequency of losses • Loss reduction – a type of risk control that seeks to lower the severity of losses that occur • Risk control – a risk management technique that attempts to reduce loss frequency and loss severity 6-2 Goals of Insurer Risk Control Activities • Profit – underwriting decisions based on information – may indicate need for nurses, ergonomic specialists, engineers, chemists • Meeting customer needs – increased awareness of OSHA, Customer Products Safety Act, CERCLA, American with Disabilities Act – Impacted with liability judgments • Comply with legal requirements – minimum level required by some states • Humanitarian and social concerns – benefits society at large by preventing or lessening losses 6-3 Earn a Profit • Underwriting – enables underwriters to make better informed decisions and provide technical support • Marketing – often the difference between being accepted or rejected, may offer tangible advice on improving safety • Claims – may have engineering, mechanical ability above that of claims than can reduce loss • Encourage insureds to improve risk control • Provide additional revenue source • Reduces errors and omissions claims 6-4 Meeting Customer Needs • Pressures of legislation – OSHA, the Consumers Products Safety Act, CERCLA, Americans with Disabilities Act • Can create additional benefits – Enhance relationship with producers – Increase market share – Attract and retain higher-quality accounts – Help agents accomplish goals 6-5 Comply with Loyal Requirements • Some states require minimum level • Texas – workers’ compensation • Some companies charge for service excess minimum required • Duty to Society – Provide financial resources to recover from accidental losses 6-6 Services Provided by Insurers • Physical surveys • Risk analysis and improvement • Safety management programs 6-7 Conducting Physical Surveys • Evaluation of Loss exposures relating to – Fire, wind storm, water damage, burglary – Legal liability – Employee injuries • Moral hazards • Morale hazards 6-8 Recommendations • Written Recommendations – – – – Conform to industry and regulatory standards Practical Address cost / cost benefits Property valuations • Assist underwriters and insured – Underwriter gains better understanding – Insured understands loss exposure – Insured confident of adequate recovery after valuation 6-9 Risk Analysis • Coordinated safety programs • Technical risk-control information • Fire protection systems testing • Pre construction counseling 6 - 10 Types of Loss Exposures Evaluated • Test and evaluate effects of noise levels • Appraise hazards to employees from solvents, toxic metals, radioactive isotopes • Assist in design of explosion suppression systems • Evaluate products liability loss exposures • Complex loss control problems 6 - 11 Developing Programs • Complete evaluation of insured’s operation • Assist insured in establishing goals • Selecting appropriate measures • Monitoring • Consultation – ongoing periodically 6 - 12 Factors Affecting Service Levels • Line of Insurance • Commercial insured size • Potential legal liability • Unbundled services 6 - 13 Service Levels • Mostly commercial • Types of exposures – noise levels, toxic metals, explosion suppression systems and fire extinguishing systems • Potential legal liability – Nelson vs. Union Wire Rope Corporation 1994 use of disclaimers 6 - 14 Cooperation Between Risk Control & Other Functions • • • • • Underwriting Marketing and sales Premium auditing Claims producers 6 - 15 Agents & Brokers • Agent and brokers – coordinate program • Large brokers – provides service equal to that of large insurance companies – Must coordinate • Unbundled – companies and brokers 6 - 16 Premium Auditing • Obtain information with which to calculate premiums and to establish future rates • To determine the actual insurance exposure for the coverage provided and render a precise report 6 - 17 Reasons • A variable premium base • Exposure units • Payroll, gross sales, area, receipts, admissions, vehicle, mileage, values, and more • Difficulty in predicating actual number 6 - 18 Reasons (cont.) • Determining correct premium • Regulatory requirements – mostly workers’ compensation • Collect ratemaking data • Inhibiting fraud • Reinforce confidence of insureds 6 - 19 Process • • • • • • • • Voluntary vs. Field Audits Planning Reviewing operations Determining employment relationship Finding and evaluating books and records Auditing the books and records Analyzing and verifying premium – related data Reporting findings 6 - 20 Importance of Accurate Audits • To insured • Goodwill • To insurer • Efficiency • Financial position • Collections • Customer retention • Insurance rates 6 - 21 Premium Audit & Other Functions • Underwriting – proper classifications and price • Account – desirability reflects management • Marketing – may be only person from insurance company seen • Claims – verify employment • Risk control 6 - 22