BUSINESS LAW II

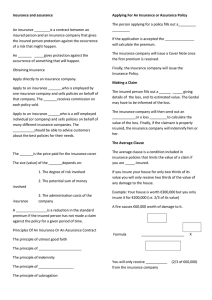

advertisement

Business Law II Chapter 19 INSURANCE LAW– GOTCHA COVERED 1. 2. ____________________ – written agreement made with an insurance company. In return for payment on the insurance, company agrees to pay you if _________________________________ occurs. Purchased in an attempt to avoid having to make large, unexpected payments when accident or illness occurs. a. ____________________ – the written agreement; provides maximum dollar amount for which company is liable b. ____________________ – the potential for loss arising from injury to or death of a person or from damage or destruction of property from a specified peril c. ____________________ – payment made for insurance coverage (usually paid monthly, semiannually, or annually); increases in cost as amount of coverage increases d. ____________________ interest – purchaser of insurance must be able to prove they would suffer ____________________ if the insured property or person is injured or dies 1) In ____________________, anyone who would suffer a direct and measurable ____________________ loss can insure the property 2) In _____________, one must demonstrate there is a _______________ _________________ they would suffer direct financial loss. Creditors may insure their debtors, businesses may insure __________________________, spouses may insure one another, etc. Common Types of Insurance a. ____________________ Insurance – pays ____________________ a set amount upon the death of a specified person 1) ____________________ Insurance – written for a certain number of years. Beneficiary receives face value if insured dies within the policy term. If term ends before death of insured, there is no obligation to pay. ____________________ insurance is the least expensive….as the policy gets older, it pays less in a claim. Business Law II b. Chapter 19 2) ____________________ Life Insurance – AKA as ordinary or straight life insurance. Requires constant premium payments for life of insured or until age 100. Portion goes into savings program against which insured can borrow. 3) ____________________ Life Insurance – time typically runs until retirement age. Beneficiary receives face value if insured dies during term. If insured lives to end of term, policy owner is paid (endowed) with face value of policy. 4) ____________________ – typically excuse insurer from obligation to pay death benefit under certain situations (death caused in crash of private plane, terrorism, military service, etc.) 5) ____________________ Clause – Prohibits insurer from refusing to perform due to misrepresentation or fraud after policy has been in effect (often one or two years). 6) ____________________ Period – Time in which overdue premium can still be paid and keep policy in effect. 7) ________________________________ – Provision can be added requiring insurer to pay twice the face amount if death is accidental. ____________________ Insurance – Coverage for loss or damage due to fire and smoke. 1) ____________________ fire policy covers direct loss resulting from fire, lightning strike or removal of items from premises endangered by fire 2) ____________________ – AKA ____________________; attached to standard policy to extend coverage and make it unnecessary to determine how much damage comes from one type of event over another (windstorm, hail, explosion, riot, etc.) 3) Proving loss is three-fold: a) There was an ____________________ fire. Business Law II 4) c. Chapter 19 b) Actual fire was ____________________. (Started by accident, negligence or deliberate act uncontrolled by insured; or friendly fire that becomes uncontrollable. c) Fire was the ________________________________ —natural and forseeable cause of the loss. ____________________ – clause that requires insured to maintain coverage equal to a certain percentage of total current value of property. ____________________ Insurance – Coverage for situations which may be intentional, negligent, or accidental acts of others as well as mere chance. 1) Insurance against ____________________ activity – embezzlement, burglary, fraud, etc. 2) ____________________ insurance – indemnifies for losses arising from ownership and operation of motor vehicles a) ____________________ coverage – covers insured when accused of negligent ownership, maintenance, or use of a motor vehicle. (1) Extends to borrowed cars (with owner’s permission) and when insured has loaned his/her car to another. (2) Pays for bodily injury/death of third parties and damage to property of third parties b) _________________________________________ coverage – pays for medical claims of occupants of insured’s vehicle who are injured. Also covers insured when in another’s vehicle; also while walking, bike riding, etc. c) ____________________ insurance – provides coverage for insured’s own vehicle when colliding with another object or overturning. d) ____________________ insurance – indemnifies against all other damage (fire, theft, water, vandalism, hail and glass breakage). Business Law II Chapter 19 e) ____________________ motorists coverage – allows insured to collect from own insurance when person causing the damage has no insurance. f) ____________________ motorists coverage – compensates insured when negligent driver does not have sufficient coverage. g) ____________________ insurance – some states require parties involved in an accident to be covered by their own insurance company, regardless of who was at fault. (If medical claims exceed set amount, injured party can sue.) h) ____________________ clause – extends auto insurance coverage to members of the insured’s household. i) Reading the numbers: (1) 3) 4) d. 50/100/50 = bodily injury $50,000 per ____________________ = bodily injury $100,000 per ____________________ = ____________________ damage $50,000 ____________________ insurance – provides protection against claims from those who are injured as a result of negligence or other torts committed by the insured. a) Is a major part of auto insurance (____________________ ) as well as homeowner’s and renter’s insurance. b) Personal service providers such as beauticians are wise to carry liability insurance. c) ____________________ insurance is another type of liability coverage – protects ____________________ (doctors, lawyers, etc.) against malpractice claims brought by patients/clients. ____________________, ____________________, or ____________________ insurance – provide coverage for hospital bills and loss of income resulting from accident or illness ____________________ Insurance – provisions of the Social Security Act and others Business Law II Chapter 19 1) ____________________ Insurance – eligible person can begin receiving Social Security retirement insurance as early as age 62. Those born in 1960 or after cannot collect until age 67. 2) ____________________ Insurance – widow, widower, and dependent children can receive benefits 3) ____________________ Insurance – must establish that the condition is physical/mental and expected to continue indefinitely or result in death. 4) Health Insurance (____________________) – provides two basic programs a) Hospital insurance to pay for hospitalization and follow-up treatment b) Medical insurance to pay for physician services, ambulance, etc. e. ____________________ Insurance – protects against loss of or damage to vessels, cargo and other property exposed to sea perils. (oldest type of insurance) f. _________________________ Insurance – originally covered personal property while being transported anywhere but on the ocean, as across land or inland waterways. g. 1) Now designed to cover whether in transport or not, but the carrier (car, plane, train, is not covered) 2) ______________________________ was added – covers any and all of insured’s personal property against almost any peril regardless of location. 3) Term ____________________ means that the protection floats with or follows the property. ____________________ Insurance – purchased to provide protection from loss when homes are damaged 1) Covers damage from fire, vandalism, theft, etc. Business Law II 3. 4. Chapter 19 2) Also protects from loss due to ____________________ (i.e. wind and lightning; some areas will also provide earthquake and flood insurance at additional rates) 3) Includes ____________________ insurance – protects you if someone is injured while on your property, even if you are careless 4) ____________________ insurance is similar coverage, for those who do not own their property (protects contents of house or apartment; includes liability insurance) h. ____________________ and ____________________________ Insurance – provides protection against financial loss caused by dishonesty. i. ____________________ Insurance – covers ____________________ expenses from _________________________________ 1) May ____________________ certain illnesses or types of treatment 2) Many ____________________ provide some coverage 3) ____________________ – those kinds of expenses which are paid a) Some provide hospital costs, doctor bills, special expenses like ambulance service, etc. b) Some pay to the policy holder an amount of money for each day of illness or injury Insurer of ______________________________ – Lloyd’s of London a. Famous for insuring _________________________, such as dancers’ legs, pianists’ fingers, etc. b. At one time, there was nothing they wouldn’t cover. Insurance industry is spreading out into an even broader range of coverage areas – ____________________ insurance, ____________________ insurance, ____________________ insurance, ____________________ insurance, ___________________________________ insurance, etc.