Fish Aquaculture questionaire (Word Document)

advertisement

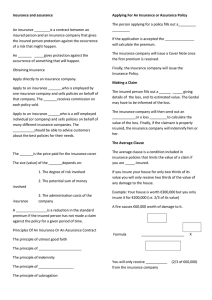

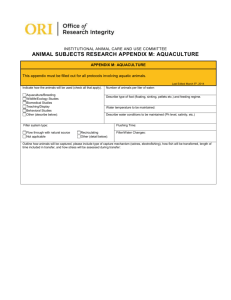

Aquaculture Facility Insurance Scheme KNOWLEDGE AND EXPERIENCE At Brennan Insurances we recognise that knowledge and experience are what matters when it comes to the aquaculture industries. The risks cannot be considered in the same manner as high volume, homologous classes of business such as motor insurance. Each aquaculture facility is unique and has its own risk profile. Over the years we have gained a wealth of experience in the challenges and risks presented by this industry and have continually developed our products and services to maximize protection for our customers, at the fairest price. NEW AQUACULTURE FACILITY As part of our commitment to continually improve the cover and service we are delighted to advise that we have arranged a new facility with the following benefits: Security is 100% Lloyd’s of London / RSA plc, both global leaders with excellent Financial Ratings. Capacity of €12,000,000 any one location. Cover can be offered on specified perils or “all risks” basis and may be written 100% or as a subscription line. Facility currently writing Irish based risks. This facility can include cover for stock mortality and marine equipment/hull. Additional Insurance requirements (both inland / off shore will be provided under our “sister” Fish Processing Facility) Significant point of difference to the historical Lloyd’s / RSA plc. aquaculture insurance market is that a large capacity may be committed by Underwriters who has a long and detailed experience of the class. Brennan Insurances will provide technical support and assistance to ensure that clients understand the technical nature of this product. Claims handling will be streamlined to allow a dedicated claims team (managed by Brennan Insurances) provide a streamlined service. This will allow Insurers to quickly establish their position regarding indemnity. For more information please contact: Liam Conlon Tel: Email: (01) 639 5580 or 086 2402128 liam.conlon@brennaninsurances.ie Eamonn Doherty Tel: Email: (01) 639 5580 or 087 2352435 Eamonn.doherty@brennaninsurances.ie Brennan Insurances, 12/14 Lower Mount Street, Dublin 2. Phone: 01 639 5580. Email: schemes@brennaninsurances.ie. Web: www.brennaninsurances.ie Brennan Insurances is regulated by the Central Bank of Ireland. Aquaculture Facility Insurance Scheme FREQUENTLY ASKED QUESTIONS Q.: Can all aquaculture units be insured? A.: In principle, yes. However, the rearing system must be one that will enable the client to keep good control of the stock so that accurate records can be produced to substantiate a claim. In addition, certain rearing systems and locations may be especially prone to certain risks and comprehensive cover will not, therefore, always be available. Q.: What does the insurance cover? A.: The stock policy covers mortality or physical loss of the insured animals as a result of a sudden and unforeseen event. Policies can either be arranged to cover “all risks” of mortality or loss (with certain exclusions) or against certain specified perils selected by the insured. Policies will normally include total loss of market value of the insured stock resulting directly from an identified pollution which renders it unfit for human consumption. Transit cover may be included within an annual rearing policy and stand-alone transit cover is available for larger operations. Q.: How does the policy valuation work? A.: The policies are written on an “agreed values” basis. This means that the policy includes a pre-agreed basis of valuation for stock in various size ranges. This valuation forms the basis for calculating the sum insured and any claims payment. The only exception to this formula is that the policy entitles the insurers to replace affected stock rather than paying cash in the event that they can do this at a lower cost than the preagreed basis of indemnity. Q.: How is the basis of indemnity worked out? A.: The principle of the insurance is that the client will be indemnified for the anticipated value of their stock. For stock up to market size, this value is production cost. Once the stock achieves a size at which it has a genuine sales value, the indemnity should reflect sales value (less any savings in processing and transportation which will not be incurred in the event that stock dies on site). Insureds can establish a number of valuation bands which may be based on stock age, size or weight, depending on how they keep their stock records. These bands should be designed to work in with the points in the production cycle at which stock are graded or counted. Q.: What happens if I have a loss? A.: In the event of a loss, the insurers will send an independent Loss Adjuster to evaluate the facts and the amount of a loss. Each month the insured is obliged to send in declarations of the stock numbers and sizes that have been on site in the preceding month. This information forms the starting point for loss evaluation. The policy document also provides guidance as to what the insured should do in order to assist in validating the cause and extent of loss. Q.: How do I calculate the sum insured? A.: The sum insured must reflect the maximum insured value that the insured anticipates will be exposed during the policy period. If this figure is not high enough at the time of loss, the claims payment will be severely reduced. Insurers accept that stocking and harvesting plans can change and that this value is an estimate, which can possibly be amended during the currency of the contract if growth, mortality or marketing plans are different to what was originally projected. In order to work out this figure, the insured must project the number and size of stock which will be Brennan Insurances, 12/14 Lower Mount Street, Dublin 2. Phone: 01 639 5580. Email: schemes@brennaninsurances.ie. Web: www.brennaninsurances.ie Brennan Insurances is regulated by the Central Bank of Ireland. Aquaculture Facility Insurance Scheme exposed during each month of the policy, taking account of anticipated growth, normal mortality, introduction of new stock and harvesting regime. The insured basis of indemnity should then be applied to the stock projections in order to calculate the anticipated value at risk in each month of the policy period. The largest monthly value is the sum insured. Q.: How about premium? A.: Each aquaculture risk is unique and the premium rate will therefore vary from farm to farm, even for identical levels of cover. In addition, each client has different preferences for the type of cover that they wish to purchase and the premium that they can afford to pay. Each policy is therefore a tailor-made contract combining the best combination of cover and cost for that specific client. For most farms the policies are arranged on an adjustable basis which means that a deposit premium is paid initially and the final premium cost is calculated at the end of the year, by applying the premium rate to the actual values that have been exposed under the policy. Q.: How big does a loss have to be before the policy will pay out? A.: Aquaculture is a high risk industry and if the insurance were to pay for each individual animal that died, the premium cost would be prohibitive. Each policy therefore contains a self-insured retention. This normally takes the form of a deductible calculated as a percentage of the value at risk at the time of loss (not as a percentage of the total sum insured or the loss amount). The precise size and means of application of this percentage will vary from client to client and has a large impact on the premium cost. This is an important aspect of the policy design and Brennan Insurances will Brennan Insurances, 12/14 Lower Mount Street, Dublin 2. Phone: 01 639 5580. Email: schemes@brennaninsurances.ie. Web: www.brennaninsurances.ie Brennan Insurances is regulated by the Central Bank of Ireland. l work with clients to establish a suitable balance between risk retention and cost. Q.: What is the procedure for obtaining a quotation? A.: Because each aquaculture operation is different and they all have their own particular risk profile, it is necessary to gather a lot of information to enable the Underwriter to assess the risk. Although a pre-risk survey is sometimes required, most insured’s are reluctant to pay for such a survey until they know that they will receive realistic insurance terms. The normal procedure is, therefore, for the client to complete a detailed application form and supply additional information (such as location maps, diagrams, photographs and stock value projections). The Underwriters will evaluate this information and calculate the terms and conditions that they are prepared to offer and the cost of this cover. A variety of different options from an expensive but very responsive contract to a more affordable catastrophe only cover may be obtained. Terms will sometimes be offered subject to a survey within a certain period of the policy start date and with a condition that any requirements of the survey are complied with or the terms may be varied. Quotations will be provided with no obligation to the client to purchase any form of cover. Q.: What is the security rating and global licensing position of the facility? A.: As the risk carriers for GAIC are all Lloyd’s syndicates / RSA plc, the facility has a Standard and Poors Security Rating of A+. It is licensed to underwrite business in 79 territories and can accept risks from over 200 countries and territories in all parts of the World. Aquaculture Facility Insurance Scheme Fish Farm Questionnaire Please complete and return this form to Liam Conlon or Eamonn Doherty By Email to: schemes@brennaninsurances.ie By Post to: 12/14 Lower Mount Street, Dublin 2 By Fax to: (01) 639 5590 Proposer Name Proposer Address Date Established Site Location No of Cages Construction of Cages Method of Feed Stock Details Type Quantity Projected Value Organic/ Non Organic 5 Year Claims History Signed: Print Name: Brennan Insurances, 12/14 Lower Mount Street, Dublin 2. Phone: 01 639 5580. Email: schemes@brennaninsurances.ie. Web: www.brennaninsurances.ie Brennan Insurances is regulated by the Central Bank of Ireland. Date: