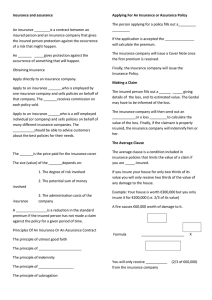

ST. ANDREW’S ANGLICAN SECONDARY SCHOOL INSURANCE TOPIC POB FORM 5 OCTOBER 2024 Copy notes into your books Definition of Insurance A contract in which one party agrees to pay for another party’s financial loss resulting from a specified event. Purpose of Insurance i. ii. iii. iv. To provide compensation to those who suffer a loss To put persons back in a position they would have been in To promote trade – risk taking To relieve individuals and businesses from some risks or burdens they face Parties of insurance i. ii. The insurer – the insurance company The insured – the person to be protected PRINCIPLES UPON WHICH INSURANCE IS BASED i. ii. iii. iv. Pooling of Risks Insurable Interest Utmost Good Faith Indemnity Explanations I. Pooling of Risks – various persons of same insurance contribute a sum of money (premium) to a fund (pool). When a contributor suffers a loss he or she is compensated from that pool II. Insurable Interest – the chance of suffering financially if an event occur must be directly related to the insured 1 III. Utmost Good Faith – parties must be truthful in the supplying of information and in the declarations made IV. Indemnity – a policy holder is compensated for the loss incurred and is put back into the position he or she was in before the loss or damage occurred Aspects of Indemnity i. No profiteering – any monies received in compensation should not be geared towards making a profit ii. Over Insurance – if the insured overs insures an item ( more than the true value) he or she will only be compensated for the true value iii. Under Insurance – if the policy holder undervalues the item. In the event of a loss he or she will be compensated for the amount paid against the claim iv. Subrogation – means ‘takes the place of’. If the loss suffered and the item is too badly damaged to be repaired, the monies paid by the insurance company takes the place of the item and the insurance takes the damaged item v. Contribution – in cases where there is ‘over lapping’ of policies (one event covered by two companies), each company is liable to pay the proportion in the amount of insurance placed with each company vi. Proximate Clause – insurance policy may cover a particular risk that is not directly related to the terms of the contract but closely related to the original event BRANCHES OF INSURANCE OR TYPES OF INSURANCE POLICIES 1. (a) Life Polices Life Assurance 2. (a) (b) (c) (d) Non-Life Policies Marine Motor Business Fire and Accident 2 Explanations I. Life Assurance – a contract between a policy holder and an insurance company where the company promises to compensate a beneficiary upon death of the insured NB - Beneficiary – a legal entity who receives money or benefits from a benefactor - Benefactor – a person who gives some form of benefit to a person, group or organization Types of Life Assurance (a) Whole Life Policy – a policy that provides compensation upon the death of the insured (b) Endowment – a policy that pays a lump sum after a specific term (maturity) and or upon death of the insured II. Marine Insurance – policy that covers loss or damage to ship or cargo Types of Marine Insurance (a) Hull (Body) Insurance – covers damage to the vessel itself and all its machinery and fixtures (b) Cargo Insurance – covers the load the ship is carrying (c) Freight Insurance – covers the possibility that the shipper does not pay the ship owner to transport the goods (d) Owner’s liability – covers the owner, crew and passengers against events III. Motor Insurance – a contract which provides compensation for loss to the owner’s vehicle, damage to property and other’s property Types of Motor Insurance (a) Third Party – a policy that insures the liability for damage to other people’s vehicle and their property (b) Comprehensive – a policy that is inclusive of third party and also provides compensation for damage to the vehicle of the insured 3 IV. Business Insurance – insurance coverage that protects businesses from losses due to events Types of Business Insurance (a) Liability – covers the risk or loss or the injury of someone else Types of Liability i. Employer’s liability – covers loss or damage or injury of workers during the course of business ii. Public Liability – covers individuals and members of the public visiting the premises (b) Property – covers the building and items or its contents (c) Credit – covers losses resulting from bad debt; failure of customers to pay for goods taken on credit (d) Fidelity – taken out to protect against loss by fraud and stealing by employees (e) Business Interruption or Consequential loss – provides coverage for losses as a result of business being suspended and or loss of earnings V. Fire and Accident – policies that covers mainly fire, combined with other risks, theft, storm, flood etc. Type(s) of Accident Insurance (a) Personal Accident and Sickness – policies taken out against death or disabilities resulting from special circumstances (plane crash, camping trip etc.) KEY CONCEPTS 1. Difference between assurance and insurance Assurance is a contract between an insured and an insurer to protect against risks that are inevitable (bound to happen) Whereas 4 Insurance is a contract between the insured and an insurer to protect against risks that are unforeseen (may not happen, unexpected) 2. Difference between insurable risks and uninsurable risks Insurable risks are risks that can be assessed in value because there is data which can be used to calculate the probability that such a risk will occur Whereas Uninsurable risks are risks that cannot be assessed or the probability of that event occurring cannot be calculated The Insurance Process Insurance is provided by: i. Insurance Companies - businesses that provides coverage, in the form of compensation resulting from loss, damages, injury, treatment or hardship in exchange for premium payments. ii. Friendly Societies – a mutual association owned by its members who provide insurance and other benefits iii. National Government through the National Insurance Scheme NB: (A) Underwriters – a person or company who evaluates risk and provides risk coverage (b) Actuary – analyses statistics and used them to calculate risks and premiun Diagram of the Insurance Process Explanation i. Prospectus – leaflet or document used to advertise or give details of policies ii. Forms that tell the insurance company what risk(s) the person buying proposes to insure against iii. Premium – the charge by the insurance company for their services iv. Policy – the document showing the contract or agreement 5 Other documents issued with the policy i. Certificate of Insurance – evidence that the insurance has been put into effect ii. Cover Note – temporary document provided whilst the certificate of insurance is being prepared iii. Endorsement – notice of an amendment to the policy iv. Renewal notice – invitation to the insurer to renew the cover note and advising the renewal of the premium and the date due NB: The Claim Form – form submitted by the insured to the insurer HOW INSURANCE FACILITATES TRADE Business persons can take more risks when they are able to recover losses if the business fails or there is a disaster. Insurance lowers the risk associated with business. 6