MBA Module 3 PPT

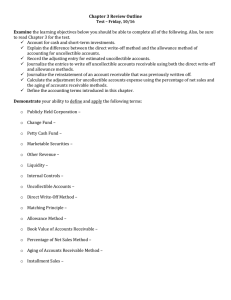

advertisement

Week 5 Revenue Recognition and Receivables Revenue Recognition Revenue recognition refers to the recording of revenue by a company GAAP has two revenue recognition criteria that must be met for revenue to be recognized (and recorded on the income statement)—revenue must be: 1. Realized or realizable 2. Earned Cisco’s Revenue Recognition Policy SEC Guidelines for Revenue Recognition SEC outlines its guidance for revenue recognition in Staff Accounting Bulletin (SAB) 101, where it states that revenue is realized, or realizable, and earned when each of the following criteria are met: 1. 2. 3. 4. There is persuasive evidence that a sales agreement exists, Delivery has occurred or services have been rendered, Seller’s price to the buyer is fixed or determinable, and Collectibility is reasonably assured. Revenue Recognition Challenges Some serious revenue recognition challenges are: Revenue recognition upon delivery pending execution of sales agreements. Gross vs. Net. Sales on consignment. Failure to take delivery. Nonrefundable fees. Channel stuffing. Mischaracterizing extraordinary or unusual transactions as revenue. Mischaracterizing transactions as “arm’s-length.” Selling undervalued assets. Percentage-of-Completion For certain industries requiring long-term contacts, revenue is recognized using the percentage-of-completion method, which recognizes revenue by determining the costs incurred to date compared with the project’s total expected costs. Percentage-of-completion method of revenue recognition requires an estimate of total anticipated costs. Percentage-of-Completion Example Cash The cash account is the first asset listed in the current asset section of the balance sheet. It consists of coin, checks, and bank drafts received by the company. Helpful Tip Transpositions occur when you switch the place of numbers (e.g., 79 becomes 97, 157 becomes 517, 6794 becomes 7649, 16945 becomes 61954) A simple trick can identify this as the reason things do not reconcile Proper Management of Cash Proper management requires that enough cash be available to meet the needs of the company’s operations. Too much cash is undesirable as it loses purchasing power in periods of inflation. Accounts Receivable Accounts receivable are reported on the balance sheet of the seller at net realizable value, which is the net amount the seller expects to collect. Gross amount less an allowance for uncollectable accounts Sellers realize that they will not be able to collect on all of the accounts that are owed to them and they must therefore match this bad debt expense with the sales revenue. Is it optimal to have no bad debts? Allowance for Uncollectible Accounts There are two widely accepted methods to estimate the amount of accounts receivable that will not be collected: Aging schedule Percentage of sales A third method, direct write-offs, is not allowable per GAAP Percentage of Sales Estimate of bad debt expense is computed as a percentage of credit sales. Example: If sales are $100,000 and we expect 2% will not be collected, then our estimate of bad debt expense will be $2,000 The other side of this entry is to increase the allowance for bad debt account. Aging Schedule When aging the accounts, an analysis is prepared of the receivables as of the balance sheet date. Each customer’s account balance is categorized by the number of days or months the underlying invoices have remained outstanding. Based on prior experience or on other available statistics, bad debts percentages are applied to each of these categorized amounts, with larger percentages being applied to older accounts. Aging Analysis Example Write-off of Uncollectible Accounts The write-off of an uncollecitble account does not affect income. The amount written-off is reflected as a reduction of the account receivable balance and the allowance for uncollectible accounts: Reporting Accounts Receivable Accounts receivable are reported on the balance sheet at net realizable value, that is, the gross amount owed to them less the allowance for uncollectible accounts. Given our gross balance of $100,000 and estimated uncollectible accounts of $2,900, accounts receivable will be reported as follows: Bad Debt Expense Bad Debt Expense is equal to the increase in the allowance for uncollectible accounts. In our previous example, if no previous balance existed in the allowance for uncollectible accounts, the company would record a bad debt expense of $2,900. Analysis Implications: Adequacy of Allowance Account Companies are making two representations by reporting the accounts receivable (net) in the current asset section of the balance sheet: 1. 2. They expect to collect the total amount reported on the balance sheet. They expect to collect this amount within the next year (because of the classification as a current asset). Analysis Implications: Adequacy of Allowance Account The first issue, from an analysis viewpoint, is whether the company has adequately provisioned for its uncollectible accounts. Compare with the percentage the company reported in prior years. Compare with the percentage reported by other companies in its industry. Could be used for shifting income between years. Receivables Turnover Rate and Days Sales in Receivables The accounts receivables turnover (ART) rate is defined as A companion ratio is the Average Collection Period: Receivables management When companies sell to other companies, they offer credit terms, which are called sales on credit (or credit sales or sales on account). An example of a common credit term is 2/10, net 30. Why offer a discount for early payment? Receivables management (cont.) Factoring Pledging Securitization Earnings management Revenue recognition Receivables