P6 Aging Accounts Receivable (AGING)

advertisement

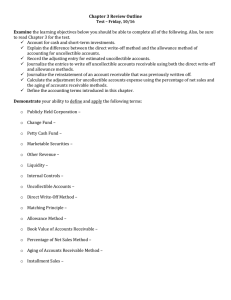

P6 Aging Accounts Receivable (AGING) P6 Aging Accounts Receivable (AGING) – begins on page 50 Three electronic files will be submitted for grading. Change the model only as instructed. Req 2 – enter Formulas 1–12 and use check figure of $1,460 for the total estimate uncollectible accounts expense, save as AGING2 Req 3 a. & b. – (applies the analysis of receivables method), begin with the balance before adjustment as given, then determine the amount necessary to adjust TO the uncollectible amount as previously determined in Req 2 of $1,460 Req 3 c. - (applies the percent of sales method), simply multiply the 2% by the credit sales amount of $70,000 which results in the adjustment amount Req 4 – (1) replace the October data with the November data, use the same order as listed in the textbook, and the formulas will recalculate the total estimated uncollectible accounts (2) answer the question with an explanation concentrating on change in AR and uncollectible accounts by age category, and the percent of uncollectible to total AR for the two months (3) save as AGING4 Req 5, Chart Analysis – the charts illustrate the aging of the accounts receivable, not the estimate of uncollectible accounts. Open AGING2 and AGING4 files, compare the charts, especially the “Not Yet Due”, “31-60 Days Past Due”, and “Over 90 Days Past Due” categories, and answer the questions in a. and b. Wksht Tickler – begin with the AGING4 file, add one more customer (Double Take Hair) between Attitudes for Hair and Hair Affair, if added in this row, no summation formulas need to be modified, save as AGINGT Chart Tickler – prepare a 3-D column chart to show the total estimated uncollectible amounts for each age category, use the CTRL key to identify non-adjacent data ranges, add titles as explanation of the chart, eliminate any unused legends