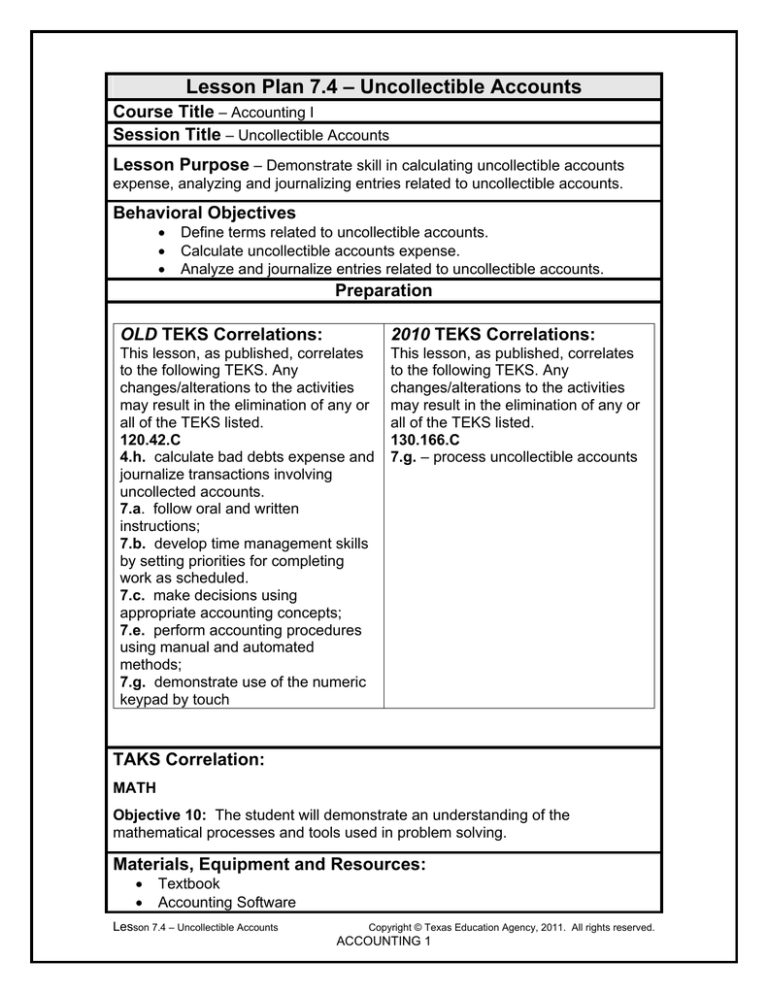

– Uncollectible Accounts Lesson Plan 7.4 Course Title Session Title

advertisement

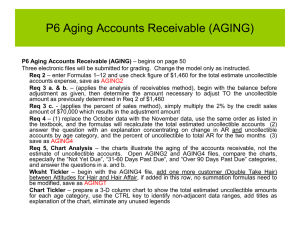

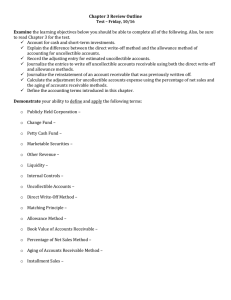

Lesson Plan 7.4 – Uncollectible Accounts Course Title – Accounting I Session Title – Uncollectible Accounts Lesson Purpose – Demonstrate skill in calculating uncollectible accounts expense, analyzing and journalizing entries related to uncollectible accounts. Behavioral Objectives Define terms related to uncollectible accounts. Calculate uncollectible accounts expense. Analyze and journalize entries related to uncollectible accounts. Preparation OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 4.h. calculate bad debts expense and journalize transactions involving uncollected accounts. 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled. 7.c. make decisions using appropriate accounting concepts; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 7.g. – process uncollectible accounts TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Accounting Software Lesson 7.4 – Uncollectible Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Journal Input Forms Spreadsheet Software Teaching Strategies: Observation Discussion Demonstration Verbal Drills Lesson Content: Demonstration and instruction on recording entries related to uncollectible accounts. Assessment: Observation Graded Assignments Additional Resources: Textbooks: Guerrieri, Donald J., Haber, Hoyt, Turner. Glencoe Accounting RealWorld Applications and Connections. Glencoe McGraw-Hill, 2000. ISBN/ISSN 0-02-815004-X. Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 Accounting Multicolumn Journal Anniversary Edition, 1st Year Course. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43524-0 Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 General Journal Accounting Anniversary Edition, 7th Edition. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43529-1. Websites: Allowance for Uncollectible Accounts – Dictionary of Small Business. Trautmann, Carl O, 1994-2009. http://www.small-businessdictionary.org/default.asp?term=ALLOWANCE+FOR+UNCOLLECT IBLE+ACCOUNTS. Estimating Uncollectible Accounts. Credit Research Foundation, 2009. http://www.crfonline.org/orc/ca/ca-13.html. Great Ideas – Uncollectible Accounts: Example Applying the Allowance Method. Southwestern College Publishing, 2009. http://www.swcollege.com/acct/car/gita/uncollectible_accounts_exa mple.html Business Partners: Loan officers from a bank Collection Agency officer Lesson 7.4 – Uncollectible Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Lesson 7.4 – Uncollectible Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 7.4.1 – Adjustments for Uncollectible Accounts Course Title – Accounting I Session Title – Uncollectible Accounts Activity Purpose – Demonstrate skill in analyzing and journalizing adjustments for uncollectible accounts at the end of the fiscal period. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C.4.c. determine and record uncollected accounts receivable; 4.h. calculate bad debts expense and journalize transactions involving uncollected accounts. 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.c. make decisions using appropriate accounting concepts; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 3.e. – use T accounts; 7.g. – process uncollectible accounts TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Accounting Software Teaching Strategies: Observation Verbal Drill Activity 7.4.1 – Adjustments for Uncollectible Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: 1. Ask students to read about uncollectible accounts either from the textbook or from a Web site you reference. 2. Discuss the risk of loss that occurs when a business sells on account. Explain the need to make adjustments and the possible result if this is not done. 3. Demonstrate the balance side and increase and decrease side of Uncollectible Accounts Expense using a “T” account. Demonstrate the contra asset Allowance for Uncollectible Accounts using a “T” account. 4. Explain how a business determines the amount to estimate for uncollectible accounts. 5. Ask students to analyze this situation and answer questions verbally: TK Phones, Inc. estimates their uncollectible accounts at the end of each fiscal period. They use 2% of total sales. Total sales for the current fiscal period were $27,596.00. What is the amount of the adjustment? What account is debited? What account is credited? If Accounts Receivable has a current balance of $22,500.00, what is the book value of Accounts Receivable after the adjusting entry? If this adjustment is not made, what is the effect on expenses for the fiscal period? If this adjustment is not made, what is the effect on assets for the fiscal period? What is the source document for this entry? 6. Have your students journalize the above adjusting entry using an input form. Assessment: Observation Graded Assignment Quality Feature Participates in class discussion Verbal question answers accurate Journalized the adjusting entry accurately Completes in a timely manner Activity 7.4.1 – Adjustments for Uncollectible Accounts Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 7.4.2 – Collection Procedures Course Title – Accounting I Session Title – Uncollectible Accounts Activity Purpose – Research collection procedures for businesses. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C.7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C N/A TAKS Correlation: READING Objective 1: The student will demonstrate a basic understanding of culturally diverse written texts. WRITING Objective 5: The student will produce a piece of writing that demonstrates a command of the conventions of spelling, capitalization, punctuation, grammar, usage, and sentence structure. Objective 6: The student will demonstrate the ability to revise and proofread to improve the clarity and effectiveness of a piece of writing. Materials, Equipment and Resources: Textbook Internet Guest Speaker Poster Board Markers Teaching Strategies: Observation Discussion Activity 7.4.2 – Collection Procedures Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: 1. Research this site: http://www.nrc.gov/reading-rm/doccollections/cfr/part015/. If the site is not available, locate another site by searching the Internet. Take notes on steps used to collect on past due accounts. 2. Invite a guest speaker who has knowledge about procedures in collecting on past due accounts. 3. Have your students break into a team of 3 or 4 and create a poster outlining their collection procedures for a business. 4. Ask the team to present their poster to the class. Assessment: Observation Graded Assignment Quality Feature Appropriate behavior during guest speaker’s visit Notes taken from the Web site were appropriate and useful in providing procedures for debt collection Participates as a team member in the team activity Poster thorough, neat, and logical in sequence Completes in a timely manner Activity 7.4.2 – Collection Procedures Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 7.4.3 – Journalizing Uncollectible Account Transactions Course Title – Accounting I Session Title – Uncollectible Accounts Activity Purpose – Develop skill in analyzing and journalizing transactions in writing off accounts or collecting from accounts that have been written off. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C. 4.c. determine and record uncollected accounts receivable; 4.h. calculate bad debts expense and journalize transactions involving uncollected accounts. 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 7.g. – process uncollectible accounts TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Input Forms Multimedia Presentation Software Teaching Strategies: Observation Demonstration Verbal Drills Activity 7.4.3 – Journalizing Uncollectible Account Transactions Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: 1. Discuss the two transactions that can occur in uncollectible accounts other than the adjusting entry: a. Writing off an account when it becomes a known bad debt. b. Collecting on an account that was written off. 2. Demonstrate the analysis of Writing off an Account by using “T” accounts and an Uncollectible Accounts presentation. 3. Have students journalize the example in an input form. Assessment: Observation Graded Assignment Quality Feature Student participates in class discussion Verbal drills answers accurate Journal entry in the input form accurate Completes in a timely manner Activity 7.4.3 – Journalizing Uncollectible Account Transactions Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1