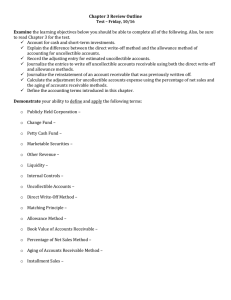

p_16_week_1_directions

advertisement

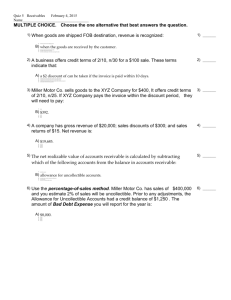

P 16-9A (1b Dr. Bad Debt Exp. $6,620) Uncollectible Accounts Percentage of Sales and Percentage of Receivables. At the completion of the current fiscal year ending December 31, the balance of Accounts Receivable for Yang’s Gift Shop was $30,000 Credit sales for the year were $355,200. Required: Make the necessary adjusting entry in general journal from under each of the following assumptions. Show calculations for the amount of each adjustment and the resulting net realize value. 1. Allowance for Bad Debts has a credit balance of $330. a. The percentage of sales method is used and uncollectible accounts are estimated to be 2.0% of credit sales. b. The percentage of receivables method is used and an analysis of the accounts produces an estimate of $6,950 in uncollectible accounts. 2. Allowance for bad debts has a debit balance of $400. a. The percentage of sales method is used and uncollectible accounts are estimated to be 1.5% of credit sales. b. The percentage of receivables method is used and an analysis of the accounts produces an estimate of $5,685 in uncollectible accounts. P 18-7A (Depr exp. For year 8 (a) 7,000.00 (b) 1,968.89 (c) 1,555,56 Straight Line, Declining Balance and Sum of The Years Digits Methods. A machine is purchased January 1 at a cost of $59,000. It is expected to serve for eight years and have a salvage value of $3,000. Required: Prepare a schedule showing depreciation for each year and the book value at the end of each year using the following methods: a. Straight line b. Double declining balance (round to two decimal places) c. Sum of the years digits (round to two decimal places)