Exam Name___________________________________

advertisement

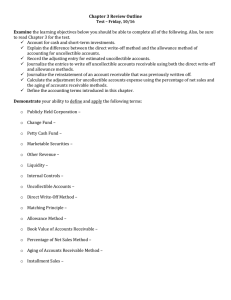

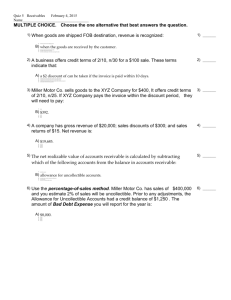

Exam Name___________________________________ MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Which of the following are the three computerized data processing steps in the order of their occurrence? A) Inputs, processing, outputs B) Cash sales, sales on account and cash receipts C) Processing, inputs and outputs D) Source documents, orders, and invoices 1) 2) Which of the following are considered hardware? A) Electronic equipment C) The server 2) B) The network D) All of the above 3) Where do inputs for the accounting system originate? A) Hardware B) Software C) Journal entries D) Source documents 3) 4) Which of the following is the beginning step in designing an accounting system? A) Classification of transactions B) Determination of menu structure C) The previous year's adjusted trial balance D) The chart of accounts 4) 5) Which of the following is the computerized posting of transactions on a continuous basis? A) Data warehouse B) Online processing C) Batch processing D) Enterprise Resource Planning 5) 6) Which of the following is generally used by small businesses? A) QuickBooks or Peachtree B) SAP, Oracle, or PeopleSoft C) Both of the above D) Neither of the above 6) 7) Which of the following is NOT a typical special journal in a manual accounting information system? A) Purchases journal B) Sales journal C) Accounts receivable journal D) Cash payments journal 7) 8) Which of the following are reasons to study a manual accounting system? A) Learning a manual system will help you understand accounting. B) Few small businesses have computerized all their accounting. C) Learning a manual system will equip you to work with both manual and electronic systems. D) All of the above. 8) 9) When should the individual amounts in the Accounts Receivable column in the Cash Receipts journal be posted to the Accounts Receivable Ledger? A) Monthly B) Daily C) Annually D) Weekly 9) 1 10) In which journal would a return of merchandise sold on account be recorded? A) The purchases journal B) The general journal C) The cash receipts journal D) The cash payments journal E) The sales journal 10) 11) Which of the following transactions is entered in the sales journal? A) A sale of merchandise for cash B) A sale of merchandise on account C) The return of merchandise purchased on account D) The return of merchandise purchased for cash 11) 12) Which of the following is the ledger containing the customers' individual accounts? A) The accounts receivable ledger B) The payroll ledger C) The general ledger D) The accounts payable ledger 12) 13) Which of the following accounts is debited for the total of the Cash column in the Cash Receipts Journal? A) The accounts receivable control account B) The inventory account C) The sales revenue account D) The cash account 13) 14) In which journal would the receipt of the proceeds from a note receivable (including accrued interest) be recorded? A) The sales journal B) The general journal C) The cash receipts journal D) The cash payments journal E) The purchases journal 14) 15) In which journal would the sale of merchandise on account be recorded? A) The sales journal B) The general journal C) The purchases journal D) The cash receipts journal E) The cash payments journal 15) 16) In which journal would the sale of merchandise for cash be recorded? A) The cash receipts journal B) The general journal C) The cash payments journal D) The purchases journal E) The sales journal 16) 17) When should the individual amounts in the Cash Payments journal be posted to the Accounts Payable Ledger? A) Daily B) Monthly C) Weekly D) Annually 17) 2 18) Which of the following are purposes of internal control? A) One of the purposes of internal control is to ensure accurate, reliable accounting records. B) One of the purposes of internal control is to encourage employees to follow company policy. C) One of the purposes of internal control is to safeguard the company's assets. D) All of the statements above are true. 18) 19) Which of the following is a requirement of the Sarbanes-Oxley Act? A) Public companies oversee the work of auditors of other public companies. B) The Public Company Oversight Board issues an internal control audit report for every publicly held company. C) Accounting firms may not both audit a public client and also provide certain consulting services for the same client. D) The outside auditor must issue an internal control report for each public company, and the Public Company Oversight Board evaluates the client's internal controls. 19) 20) Which of the following describes the internal control procedure "separation of duties"? A) Prenumber invoices and other documents. B) External auditors will monitor internal controls. C) Cashiers must not have access to accounting records. D) The information system is critical. 20) 21) Which of the following describes the internal control procedure "proper documents"? A) A company should purchase a fireproof vault. B) Prenumber invoices and other documents. C) Separate the custody of assets from accounting. D) Mandatory vacations will improve internal control. 21) 22) A security guard at a Wal-Mart costs about $28,000 a year. On average, each guard prevents about $50,000 of theft. Which of the following internal control concepts does this illustrate? A) Separation of duties B) Cost/benefit relationship C) Proper authorization D) Competent, reliable, and ethical personnel 22) 23) Which of the following is a security procedure designed for e-commerce which rearranges text messages by a mathematical process? A) Trojans B) Firewalls C) Phishing D) Encryption 23) 24) Which of the following is a common tactic to overcome internal controls? A) Collusion B) Firewalls C) Encryption D) Separation of duties 24) 25) Which of the following are the three parties to a check? A) The signer, the depositor, and the endorser B) The maker, the payee, and the bank C) The bank, the payee, and the IRS D) The bank, the maker, and the payor 25) 26) A check was written by a business for $205 but recorded in the cash payments journal as $502. How would this error be included on the bank reconciliation? A) A deduction on the bank side B) A deduction on the book side C) An addition on the book side D) An addition on the bank side 26) 3 27) The bank collected a note receivable of $1,000. How would this information be included on the bank reconciliation? A) An addition on the bank side B) A deduction on the book side C) A deduction on the bank side D) An addition on the book side 27) 28) Which of the following is TRUE of a bank reconciliation? A) A bank reconciliation should not be prepared by an employee who handles cash transactions. B) A bank reconciliation is part of a sound internal control system. C) A bank reconciliation is a formal financial statement. D) Both A and B are true statements. 28) 29) The following information is available for Matts Unlimited Company for the current month. What is the adjusted book balance on the bank reconciliation? 29) Book balance end of the month Outstanding checks Deposits in transit Service charges Interest revenue A) $5,525 B) $7,466 $5,575 584 2,500 75 25 C) $5,550 D) $5,500 30) A check of $75 deposited by a company was returned to the bank for nonsufficient funds. How would this information be included on the bank reconciliation? A) An addition on the bank side B) An addition on the book side C) A deduction on the book side D) A deduction on the bank side 30) 31) The bank charged a service fee of $20. How would this information be included on the bank reconciliation? A) A deduction on the book side B) A deduction on the bank side C) An addition on the book side D) An addition on the bank side 31) 32) The bank recorded a $2,000 deposit as $200. How would this information be included on the bank reconciliation? A) An addition on the book side B) A deduction on the book side C) An addition on the bank side D) A deduction on the bank side 32) 33) In which journal would a loan from the bank be recorded? A) The cash payments journal B) The purchases journal C) The sales journal D) The general journal E) The cash receipts journal 33) 34) Which of the following are considered software? A) The server B) The set of programs that store transaction data C) The set of programs that edit transaction data D) Both B and C 34) 4 35) A company received a bank statement with a balance of $5,350. Reconciling items included a bookkeeper error of $200 (a $300 check recorded as $500), two outstanding checks totaling $720, a service charge of $15, a deposit in transit of $180, and interest revenue of $21. What is the adjusted balance? A) $4,636 B) $5,016 C) $4,610 D) $4,810 35) 36) Which of the following demonstrates internal control over cash receipts? A) A mailroom employee sends remittance advices to the treasurer. B) A mailroom employee sends all customer checks to the treasurer who has the cashier make the bank deposit. C) A mailroom employee deposits all customer checks at the bank. D) All of the above demonstrate internal control over cash receipts. 36) 37) Where is the cash account included on the balance sheet? A) As a current asset B) As current revenue C) As a current expense D) As a current liability 37) 38) Which of the following is a fund containing a small amount of cash that is used to pay for minor expenditures? A) An expense fund B) A petty cash fund C) An expenditure fund D) A cash payments fund 38) 39) Which of the following would be included in the entry to record the replenishment of a petty cash fund? A) A debit to cash in bank B) A credit to petty cash C) A credit to various expenses and assets D) A credit to cash in bank 39) 40) A petty cash fund was established with a $250 balance. It currently has cash of $31 and petty cash tickets totaling $219. Which of the following would be included in the entry to replenish the fund? A) A credit to petty cash for $219 B) Debits to various expenses for $219 C) A debit to petty cash for $219 D) A credit to cash in bank for $250 40) 41) Petty cash is accounted for by maintaining a constant balance in the petty cash account, supported by the fund (cash plus payment tickets) totaling the same amount. Which of the following is this type of system? A) An imprest system B) A voucher system C) A control system D) A balanced system 41) 5 42) A petty cash fund was established with a $200 balance. The fund currently has cash of $32. It also has petty cash tickets for the following items. Which of the following entries would be the correct entry to replenish the fund? Office supplies Delivery expense A) Cash in bank Petty cash B) Office supplies Delivery expense Cash in bank C) Miscellaneous expense Cash in bank D) Petty cash Cash in bank 42) $54 114 168 54 114 168 168 168 168 168 168 43) Why are certified public accountants expected to maintain higher standards than society in general? A) Their ability to attract business depends entirely upon their reputation. B) They are only required to do so if they are auditing publicly held companies. C) They are required to do so by federal law. D) They are not employees. 43) 44) Which of the following is a disadvantage of selling on credit? A) Sales can be made to a more diverse group of customers. B) Profits are increased by making sales to a wide range of customers. Increased sales will result in greater profits since increased uncollectible accounts will be less than increased sales. C) Some customers do not pay, creating an expense. D) Both A and B are disadvantages of selling on credit. 44) 45) Which of the following are the two methods of accounting for uncollectible receivables? A) The asset method and the sales method B) The direct write-off method and the liability method C) The allowance method and the liability method D) The allowance method and the direct write-off method 45) 46) Which of the following are the two methods of estimating uncollectible receivables? A) The aging-of-accounts-receivable method and the percent-of-sales method B) The allowance method and the percent-of-sales method C) The direct write-off method and the percent-of-sales method D) The allowance method and the direct write-off method 46) 47) Which of the following entries would be used to account for uncollectible receivables using the direct write-off method? A) Uncollectible accounts expense is debited and allowance for uncollectible accounts is credited. B) Allowance for uncollectible accounts is debited and uncollectible accounts expense is credited. C) Uncollectible accounts expense is debited and accounts receivable is credited. D) Accounts receivable is debited and uncollectible accounts expense is credited. 47) 6 48) Which of the following is the income-statement approach to estimating bad debts? A) The percent-of-sales method B) The direct write-off method C) The aging-of-accounts-receivable method D) The allowance method 48) 49) The allowance for uncollectible accounts currently has a credit balance of $200. The company's management estimates that 2.5% of net credit sales will be uncollectible. Net credit sales are $115,000. What will be the amount of uncollectible-account expense reported on the income statement? A) $3,075 B) $2,875 C) $3,275 D) $2,675 49) 50) The allowance for uncollectible accounts currently has a debit balance of $200. The company's management estimates that 2.5% of net credit sales will be uncollectible. Net credit sales are $115,000. What will be the amount of uncollectible-account expense reported on the income statement? A) $3,275 B) $2,675 C) $3,075 D) $2,875 50) 51) The allowance for uncollectible accounts currently has a credit balance of $900. After analyzing the accounts in the accounts receivable subsidiary ledger, the company's management estimates that uncollectible accounts will be $15,000. What will be the amount of uncollectible-account expense reported on the income statement? A) $14,100 B) $14,900 C) $15,900 D) $15,000 51) Table 9.1 The following information is from the 2008 records of Armadillo Camera Shop: Accounts Receivable, December 31, 2008 Allowance for uncollectible accounts, December 31, 2008 prior to adjustment Net credit sales for 2008 Accounts written off as uncollectible during 2008 Cash sales during 2008 $20,000 (debit) 600 95,000 7,000 27,000 (debit) 52) Refer to Table 9.1. Uncollectible accounts expense is estimated by the percent-of-sales method. Management estimates that 3% of net credit sales will be uncollectible. Which of the following will be the amount of Uncollectible Accounts Expense? A) $3,450 B) $2,850 C) $7,000 D) $2,250 52) 53) Refer to Table 9.1. Uncollectible accounts expense is estimated by the aging-of-accounts-receivable method. Management estimates that $2,850 of accounts receivable will be uncollectible. Which of the following will be the amount of Uncollectible Accounts Expense? A) $2,850 B) $2,250 C) $3,450 D) $7,000 53) 7 Table 9.2 The following information is from the 2009 records of Rawhide Leather Products. Accounts Receivable, December 31, 2009 Allowance for uncollectible accounts, December 31, 2009 prior to adjustment Net credit sales for 2009 Accounts written off as uncollectible during 2009 Cash sales during 2009 $330,000 (debit) 4,500 1,500,000 25,500 270,000 (credit) 54) Refer to Table 9.2. Uncollectible accounts expense is estimated by the percent-of-sales method. Management estimates that 2% of net sales is uncollectible. Which of the following will be the adjusting entry to record uncollectible accounts expense for 2009? 34,500 A) Allowance for uncollectible accounts Accounts receivable 34,500 30,500 B) Uncollectible accounts expense Allowance for uncollectible accounts 30,500 25,500 C) Uncollectible accounts expense Accounts receivable 25,500 30,000 D) Uncollectible accounts expense Allowance for uncollectible accounts 30,000 54) 55) Refer to Table 9.2. Uncollectible accounts expense is estimated by the aging-of-accounts-receivable method. Management estimates that $35,000 of accounts receivable will be uncollectible. Which of the following will be the journal entry to record uncollectible accounts expense under the allowance method? 30,000 A) Uncollectible accounts expense Allowance for uncollectible accounts 30,000 34,500 B) Allowance for uncollectible accounts Accounts receivable 34,500 25,500 C) Uncollectible accounts expense Accounts receivable 25,500 30,500 D) Uncollectible accounts expense Allowance for uncollectible accounts 30,500 55) 56) A company has significant uncollectible receivables. Why is the direct write-off method unacceptable? A) It violates the matching principle. B) Assets are overstated on the balance sheet. C) Both A and B are true. D) Neither A nor B are true. 56) 57) On which of the following dates does a three-month note dated November 12 mature? A) February 10 B) February 13 C) February 12 D) February 11 57) 58) What is the maturity value of a note? A) The principal amount minus total interest due B) The face amount of the note C) The principal amount times the interest rate D) The principal amount plus interest due 58) 8 59) A company reports net accounts receivable of $107,460 on its December 31, 2009 balance sheet. The allowance for uncollectible accounts has a credit balance of $3,200. What is the balance in accounts receivable? A) $107,460 B) $110,660 C) $105,860 D) $104,260 59) 60) Which of the following is TRUE about the listing of assets in order of their liquidity on a balance sheet? A) Cash is listed first because it is the most liquid asset. B) Short-term investments are less liquid than short-term current receivables because the company must collect the receivables. C) Receivables are less liquid than merchandise inventory because the goods must first be sold. D) All of the statements above are true. 60) 61) A company has the following account balances. What is the acid-test ratio? 61) Cash Short-term investments Net current receivables Inventory Total current liabilities A) .70 $60,000 $75,000 $140,000 $145,000 $395,000 B) .94 C) .91 D) 1.06 62) Which of the following is the practice of selling a note before its maturity date? A) Discounting a notes receivable B) Dishonoring a notes receivable C) Netting a notes receivable D) Bartering a notes receivable 62) 63) On which of the following dates does a 90-day note dated August 26 mature? A) November 26 B) November 25 C) November 23 63) D) November 24 64) What is the maturity value of a 90-day, 12% note for $20,000? (Use a 360-day year.) A) $22,400 B) $20,000 C) $20,600 D) $21,200 9 64) Table 9.2 The following information is from the 2009 records of Rawhide Leather Products. Accounts Receivable, December 31, 2009 Allowance for uncollectible accounts, December 31, 2009 prior to adjustment Net credit sales for 2009 Accounts written off as uncollectible during 2009 Cash sales during 2009 $330,000 (debit) 4,500 1,500,000 25,500 270,000 (credit) 65) Refer to Table 9.2. Uncollectible accounts expense is determined by the direct write-off method. Which of the following will be the journal entry to record uncollectible accounts expense? 25,500 A) Uncollectible accounts expense Accounts receivable 25,500 30,500 B) Uncollectible accounts expense Allowance for uncollectible accounts 30,500 30,000 C) Uncollectible accounts expense Allowance for uncollectible accounts 30,000 34,500 D) Allowance for uncollectible accounts Accounts receivable 34,500 65) Table 9.1 The following information is from the 2008 records of Armadillo Camera Shop: Accounts Receivable, December 31, 2008 Allowance for uncollectible accounts, December 31, 2008 prior to adjustment Net credit sales for 2008 Accounts written off as uncollectible during 2008 Cash sales during 2008 $20,000 (debit) 600 95,000 7,000 27,000 (debit) 66) Refer to Table 9.1. Uncollectible accounts expense is determined by the direct write-off method. Which of the following will be the amount of Uncollectible Accounts Expense? A) $2,850 B) $2,250 C) $7,000 D) $3,450 66) 67) The allowance for uncollectible accounts currently has a credit balance of $200. The company's management estimates that 2.5% of net credit sales will be uncollectible. Net credit sales are $115,000. What will be the amount of allowance for uncollectible accounts reported on the balance sheet? A) $3,075 B) $2,875 C) $2,675 D) $3,275 67) 68) Which of the following is the balance-sheet approach to estimating bad debts? A) The allowance method B) The direct write-off method C) The percent-of-sales method D) The aging-of-accounts-receivable method 68) 10 69) Which of the following entries would be used to account for uncollectible receivables using the allowance method? A) Accounts receivable is debited and uncollectible accounts expense is credited. B) Uncollectible accounts expense is debited and accounts receivable is credited. C) Uncollectible accounts expense is debited and allowance for uncollectible accounts is credited. D) Allowance for uncollectible accounts is debited and uncollectible accounts expense is credited. 69) 70) Which of the following is the entry to establish a petty cash account? A) Miscellaneous Expense B) Cash in Bank Cash in Bank Petty Cash C) Miscellaneous Expense D) Petty cash Petty Cash Cash in Bank 70) 71) Which of the following would be considered an output of an accounting system? A) A balance sheet B) A journal entry C) An adjusted trial balance D) All of the above 71) 72) Which of the following is TRUE of the manual posting process? A) The total of the cost of goods sold column in the Sales Journal should be posted daily. B) Individual accounts receivable amounts form the Cash Receipts Journal should be posted monthly. C) Individual accounts receivable amounts from the Sales Journal should be posted daily. D) None of the above. 72) 73) Which of the following would be a legal consequence of violating the Sarbanes-Oxley Act? A) An executive of the company that is convicted of making false sworn statements could be sentenced to 20 years in prison. B) Internal control staff convicted of lack of independence could be sentenced to 25 years in prison. C) The Public Company Oversight Board could require that the external auditor replace the internal control staff of a company for 3 to 5 years. D) A company's internal control system could be dismantled and replaced by the Public Company Oversight Board. 73) 74) Which of the following describes the internal control component "risk assessment"? A) Risk assessment is designed to ensure that the business's goals are achieved. B) Internal auditors monitor company controls to safeguard assets, and external auditors monitor the controls to ensure that the accounting records are accurate. C) Risk assessment is the "tone at the top" of the business. D) A company must identify its risks. 74) 75) Which of the following describes the internal control procedure "competent, reliable and ethical personnel"? A) A company purchases burglar alarms. B) The information system is critical. C) A company must train and supervise high-quality employees. D) External auditors monitor internal controls. 75) 11 76) Which of the following describes the internal control procedure "assignment of responsibilities"? A) To validate their accounting records, a company should have an audit by an external accountant. B) External auditors monitor internal controls. C) Separate the custody of assets from accounting. D) With clearly assigned responsibilities, all important jobs get done. 76) 77) At the West Texas Clothing Store, a sales employee assists customers with finding the items the client wishes to purchase, ringing up the purchase and collecting the cash. At the end of the day, this employee counts the cash and fills out a cash-count form. Which internal control procedure is being violated by West Texas Clothing Store? A) To validate their accounting records, a company should have an audit by an external accountant. B) Separation of duties is necessary. C) Competent, reliable, and ethical personnel should be hired. D) Job rotation improves internal control. 77) 78) Which of the following are employees of the business? A) Insurance auditors B) Internal auditors C) IRS auditors D) External auditors 78) 79) Which of the following are particular problems that must be addressed in the internal controls for e-commerce? A) Phishing expeditions B) Stolen credit-card numbers C) Trojans D) All of the above 79) 80) Which of the following is a security procedure designed for e-commerce? A) Burglar alarms B) Fireproof vaults C) Firewalls D) None of the above 80) 81) Which of the following items will NOT appear on the books side of the reconciliation? A) The bank recorded a $2,000 deposit as $200. B) The bank charged a service fee of $20. C) A nonsufficient funds check of $75 returned to the bank. D) The bank collected a note receivable of $1,000. 81) 82) A company received a bank statement showing a balance of $62,300. Reconciling items were outstanding checks of $1,450 and a deposit in transit of $8,500. What is the company's adjusted bank balance? A) $69,350 B) $70,850 C) $60,850 D) $72,250 82) 83) Which of the following would be included in a journal to record an ns check? A) A debit to accounts payable and a credit to cash B) A debit to miscellaneous expense and a credit to cash C) A debit to cash and a credit to accounts receivable D) A debit to accounts receivable and a credit to cash 83) 12 84) Which of the following items would require an adjusting entry after preparation of the bank reconciliation? A) Errors made on the books revealed by the bank reconciliation B) All items on the bank's side C) Outstanding checks D) Errors made by the bank revealed by the bank reconciliation 84) 85) A check was written by a business for $329 but recorded in the cash payments journal as $239. How would this error be included on the bank reconciliation? A) A deduction on the bank side B) An addition on the book side C) A deduction on the book side D) An addition on the bank side 85) 86) A petty cash fund was established with a $300 balance. It currently has cash of $78 and petty cash tickets totaling $222. Which of the following would be included in the entry to replenish the fund? A) A credit to petty cash for $222 B) A credit to cash in bank for $300 C) Debits to various expenses for $222 D) A debit to petty cash for $222 86) Table 9.1 The following information is from the 2008 records of Armadillo Camera Shop: Accounts Receivable, December 31, 2008 Allowance for uncollectible accounts, December 31, 2008 prior to adjustment Net credit sales for 2008 Accounts written off as uncollectible during 2008 Cash sales during 2008 $20,000 (debit) 600 95,000 7,000 27,000 (debit) 87) Refer to Table 9.1. Uncollectible accounts expense is estimated by the percent-of-sales method. Management estimates that 3% of net credit sales will be uncollectible. Which of the following will be the amount of Allowance for Uncollectible Accounts after adjustment? A) $7,000 B) $2,850 C) $3,450 D) $2,250 87) 88) Refer to Table 9.1. Uncollectible accounts expense is estimated by the aging-of-accounts-receivable method. Management estimates that $2,850 of accounts receivable will be uncollectible. Which of the following will be the amount of Allowance for Uncollectible Accounts after adjustment? A) $3,450 B) $2,850 C) $2,250 D) $7,000 88) 89) Refer to Table 9.1. Uncollectible accounts expense is estimated by the percent-of-sales method. Management estimates that 3% of net credit sales will be uncollectible. Which of the following will be the amount of net accounts receivable after adjustment? A) $17,750 B) $17,150 C) $13,000 D) $16,550 89) 90) Refer to Table 9.1. Uncollectible accounts expense is estimated by the aging-of-accounts-receivable method. Management estimates that $2,850 of accounts receivable will be uncollectible. Which of the following will be the amount of net accounts receivable after adjustment? A) $17,150 B) $13,000 C) $17,750 D) $16,550 90) 13