The Objectives of Accounting: The Ontario Curriculum, Grades 11

advertisement

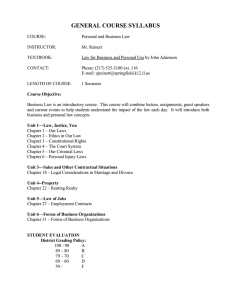

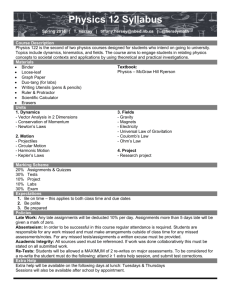

Assumption Catholic Secondary School Business Department Prerequisite: Grade 11 Financial Accounting Fundamentals, University/College, BAF 3M Instructor: Mrs. N. Laferriere (laferrierem@hcdsb.org) Text: Principles of Financial Accounting, Canadian Ed., Weygandt, Kieso, Kimmel, Trenholm, Kinnear, Barlow and Atkins. Wiley, 2014. Companion Website: www.wileyplus.com (student resources study corner) COURSE DESCRIPTION: This course introduces students to advanced accounting principles that will prepare them for postsecondary studies in business. Students will learn about financial statements for various forms of business ownership and how those statements are interpreted in making business decisions. This course expands students’ knowledge of sources of financing, further develops accounting methods for assets, and introduces accounting for partnerships and corporations. Students will also study various means of financing a business and ways in which the strength of a corporation can be determined through the reading of its annual report. THE OBJECTIVES OF ACCOUNTING: The Ontario Curriculum, Grades 11 and 12: Business Studies, 2006, (revised) The Accounting Cycle Overall Expectations - By the end of this course, students will: √ demonstrate an understanding of accounting principles and practices; √ demonstrate an understanding of the accounting cycle in a computerized environment for a service business and a merchandising business; √ demonstrate an understanding of ethics and issues in accounting. Accounting Practices for Assets Overall Expectations - By the end of this course, students will: √ demonstrate an understanding of accounting procedures for short-term assets; √ analyze accounting procedures for inventories; √ demonstrate an understanding of methods of accounting for capital assets. Partnerships and Corporations Overall Expectations - By the end of this course, students will: √ demonstrate an understanding of accounting in partnerships; √ demonstrate an understanding of accounting in corporations. Financial Analysis and Decision Making Overall Expectations - By the end of this course, students will: √ compare methods of financing; √ explain and interpret a corporation’s annual report; √ use financial analysis techniques to analyze accounting data for decision-making purposes. Continued… Assumption Catholic Secondary School Business Department Page 2 TOPICS COVERED: (Tentative Outline) UNIT CHAPTER(S) 1 1, 2, 11 and 16 3&4 2 3 4 5 6 7 8 9 10 5 6 8 8 & 10 9 17 13 & 14 12 Personal Interest CONTENT Accounting In Action The Recording Process Financial Reporting Concepts The Cash Flow Statement Adjusting the Accounts Completion of the Accounting Cycle Accounting for Merchandising Operations Inventory Costing Internal Control and Cash Controls Accounting for Receivables & Current Liabilities Long – Lived Assets Financial Statement Analysis Accounting for Corporations Accounting for Partnerships Personal Income Tax Forms EVALUATION: Term Work 70 % Category Knowledge / Understanding Weight 20 Application 25 Thinking / Inquiry 15 Communication 10 Final Evaluation 30% Task Weight Culminating Activity 10 Exam 20 The term work categories will be evaluated using tests, quizzes, assignments, case studies, projects and reports, presentations, exercises, etc. In every business studies course, it is vital that students maintain healthy learning skills throughout. The ability to work independently, develop teamwork skills, organizational skills, sound work habits and homework completion, and initiative will be crucial to the success of each student in this course. Regular attendance, punctuality, and class participation will also help to ensure success! Materials Required: (bring to class every day) Pencils, pens, calculator, notebook/binder, textbook, Annual Report Expectations of Student Conduct: 1. Be RESPECTFUL to your teacher, classmates and classroom environment 2. COMPLETE and SUBMIT all assigned work …on time! 3. Participate and have FUN! Continued… Assumption Catholic Secondary School Business Department ASSIGNMENT/HOMEWORK/CASE SUBMISSIONS Page 3 ABSENCES FROM CLASS: The student is responsible for catching up on all class notes and completing any assignments missed while absent. Finding an accounting friend is best way to ensure nothing is missed LATE ASSIGNMENTS: Once an assignment has been marked and handed back, late assignments will no longer be accepted and the student will be assigned a mark of “0”. MISSED TEST (Quiz, In-class assignment, etc.) The student will be given the opportunity to write the missed evaluation upon return to school as long as the absence has been approved by administration. If absent only on the day of the test – student will write the day he/she returns If absent only for review (day before test) – student will write on the scheduled test day If absent for both review and test days – student will write the day he/she returns If absent for an extended period of time – student is expected to meet with teacher to discuss an appropriate time to write the evaluation MISSED CLASSES/LATES/UNIFORM: school policy in effect—see student handbook I have read the above information and understand the expectations of the Accounting course: Parent Signature: _______________________________ Date: ______________________ Student Signature: _____________________________ Date: ______________________