International Parity Conditions (Part III)

advertisement

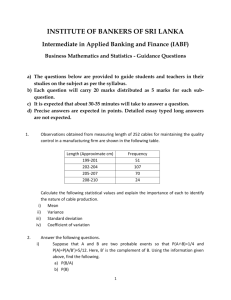

International Parity Conditions - CIP (Part III) Illustration of CIP • Imagine that there are only two countries left on earth: the US and Japan • You are in the US • You have 1 USD and you want to invest it • You can invest either in Japan, or in the US • The yearly interest rate in the US is 5% • The yearly interest rate in Japan is 1% • The (spot) exchange rate is 120JPY/USD Analyze the Alternatives • If you invest in US you will have to go the bank, put your money into an account • After one year your dollar will have accumulated interest, so you get • 1 USD*1.05=1.05 USD • If you want to invest in Japan – First you have to buy Japanese Yen What is the price of JPY in term of USD? Invest in Japan • We said 120 JPY/USD • So you go to the bank and buy Yen. How many do you get? – 1USD*120 JPY/USD= 120 JPY • Now you are ready to invest in a Japanese account for one year at 1% • After one year you will get: • 120JPY*(1.01)=121.2 JPY Which is Better? • Invest in US and get 1.05 USD? • Invest in Japan and get 121.2 JPY? The questions we want to answer • How many JPY per USD should you commit today to pay after one year? • Would you pay more or less than 121.2 JPY per 1.05 USD = 115.35JPY/USD? Framework • Recall what is the no-arbitrage condition • Recall the two investment opportunities: Invest 1USD in US at 5% TODAY Buy 120JPY with your dollar Get 1.05USD How much can you sell your JPY today? Wait 1 year Invest 120JPY in Japan at 1% Get 121.2JPY Answer • The central idea is that both opportunities entail no risk, hence they must yield the same return! (Otherwise?) • The no-arbitrage exchange rate that we have determined 115.35JPY/USD is what we have called 1-year forward exchange rate • This is the fair price of 1 USD expressed in JPY one year form today that everybody must accept today to avoid memorable losses The relation between forward rate and future spot rate • Forward rate should reflect the expected future spot rate on the date of settlement of the forward contract. • In other world, the forward rate should be an unbiased predictor of the future spot rate. • If this condition is violated there is an arbitrage opportunity, or there may exist other market imperfections More formally • Denote Ft a one-period forward rate observed at time t. Then: Ft ES t 1 • E[St+1] is the expected future exchange rate. The actual, realized St+1 may or may be not equal to E[St+1]. Forward premium • The forward-spot rate differential, (Ft - St), is called a forward premium. • The forward premium should be equal to the expected change in the exchange rate. Ft S t ES t 1 S t St St Covered interest rate parity • The CIP condition is: Ft 1 i 1 iB St A • CIP is the relation between the return on a hedged investment in a foreign currency in terms of the domestic currency. • It does guarantee that the return on foreign investment will be equal the domestic interest rate on investment of identical risk. Example continued from UIP • First investor purchases a 1-year U.S bond with 5% interest rate. • Second investor exchanges $ for DM, buys a 1-year German bond with 3% interest rate, and takes a short position in DM forward contract. • The initial spot $/DM rate is 0.58. • The forward one-year $/DM rate is 0.5913. • The spot $/DM rate a year later is 0.59. • Which investor is better off? Example: the solution • The U.S. dollar denominated return to the first investor is 5%. • The U.S. dollar denominated return to the second investor is also 5%, since: 0.5913 A 1 i 1 0.03 0.5800 1.050 How did it happen? • The forward one-year $/DM rate of 0.5913 was determined based on the covered interest rate parity condition. • So, if Ft is an unbiased predictor of St+1, investors should be indifferent between investing in domestic versus foreign securities. Empirical evidence • To test whether the forward rate is an unbiased predictor of the future spot rate the framework of the following regression model is used: Ft S t S t 1 S t a b ut 1 St St • If Ft = E[St+1], then we should find that a=0 and b=1. • Estimation generally leads to b<1 or even b<0. Implications of the test results • Existence of simple profitable trading strategies based on publicly available information. • Violation of the semi-strong form of market efficiency hypothesis. • Existence of a foreign exchange risk premium with no violation of market efficiency. High volatility of forex vs. interest rates Foreign exchange risk premium • The origin of the risk premium (classical view): – An investor invests in domestic and foreign bonds. – The nominal riskiness of domestic and foreign assets is different. – This difference presents a source of risk. – An investor demands a premium as a compensation for bearing this risk in the portfolio. • Foreign risk premium is time-varying. Recent findings: from Bansal and Dahlquist (1999) • The negative relation between the expected currency depreciation and interest rate differential (forward premium) is observed only – in developed economies. – when the U.S. interest rate exceeds interest rates of other industrialized countries. • Cross-country differences in risk premia are related to country-specific factors, such as per capita GNP, inflation rates, inflation volatility. 3. Conclusion with the 4 Relations Conclusions • The law of one price (LOP) is the fundamental no-arbitrage condition. • All parity conditions follow from the LOP. • All parity conditions do not account for possible market imperfections.