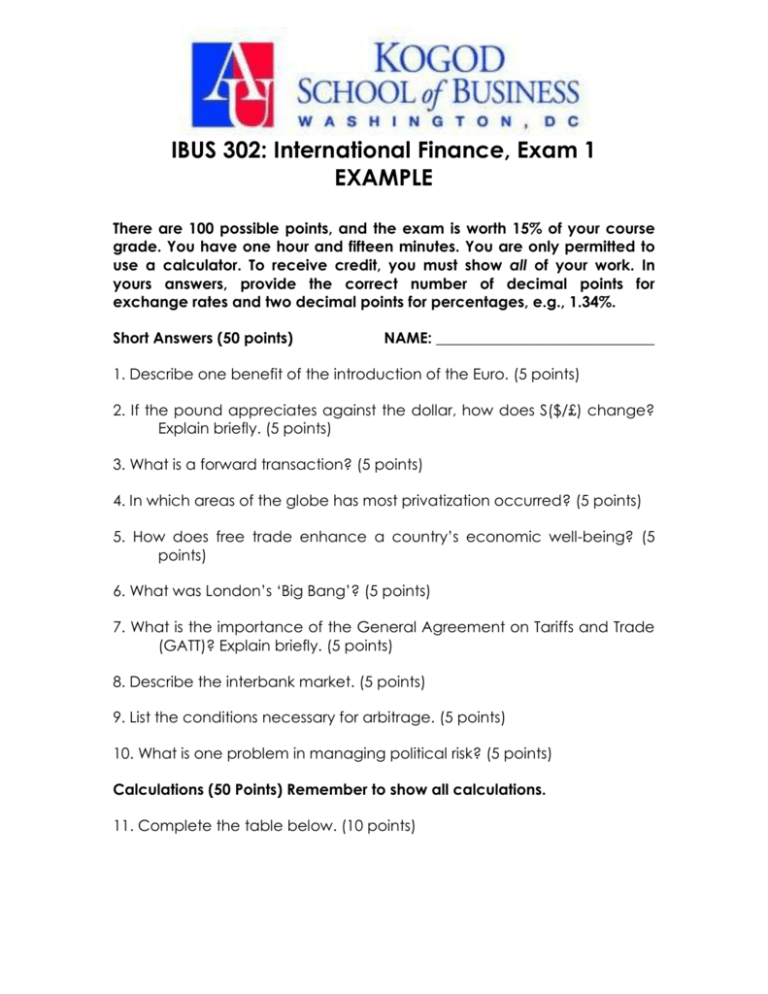

IBUS 302: International Finance, Exam 1 EXAMPLE

advertisement

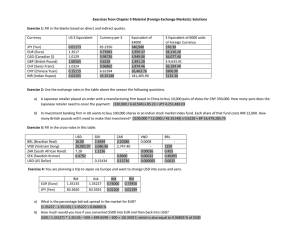

IBUS 302: International Finance, Exam 1 EXAMPLE There are 100 possible points, and the exam is worth 15% of your course grade. You have one hour and fifteen minutes. You are only permitted to use a calculator. To receive credit, you must show all of your work. In yours answers, provide the correct number of decimal points for exchange rates and two decimal points for percentages, e.g., 1.34%. Short Answers (50 points) NAME: _____________________________ 1. Describe one benefit of the introduction of the Euro. (5 points) 2. If the pound appreciates against the dollar, how does S($/£) change? Explain briefly. (5 points) 3. What is a forward transaction? (5 points) 4. In which areas of the globe has most privatization occurred? (5 points) 5. How does free trade enhance a country’s economic well-being? (5 points) 6. What was London’s ‘Big Bang’? (5 points) 7. What is the importance of the General Agreement on Tariffs and Trade (GATT)? Explain briefly. (5 points) 8. Describe the interbank market. (5 points) 9. List the conditions necessary for arbitrage. (5 points) 10. What is one problem in managing political risk? (5 points) Calculations (50 Points) Remember to show all calculations. 11. Complete the table below. (10 points) 3/19/2016 IBUS 302: International Finance, Exam 1 2 (of 2) Exchange Rates JPY EUR CAD 95.2381 0.7138 1.1571 USD USD JPY EUR CAD 12. If Sb(€/£) = 0.8643 and Sa(€/£) = 0.8650, what are the following values: (10 points) Sb(£/€) = ________________ Sa(£/€) = ________________ 13. Find the Bid-Ask Cross Rates. (10 points) Bid Ask USD 1 1.4010 0.8642 0.9225 USD EUR CAD CHF USD EUR CAD CHF USD 1 1.4018 0.8647 0.9231 Find Cross-Rate Sb(CHF/CAD) 14. Triangular Arbitrage (10 points) Exchange Rates JPY EUR CAD 1 95.2381 0.7138 1.0571 0.010500 1 0.007495 0.011100 1.4010 133.4241 1 1.4809 0.9460 90.0937 0.7752 1 USD USD JPY EUR CAD 1. Is there an arbitrage opportunity? 2. What is the arbitrage profit? 3. What is the order of currencies to capture the profit? Arbitrage (Yes/No) Arbitrage Profit USD, JPY, CAD Order of Currencies $ → _____ → _____ → $ 15. Calculate the Forward Premiums/Discounts. (10 points) Forward Rates USD/EUR 0 1.4002 1 1.4005 3 1.4025 6 1.4055 Forward Premium/Discount 1 3 6